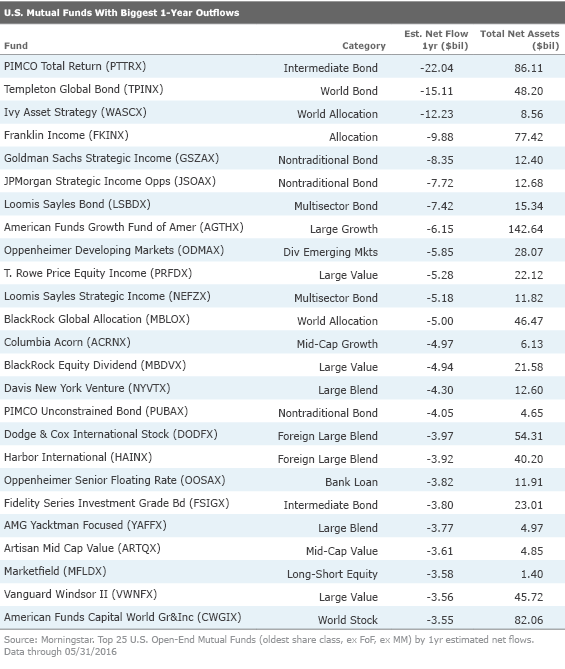

25 Funds Investors Are Dumping

These funds are getting heavy redemptions--but is the selling justified?

Investors gobbled up so-called nontraditional bond funds when many such offerings launched in the wake of the financial crisis. Conventional wisdom held that the economy would continue to recover and the Federal Reserve would eventually hike interest rates. Under such a scenario, nontraditional bond funds with the latitude to maintain short durations and eschew rate-sensitive Treasuries, among other strategies, would be able to avoid the worst landmines in a tricky bond market.

Fast forward five years, however, and the scenario hasn't unfolded in exactly that way. Treasury yields have actually moved down during the period, and investors are throwing in the towel on several prominent nontraditional bond funds.

That's just one of the takeaways from our recent survey of individual funds that investors are selling. (Next week we'll cover what funds they've been buying.) With the help of Morningstar senior research analyst Annette Larson, we took a look at the 25 funds that had seen the biggest redemptions in absolute dollar terms--not as a percentage of their assets--in the one-year period through May 31, 2016. You can see last year's discussion of the most heavily redeemed funds here; several of the funds on this year's list were there last year, too.

Many of these funds have posted disappointing performance, in either absolute or relative terms; some have experienced fundamental changes. Here's a review of some of the most heavily redeemed funds over the past year, as well how those selling decisions square with Morningstar analysts' research. In some cases, we think investors have ample justification for selling; in others, we think investors could be overly focused on short-term performance.

Cult of Personality

Dwarfing every other fund on the outflows front over the past year was

Whereas investors have had a few reasons for giving up on PIMCO Total Return, there’s a clear culprit behind redemptions at

Flexible Bond Funds Disappoint … Also prominent on the list are fixed-income offerings with somewhat flexible approaches, including those in the aforementioned nontraditional bond category as well as the multisector bond group, which features more-aggressive go-anywhere offerings.

discusses their composition and

discusses their possible role, or not, in a broadly diversified portfolio.)

Multisector bond fund

… As Do Some Flexible, Multiasset Offerings

Just as investors have been giving flexible bond funds the heave-ho, so have they lost patience with several actively managed funds with the latitude to range across asset classes. Global-allocation fund

Caught Up in the Passive Tide On the pure equity side, investors have put a host of actively managed funds on the chopping block. In nearly every case, outflows likely owe to weak performance, fundamental considerations, or a combination of the two. Investors' ongoing preference for passively managed equity options no doubt has contributed to outflows, too.

Investors are also throwing in the towel on a few fine international-equity funds. The Silver-rated

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)