Large-Growth Funds and Sustainability: A Closer Look

We examine high-rated and low-rated funds through our sustainability lens.

The Morningstar Sustainability Rating for Funds is a category-relative measure of how well companies in a fund’s portfolio are handling the various environmental, social, and governance, or ESG, issues they face within their businesses. It can be used to help incorporate sustainability in the selection and monitoring of client or personal portfolios. The company-level data on ESG performance comes from Sustainalytics, an ESG research firm that evaluates companies based on the most material and impactful ESG issues in their industries. The company-level data are rolled up on an asset-weighted basis to calculate a portfolio score. Ratings are then assigned relative to a fund’s Morningstar Category.

When rolling out the rating in March, we did a preliminary study suggesting that intentionally sustainable funds mostly have high Sustainability Ratings, and surveyed Morningstar Medalists (those with a Morningstar Analyst Rating of Gold, Silver, or Bronze) that also earn the highest Sustainability Rating. We recently took a look at the U.S. Large-Growth Morningstar Category in sustainability terms, surveying the Medalists in the category with the highest Sustainability Rating (5 globes) and those with the lowest rating (1 globe).

For this report, we drilled deeper into funds in the large-growth category with the highest and lowest Sustainability Ratings. We created composite portfolios from all funds in those two groups (not just Medalists); the 5-globe composite consists of 47 funds, while the 1-globe has 46 funds. We compared the composites on a number of factors to develop a profile of what a high-rated and low-rated large-growth fund looks like through our sustainability lens. We also used the composites to identify some of the companies driving high and low ratings within the category.

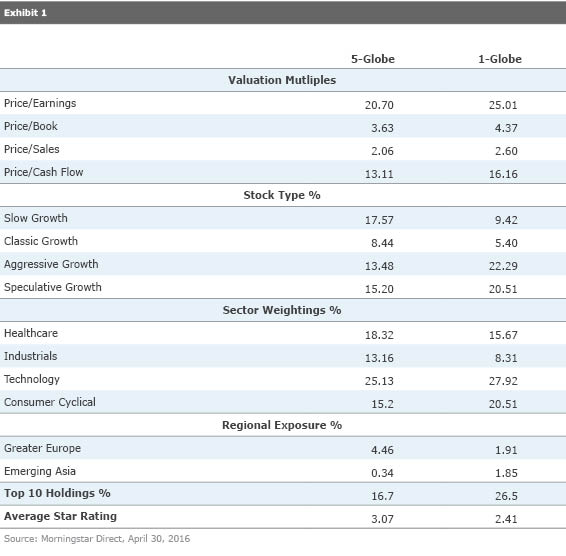

5-Globe Large-Growth Funds vs. 1-Globe Large-Growth Funds A comparison of the composite portfolios suggests a clear distinction between large-growth funds with high Sustainability Ratings and those with low ratings: 5-globe funds are typically moderate-growth offerings while 1-globe funds tend to have much more aggressive profiles. The typical 5-globe fund is valuation-sensitive, well-diversified, and focused on stable, growing companies. By contrast, the typical 1-globe fund has higher multiples, a more concentrated portfolio, and holds more-volatile fast-growing firms. As a result, 5-globe large-growth funds tend to be less risky, which helps drive better overall Morningstar Ratings. The average star rating for 5-globe funds is 3.07, compared with 2.41 for 1-globe funds.

The stark difference between the two composites can be seen in a variety of data points in Exhibit 1. The average Price/Earnings multiple for the 5-globe composite is 20.7; for the 1-globe composite, it is 25. About 26% of the 5-globe composite consists of companies we categorize as “Slow Growth” and “Classic Growth”; for the 1-globe composite, that exposure is only 14.8%. By contrast, 16.5% of the 5-globe composite is in companies we label “Aggressive Growth” and “Speculative Growth.” For the 1-globe composite, nearly a third of assets fall into those groups. From a sector perspective, 5-globe funds have overweightings in healthcare and industrials relative to 1-globe funds and underweightings in technology and consumer cyclicals.

Five-globe funds tend to have more-diversified portfolios. The top 10 holdings comprise 16.7% of assets in the 5-globe composite, while the top 10 holdings take up 26.5% of assets in the 1-globe composite. Both composites had about the same amount of non-U.S. exposure, but for the 5-globe composite, most of that exposure is in Europe, where companies tend to score better on sustainability, while 1-globe funds have greater exposure to emerging Asia, where companies score worse.

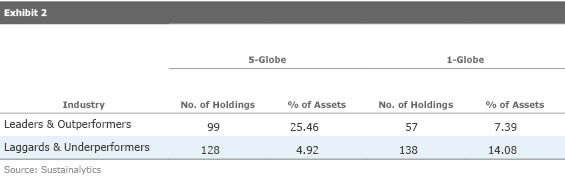

What Companies Are Driving Large-Growth Sustainability Ratings? Based on their company ESG research, Sustainalytics characterizes companies placing in the top 5% among their industry peers as sustainability "leaders." Those placing in the next 15% of their peer group are considered "outperformers." Our 5-globe composite contains 99 holdings worth 25.5% of assets of industry-leading or -outperforming companies. The 1-globe composite contains only 57 holdings worth 7.4% of assets.

At the other end of the spectrum, Sustainalytics groups the firms placing in the bottom 5% among their industry peers as sustainability “laggards” and those placing in the next worst 15% as “underperformers.” The 1-globe composite contains 138 holdings worth 14.1% of assets of industry laggards or underperformers, while the 5-globe composite contains 128 holdings worth 4.9% of assets.

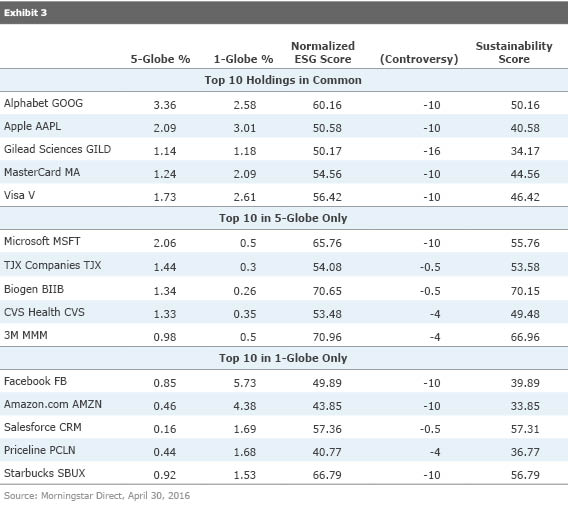

To provide an idea of specific companies that are influencing the sustainability ratings in the large-growth category, we focused on the top 10 holdings in the 5-globe and 1-globe composites. The two composites hold five companies in common, although they are weighted more heavily in the 1-globe composite than in the more-diversified 5-globe composite. That leaves five unique holdings in the top 10 of each composite portfolio, as shown in Exhibit 3.

The normalized company ESG score in Exhibit 3 is based on Sustainalytics’ overall assessment of the firm relative to its industry peers. We normalized those scores so that a score of 50 means a company’s score is at its industry average; a score of 60 means it is one standard deviation above average; a score of 40 is one standard deviation below average, and so on. Most company ESG scores sit well within a range of 30 to 70.

The controversy deduction is for company involvement in current ESG-related incidents. Sustainalytics keeps track of these incidents and evaluates them on a scale of increasing severity ranging from Level 1 (Low) to Level 5 (Severe). Companies involved in a Level 1 controversy receive a minor deduction of only 1 point. Those involved in a Level 5 controversy, however, receive a 20-point dedication from the normalized ESG score, equivalent to two standard deviations.

In the 5-globe composite, two of the five unique holdings in the top 10 stand out as especially strong sustainability performers--

Final Thoughts Large-growth funds that have the best Morningstar Sustainability Rating tend to be moderate-growth strategies focused on stable-growth companies, many of which, based on Sustainalytics research, are managing their ESG-related risks and opportunities relatively well. These include industry outperformers like Biogen and 3M, which were top holdings in the 5-globe composite portfolio.

Those with the worst Sustainability Ratings, by contrast, tend to be aggressive-growth strategies focused on high-growth companies, many of which are managing their ESG-related risks and opportunities less effectively relative to their industry peers. These include several poor performers that were top holdings in the 1-globe composite portfolio, including Facebook, Amazon, and The Priceline Group. While, in some respects, companies like those may be said to have relatively small sustainability footprints relative to companies in other heavy-industry sectors, these firms nonetheless fare poorly relative to their own peers on sustainability issues.

As a portfolio-based metric, the Sustainability Rating can be used to assess how well the companies held in a fund’s portfolio are addressing the key ESG risks and opportunities they face in their businesses, but it is not meant to be a stand-alone metric. Investors may use it to help incorporate sustainability into their portfolios but should also consider traditional factors in fund selection, such as those associated with our five-pillar manager-research process (Process, Performance, Price, People, and Parent).

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)