Does It Make Sense to Include Non-Traditional-Bond Funds in Your Portfolio?

High correlations to risky assets dent their appeal as a core-bond fund substitute.

As we discussed last week, non-traditional-bond fund portfolios have generally pursued two main themes in recent years: 1) downplaying interest-rate risk and 2) taking risk in credit-sensitive areas such as high-yield corporate and emerging-markets debt. Today, we’ll discuss the impact these preferences have had on performance and what that implies for this group’s usefulness in a broader portfolio context.

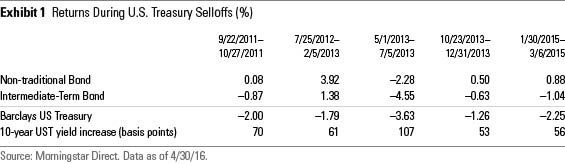

Some Success Providing Defense Against Interest-Rate Risk Let's start with interest-rate risk, the chief source of anxiety that drove this Morningstar Category's explosive growth in recent years. Granted, the category has faced headwinds in that regard since its launch in 2011; Treasury yields are lower now, and there's only one instance of the 10-year note rising by more than a percentage point in that stretch. But taking a look at the category's performance during periods where the yield on the 10-year U.S. Treasury has risen by half a percentage point or more, as shown in the exhibit below, the group as a whole has been reasonably effective at outperforming the typical intermediate-term-bond fund in periods of rising interest rates.

The taper tantrum from May through early July 2015--during which markets reacted to then Federal Reserve chairman Ben Bernanke’s suggestion that the Fed might slow down its rate of bond purchases--was an especially challenging period for the category because sectors that are less correlated to Treasury moves, such as high-yield corporates and emerging-markets debt, sold off as well. Before that sell-off, yields on high-yield corporates had dipped below 5% for the first time on record, with yield spreads over Treasuries also tight of their historic norms. As a result, the high-yield sector became more vulnerable to rising Treasury yields than it had been in the past. Nevertheless, the average non-traditional-bond fund lost only half as much as the intermediate-term-bond category mean during that two-month stretch.

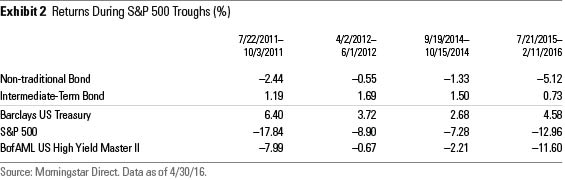

Weaker Results During "Risk" Sell-Offs That success during periods of rising Treasury yields has come at a cost, however. In particular, non-traditional-bond funds have struggled when riskier fare has slumped.

The following exhibit compares performance between the non-traditional-bond and intermediate-term-bond categories during equity market troughs over the past five years. In each case, the intermediate-term bond cohort delivered gains while the non-traditional-bond group experienced losses.

The pain was particularly acute in the most recent equity downdraft that spanned the second half of 2015 through early 2016. That period coincided with a sharp high-yield bond sell-off, as falling commodity prices slammed high-yield debt issuers in energy- and commodity-related industries. The commodity price rout has also had an impact on emerging-markets debt and currencies, as well as the currencies of some developed-markets commodity exporters.

These numbers also underscore how difficult it has been for managers in the category to use their duration flexibility to their advantage. In late 2014 and early 2015, for example, many were convinced that the Federal Reserve would finally embark on a succession of rate hikes, and they took steps to shorten their funds’ durations, even taking them negative in some instances. That was the right call in the first quarter of 2015, as Treasury yields rose modestly. However, funds that maintained a defensive stance toward interest-rate risk throughout the year missed out on a flight-to-quality Treasury rally in the second half of 2015, which could have offset some of the losses among their credit positions.

Supplanting Rate Risk Leads to Higher Sensitivity to Credit and Equities The non-traditional-bond category's struggles during these periods point to a larger issue. Short-term floating rates tied to banking are, outside of very unusual circumstances, usually very low. Using Libor-based benchmarks makes it much easier for fund companies to tout or defend their results from criticism by pointing to the fact that they beat their stated modest return hurdles. Despite those efforts to temper investors' return expectations, most managers recognize that shareholders won't often stick around unless their funds stay within the range of more-conventional options.

In their efforts to protect investors from rising yields and still produce sufficiently alluring returns, many funds exchange exposure to interest rates for other types of risk. In fact, minimizing or eliminating the income "carry" advantage normally inherent in longer-maturity exposures makes investing in riskier options among the only ways in which managers can surpass their high expense hurdles and still produce returns high enough to keep investors happy.

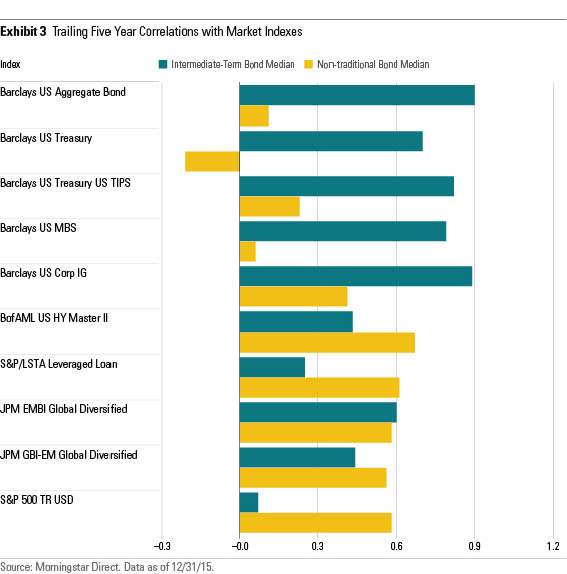

As shown in the exhibit below, the non-traditional-bond category’s performance has been highly correlated to equities, high-yield corporates, and emerging-markets debt.

Given the wide range of investment styles employed by many in the category, these correlation coefficients vary among individual funds. However, roughly 80% of distinct funds in the category have exhibited correlations of at least 0.50 to high-yield corporate bonds during the trailing three- and five-year periods. Close to 60% of the group has exhibited correlations of at least 0.50 to equities.

This is a crucial consideration for investors who are weighing whether to replace at least part of their core-bond stake with a non-traditional-bond strategy. While non-traditional-bond funds have displayed low or negative correlations with high-quality bond market risks--predominantly U.S. government-backed debt and agency mortgage-backed securities--their high correlation with equity market risk hampers their use as a portfolio diversifier.

Five-Year Look Back

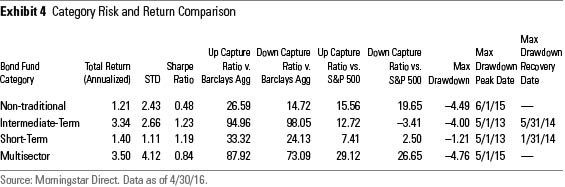

Despite overweightings to more-volatile sectors such as high-yield corporate debt, non-traditional-bond funds deserve some credit for keeping volatility in line with core-bond funds by virtue of their successful defense against high-quality sector yield spikes. Compared with traditional core-bond funds, however, non-traditional-bond funds’ returns have generally been lackluster, explaining their poor risk-adjusted returns. The funds’ high correlation to stocks has also been problematic at times.

To be fair, non-traditional-bond funds have not had the opportunity to soldier through a more pronounced rising-yield setting, an environment seemingly more conducive to their strengths. What’s more, given the diversity of strategies in the category, performance has varied widely: In any 12-month period, for instance, the difference in returns between the best-performing and worst-performing decile was greater than 7 percentage points, on average, or more than twice the size of the gap between the best and worst intermediate-term-bond funds. It is therefore important not to paint with too broad a brush.

Still, the group as a whole has had difficulty proving itself to be a compelling all-weather fixed-income alternative. In particular, many funds in the group that have a wide degree of latitude in managing duration haven’t gained an obvious edge from that flexibility.

Final Thoughts Overall, funds in the non-traditional-bond category suggest that their investors can enjoy returns commensurate with what intermediate-term-bond funds would otherwise produce, sidestep interest-rate sensitivity while doing so, and expect to avoid losses given their use of absolute return strategies. So far, though, the overall category has failed to deliver on its contradictory set of promises. High correlations to credit-sensitive sectors and equity markets reduce the appeal of funds in this category marketed as absolute return vehicles and belie the difficulty in successfully capitalizing on the freedom of unconstrained strategies to source alpha and simultaneously avoid market sell-offs.

Non-traditional-bond funds are a poor substitute for conventional-bond funds--that otherwise consistently carry marketlike levels of duration--as a ballast to counter equity market turbulence. Sensitivity to the Treasury market embedded in conventional-bond funds can often provide the single most effective portfolio ballast when market shocks lead to extreme correlations among other bond market and equity market sectors.

/s3.amazonaws.com/arc-authors/morningstar/1b991ddd-b85f-490e-8687-e60e3f136800.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1b991ddd-b85f-490e-8687-e60e3f136800.jpg)