Why Are Primecap Funds So Sustainable?

These Gold-rated funds have Morningstar Sustainability Ratings of High despite not explicitly trying to do so.

The Morningstar Sustainability Rating for funds, which we introduced in March, helps investors measure how sustainable a mutual fund's portfolio is--that is, how well the companies it owns are handling the various environmental, social, and governance (ESG) issues they face. Research firm Sustainalytics first looks at company-level ESG factors such as environmental and workplace policies, product safety, and corporate responsibility, combining these into an ESG score for each company. Penalties are assessed for any ESG-related controversies, ranging from minor issues to major problems such as Volkswagen's recent emissions scandal. The resulting Sustainability Scores are rolled up on an asset-weighted basis to calculate a Portfolio Sustainability Score, and funds are ranked against their Morningstar Category peers. Funds with a Sustainability Rating of High (represented by 5 globes) have holdings that collectively score very well on ESG factors, while funds with lower scores earn lower ratings, down to Low (represented by 1 globe).

One useful feature of this rating is the fact that it's assigned to all funds, not just those that are marketed as socially responsible or ESG-oriented. Not surprisingly, funds that commit themselves to sustainability as part of their mandate do tend to have high Sustainability Ratings, with 80% earning ratings of Above Average or High. But there are also plenty of funds that earn high ratings even though they don't explicitly aim for such a result. We took a look at some such funds recently in a survey of Morningstar Medalists that also earn 5-globe Sustainability Ratings and in a survey of medalists in the large-growth category with the highest and lowest sustainability ratings.

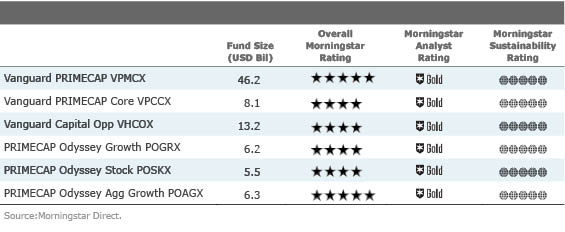

To get a better idea of why these funds have such high Sustainability Ratings, it's worth taking a closer look at some of them and drilling down into their portfolios. Consider the Primecap funds, four of which--

A good example is the biotech and big pharma firms that have been prominent in all the Primecap portfolios for years. Many of these earn good Sustainability Scores because they have a positive impact on society (helping cure diseases), and they tend not to have many problems with environmental or social issues.

Technology is the other sector in which all the Primecap funds are relatively heavy, and here, too, several of the funds' top holdings score very well on sustainability.

The Primecap funds are often helped on the sustainability front by what they don't own. For example, none of the funds has more than a tiny percentage of its portfolio in energy or materials companies, many of which have low or mediocre Sustainability Scores. That doesn't mean that these funds hold no firms with very low Sustainability Scores; Chinese Internet firm

However, such examples are few and far between in these funds. In general, the Primecap managers tend to like companies that have a positive impact on the world and avoid serious ethical problems, in addition to looking like good long-term investments. Many ESG fund managers argue that those two features are explicitly connected, but the Primecap funds show that it's not necessary to have an intentional ESG or sustainability focus to invest in a way that results in a responsible outcome for investors.

/s3.amazonaws.com/arc-authors/morningstar/1ec055c4-13ba-4cb0-bbe5-607ba591d202.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1ec055c4-13ba-4cb0-bbe5-607ba591d202.jpg)