What's in Non-Traditional-Bond Fund Portfolios?

Non-traditional-bond funds have swapped interest-rate risk for other risks.

Almost five years ago, we launched our non-traditional-bond Morningstar Category to create a more useful classification for the deluge of new bond funds following the global financial crisis. These funds gave active bond managers a wide degree of latitude to invest across global fixed-income sectors. Many of these funds promised investors an attractive absolute return stream uncorrelated to traditional markets, but they are most often positioned as substitutes to traditional core-bond funds that are designed to protect investors from the looming risk of rising rates.

Here we'll take a look at how the category's broad parameters have been implemented in practice. While funds in the non-traditional-bond category are generally touted for their flexibility, many have simply exchanged interest-rate risk for some other risk. For instance, funds in the category often feature sizable investments in high-yield, emerging-markets debt, or other "spread" or "risk" sectors. In addition, these funds tend to use derivatives more heavily than those in other, more-traditional fixed-income categories.

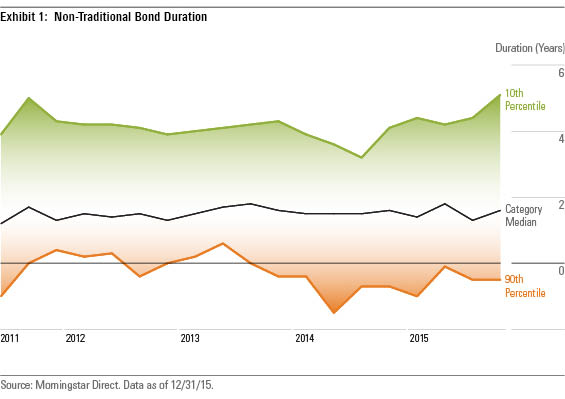

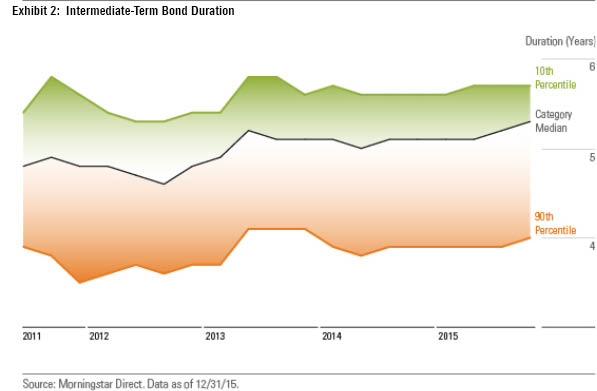

Interest-Rate Defense During the past five years, the category's bias toward minimizing interest-rate risk has been evident. The following chart shows that, as a group, non-traditional-bond funds have exhibited relatively low levels of interest-rate sensitivity with average durations between 1.0 and 2.0 years. That's considerably shorter than the intermediate-term-bond category norm of around 5.0 years during this time, which is roughly comparable to the duration of the Barclays U.S. Aggregate Bond Index.

Looking at the average alone can be misleading. While some portfolio managers have kept their funds' durations consistently low in recent years, others have varied widely, as evidenced by the roughly four-year gap between the category's most (10th percentile) and least (90th percentile) interest-rate-sensitive funds.

In comparison, most intermediate-term-bond funds' durations have stayed within a tight band of roughly 1.5 years around the category norm.

Despite parameters that allow non-traditional-bond fund managers to adjust duration within a range of 10 years or more, the vast majority have thus far been reluctant to extend duration long enough to match the market's, which isn't entirely surprising given how stubbornly low yields have remained during the past several years.

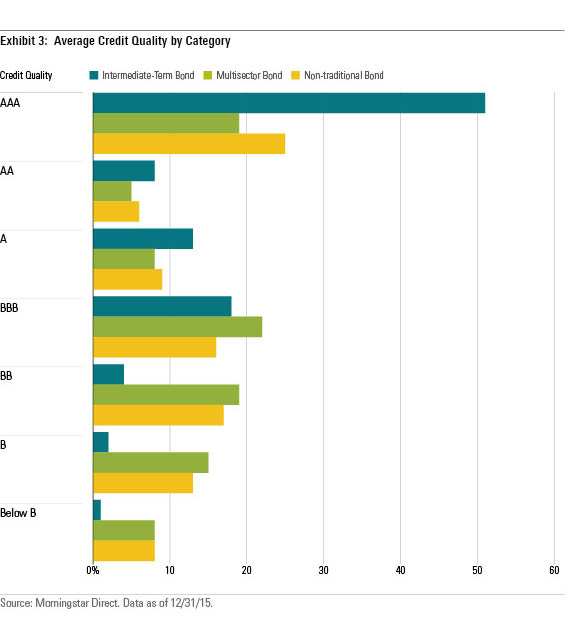

Heavy Credit Exposure While minimizing interest-rate risk relative to traditional core-bond funds, many non-traditional-bond portfolios have taken on generous helpings of credit risk. This is evident in comparing the categories' exposures to different credit quality tiers. Whereas the typical intermediate-bond fund holds around 10% in below-investment-grade and nonrated bonds, the non-traditional-bond category norm has roughly 44% exposure to these lower-quality issues, which is nearly on par with the credit-sensitive multisector-bond norm.

Again, looking at averages can gloss over the different stances that managers in the category are taking.

Prevalence of Derivatives Another common theme among funds in the category is the liberal use of derivatives. Generally speaking, it's easier for many investors to quickly add or reduce market exposures with derivatives such as credit default swaps, futures contracts, and interest-rate swaps without having to tie up as much capital as would be required when trading cash bonds. Moreover, as tightening regulations following the financial crisis have made it costly for banks to keep bonds on their balance sheets, liquidity among cash bonds has eroded even further.

That has made derivatives an especially enticing tool for managers seeking to generate positive absolute returns without broad, systematic market risks. In theory, one can insulate a portfolio of conventional bonds from interest-rate volatility, for example, by sharply reducing its duration with futures contracts or interest-rate swaps. Similarly, one can take on credit exposure to specific issuers while theoretically insulating a portfolio from broader credit-market risk by shorting credit default swaps linked to a broad basket of credit-sensitive bonds.

Many funds in the category include global currencies and far-flung credit markets in their tool kits, and both can be difficult (or impossible) to develop without derivatives. In the case of currencies not easily converted to or from hard currencies such as the euro or the U.S. dollar, so-called nondeliverable forward contracts may be a manager's only practical option.

To Be Continued... What kind of results have the category's aversion to interest-rate risk and preference for risky assets produced? In a follow-up article next week, we'll discuss the impact these portfolio trends have had on the group's performance and the implications for their usefulness in investors' portfolios.

/s3.amazonaws.com/arc-authors/morningstar/1b991ddd-b85f-490e-8687-e60e3f136800.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1b991ddd-b85f-490e-8687-e60e3f136800.jpg)