ESG + ETF = BFFs?

Investor demographics are slowly turning in favor of the pairing of impact-oriented strategies and the exchange-traded fund chassis, and investors' need for relevant analytics is growing as a result.

A version of this article was published in the May 2016 issue of Morningstar ETFInvestor. Download a complimentary copy of ETFInvestor here.

Sustainable investing appears to be making its way into the mainstream. Much like other rapidly evolving corners of the market (the other example nearest and dearest to our hearts would be strategic beta), the category is suffering from a bit of an identity crisis. What should we call it? How should we define it? And most important of all, how can we capture and measure environmental, social, and governance, or ESG, as well as other impact-related criteria, and incorporate them into our investment process? Earlier this year, Morningstar stepped into this breach as we introduced the Morningstar Sustainability Rating for funds, with the goal of helping investors to make better-informed decisions and invest in ways that are meaningful to them. (Jon Hale, Morningstar's head of sustainability research, shares our own definition and details the rationale behind our undertaking in this arena in "The Appeal of Sustainable Investing.")

Here, I'll zero in on the intersection of sustainable investing and exchange-traded funds. First, I'll discuss why I think the two are a good match. From there, I'll examine the current ETF landscape through the lens of the Morningstar Sustainability Rating to show you how you might be able to employ this new tool kit in analyzing and selecting funds for your portfolio.

ESG and ETFs Make Quite a Match Index-linked investments like ETFs lend themselves well to the sort of positive (selecting firms that proactively address sustainability issues) and negative (excluding tobacco companies, firearms manufacturers, casinos, and so on) screens that underlie many sustainability-oriented investment mandates. However, these strategies have historically been managed in a highly customized manner within private accounts to meet the particular demands of specific--typically institutional--clients. More recently, some of those same institutions have partnered with ETF sponsors to design and launch ETFs tied to ESG benchmarks.

A prominent example is SPDR SSGA Gender Diversity ETF SHE, which debuted in early March. The fund is the result of a collaborative effort between State Street Global Advisors and the California State Teachers' Retirement System, or CalSTRS. CalSTRS' investment team has a broad diversity mandate, which includes a specific directive to invest in a manner that promotes gender diversity within the upper echelons of publicly traded U.S. corporations.

The index behind SHE begins with the 1,000 largest U.S.-listed stocks by market capitalization and carves them into 10 sectors. From there, it selects stocks from each sector on the basis of ratios of female executives and board members to the total number of corporate executives and board members. Thus, the fund's portfolio is made up of those stocks that have the greatest representation of female leaders among their management ranks in any given sector.

CalSTRS not only provided the idea that spawned this ETF but also put up $250 million in seed capital to get it off the ground--with an additional $250 million investment reportedly in the works.[1] CalSTRS gets a custom-built strategy at a competitive price with the added benefit of the liquidity inherent to the ETF package. Meanwhile, a multitude of investors now have access to a novel strategy that might allow them to invest in a manner that reflects their own values in a broadly accessible, low-cost format. At first blush, ETFs and ESG seem to be a good pair.

Demographic trends are also driving the emergence of new ETFs with sustainability mandates. A 2015 survey of individual investors conducted by the Morgan Stanley Institute for Sustainable Investing showed that 84% of millennial investors are interested in sustainable investing.[2] Elsewhere, in its 2015 ETF investor survey, Charles Schwab found that ETFs accounted for a greater portion of millennials' portfolios (41%) than those of any other generation.[3] Furthermore, 61% of millennials expected to increase their investments in ETFs during the following year--nearly twice as many as the next-closest generation (Gen X at 33%). As millennials grow to represent an ever-larger share of the investor base in the coming decades, I believe it is reasonable to assume that the roster of ESG-oriented ETFs will continue to multiply.

The Morningstar Sustainability Rating for Funds Given the growing interest in sustainability and the expanding menu of impact-oriented funds, investors need better tools to help them determine whether the investments they own or are considering for their portfolio reflect best sustainability practices. That's why we've created the Morningstar Sustainability Rating for funds and sustainability scores based on ESG factors.

This is a two-step process. Morningstar first calculates a fund's Portfolio Sustainability Score, which measures how well the companies it holds are managing their ESG risks and opportunities. We are basing the scores on research from Sustainalytics, a leading provider of company-level ESG research and ratings. Morningstar's Portfolio Sustainability Score is an asset-weighted average of the company ESG scores with deductions made for holdings involved in controversial incidents, or the Portfolio Controversy Score.

In the next step, we assign a Morningstar Sustainability Rating, which is the Portfolio Sustainability Score relative to Morningstar Category peers. We assign the ratings along a bell-curve distribution to five groups--Low, Below Average, Average, Above Average, and High.

Using the Morningstar Sustainability Rating for Funds The ratings can serve as an initial screen for investors interested in sustainability and ESG factors. They are also a useful starting point for investors wanting to know more about a fund's investment process and how it relates to sustainable investing. The ratings will help investors determine both the level of sustainability in their existing portfolios and allow them to set sustainability targets. Some investors, for example, may prefer only funds that have high ratings; others may wish to avoid funds with low ratings. Still others may wish to achieve an above-average rating across all funds in their portfolios.

It is important to note that the ratings are portfolio-based, not performance-based. They do not reflect a fund's performance on either an absolute or risk-adjusted basis, nor are they a qualitative Morningstar evaluation of a fund's merits. They should not be the sole basis for an investment decision.

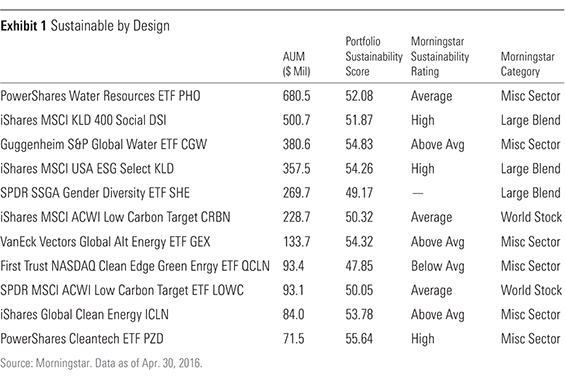

ESG ETFs Under the Microscope Generally speaking, ESG-oriented ETFs earn high marks for sustainability. Exhibit 1 shows the largest ESG ETFs in our database for which we currently calculate portfolio sustainability scores, ranked by their assets under management as of the end of April. Each ETF's Morningstar Sustainability Rating is Average or better, except for First Trust Nasdaq Clean Edge Green Energy ETF QCLN, which is in the unfortunate position of being the least green and clean fund in a category that is awfully competitive by both measures. Also worth noting is that the two funds with the broadest ESG mandates, iShares MSCI KLD 400 Social DSI and iShares MSCI USA ESG Select KLD, were standouts relative to the U.S. large-blend category--both earning High Sustainability Ratings. The Portfolio Sustainability scores tell us that these funds are generally delivering on their advertised sustainability mandates.

Zooming Out

These measures are perhaps even more useful when analyzing funds that don't have a specific ESG mandate. For example,

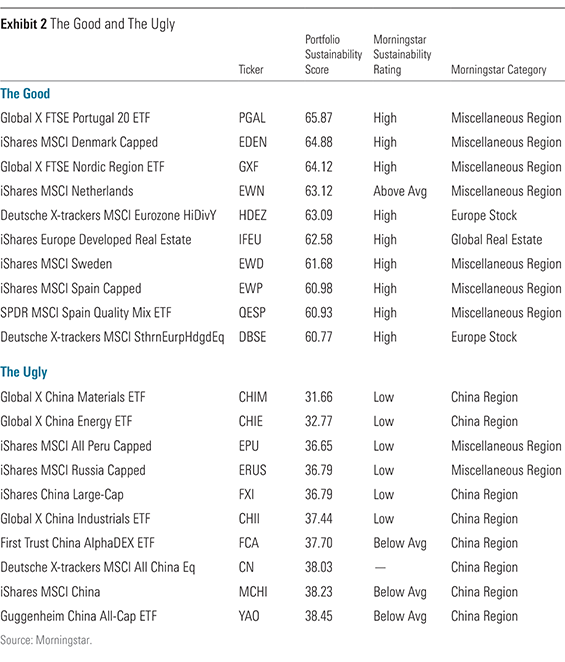

In Exhibit 2 I have included the ETFs with the highest ("The Good") and lowest ("The Ugly") Portfolio Sustainability scores. Clearly, an investment in Chinese mining or energy firms is not an eco-friendly proposition. Conversely, an investment in either Northern (think Big Pharma,

This exercise of isolating the "Good" and the "Ugly" is intended to illustrate an important point. These inputs are not meant to be used in isolation to inform investment decisions. They should not be seen as a substitute for comprehensive due diligence in the fund-selection process. Rather, they can be a useful complement to your existing tool kit and one that I expect will grow in importance over time.

Key Takeaways 1) Sustainability is playing an increasingly important role in driving an ever-larger number of investors' decision-making processes. Demographic trends will likely accelerate this trend. ETFs appear to be particularly well-suited to meet the demands of a more impact-conscious investor base.

2) The Morningstar Sustainability Rating for funds and sustainability scores based on ESG factors provide a unique lens through which to view funds and assess how well the companies they invest in are managing ESG risks and opportunities--whether they have a specific ESG mandate or not.

3) These new metrics are just one implement in a much broader tool kit. They should not be seen as a substitute for comprehensive due diligence in the fund-selection process.

4) Impact investing is very personal by definition. No strategy will perfectly align with any one investor's values or unique circumstances.

[1] Sullivan, P. 2016. "In Fledgling Exchange-Traded Fund, Striking a Blow for Women." The New York Times. March 4, 2016. http://www.nytimes. com/2016/03/05/your-money/in-fledgling-exchange-traded-fund-striking-a-blow-for-women.html?_r=0

[2] Morgan Stanley Institute for Sustainable Investing. 2015. "Sustainable Signals: The Individual Investor Perspective." https://www.morganstanley.com/sustainableinvesting/pdf/Sustainable_Signals.pdf

[3] Charles Schwab. 2015. "2015 ETF Investor Study by Charles Schwab." https://www.aboutschwab.com/press/research/2015-etf-investor-study-by-charles-schwab

Disclosure: Morningstar, Inc.'s Investment Management division licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)