Ultimate Stock-Pickers: Top 10 Buys and Sells

The volatility brought on by concerns over global economic growth in the first quarter presented our top managers with both buying and selling opportunities.

By Eric Compton | Associate Stock Analyst

As many of you already know, our primary goal with the Ultimate Stock-Pickers is to uncover investment ideas that our equity analysts and top investment managers find attractive, and to reveal that information in a timely enough manner for investors to gain some value from it. As part of this process, we scour the holdings of our listing of top managers as they become publicly available, attempting to identify trends and outliers among the holdings, as well as the purchases and sales in each period.

In our last article, we discussed the early read we had on the buying activity of our Ultimate Stock-Pickers during the first quarter of 2016 (based on the holdings of three fourths of our top managers), focusing in on high-conviction purchases and new-money buys. We noted that after a dearth of buying activity for more than two years that the conviction buying activity of our top managers had finally increased a bit (even as the selling activity had also increased during the period). Undoubtedly, the market volatility during the first quarter provided our managers with some new opportunities to put money to work, as well as to exit some positions where they felt they might have been exposed. With all of our Ultimate Stock-Pickers now having reported their stock holdings for the most recent period, we have a good sense of what kind of trading took place during the first few months of the year--which included a continuation of some of the trends we identified in our previous article (such as a greater propensity for purchasing securities from the financial-services sector).

Most of the conviction buying during the most recent period was focused on high-quality names with defendable economic moats--exemplified by a greater number of wide- and narrow-moat companies on our list of top 10 (and top 25) high-conviction purchases. Looking back to the early read we had on the first quarter's buying activity in our last article, five of the companies on that list of top 10 high-conviction purchases--narrow-moat

Even with all of this buying and selling, our top managers remained underweight in energy, communication services, healthcare, and utilities relative to the weightings of those sectors in the S&P 500 at the end of March. They also continued to hold overweight positions in the financial-services, technology, consumer defensive and cyclicals, as well as basic materials sectors (with their exposure to real estate and industrials more or less in line with the benchmark index).

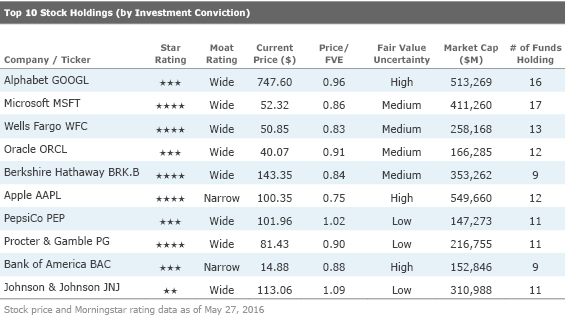

While our top managers' trading activity increased during the most recent period, the overall makeup of the top 10 stock holdings by investment conviction did not change all that much. Only one company--wide-moat

In late February, (Berkshire) released its annual report and Warren Buffett's letter to shareholders. We found this year's letter to be particularly compelling, as it touched upon several themes that we have been focused on, namely, 1) the strength and diversity of Berkshire's operations, 2) the decreasing reliance on its equity portfolio, 3) the growth and stability of the insurance operations, 4) the Company's strong free cash flow and liquidity position, and 5) the prospects for continued operating income growth through organic and inorganic means. In late January we added to our Berkshire position for the first time in five years.

Morningstar analyst Greggory Warren had been pushing Berkshire as an investment idea more heavily during January and February, when the stock price dropped about as close to the company's repurchase threshold (of less than 1.2 times book value per share) as it did back in the third quarter of 2011 (when Buffett first initiated the company's share repurchase program at prices less than 1.1 times book value per share). Despite having run up some 15% since their lows earlier this year, the shares remain undervalued, trading at around a 16% discount to Warren's fair value estimate.

As we noted above, five of the top 10 stock purchases this time were also represented on the list of top 10 high-conviction purchases from our last article. On top of that, eight of the top 10 stock purchases were also new-money buys for some of our top managers. For those who may not recall, when we look at the buying activity of our Ultimate Stock-Pickers during each period, we tend to focus on high-conviction purchases and new-money buys. We think of high-conviction purchases as instances where managers make meaningful additions to their existing holdings (or make significant new-money purchases), with a focus on the impact these transactions have on the portfolio overall.

Our top 10 purchases this time around were almost equally split among the financial-services, technology, and healthcare sectors. Bank of America, which was purchased by seven of our top managers, remains a top 10 holding for our Ultimate Stock-Pickers. The most notable purchases of the security during the period came from

Within the financials sector, we continued to avoid most of the big, money-center banks, which struggled in the first quarter. New requirements under The Dodd-Frank Act continued to put pressure on bank returns, and money-center bank stocks suffered in the absence of higher rates as a catalyst for earnings growth. In addition, capital market results are likely to be down compared to the first quarter of 2015. Finally, bank exposure to energy-related credits has investors concerned that asset quality could begin to deteriorate. In late February, we established a position in Bank of America, as the stock had gotten very cheap on both price-to-book and price-to-earnings measures.

Citigroup also benefited from a higher-conviction new-money purchase from the managers at Oakmark Equity & Income, as well as some meaningful additions from

We are pleased that the market's rebound throughout the second half of the quarter lifted the Fund to a 1% return for the quarter, and also that the market's earlier decline allowed us to establish positions in four companies at prices that were on average 23% lower than at the start of the year. Investors' occasional manifestations of fear—and greed—often provide us with unusually good opportunities to carry out our disciplined, value-based investment strategy. Typically, that means that we venture toward whatever is out of favor and away from what is in favor. So while the world was fretting about a potential U.S. recession earlier this year, we added four economically sensitive businesses to the portfolio: Citigroup, Comerica, State Street and Jones Lang LaSalle.

We believe that universal banks are significantly undervalued relative to their normalized earnings power. Citigroup's global franchise gives it a unique advantage as the company has more than twice as many country banking licenses and direct local payment network connections as its closest competitor. This unique global reach is an attractive asset that is virtually impossible to replicate in today's regulatory environment, and we believe it makes Citigroup one of the only viable choices for multinational corporations looking for a consolidated banking relationship. We calculate that Citi has meaningful excess capital, which—combined with its significant deferred tax assets—should give its management team various options to increase shareholder value.

As we noted in our previous article, Morningstar analyst Jim Sinegal agreed with these sentiments and continues to believe that the shares of Citigroup (as well as Bank of America) remain undervalued. Citigroup was, however, the most undervalued of the names that appeared on our list of top 10 purchases, trading at 69% of our $68 per share fair value estimate at the end of last week. With Bank of America having recovered from its lows earlier this year, the opportunity to acquire shares cheaply is not quite as substantial as it once was. That said, the company's shares are still slightly undervalued, trading at 88% of our $17 per share fair value estimate.

Bank of America and Citigroup were not the only financial-services stocks to see heavier buying activity during the quarter, though, as our top managers gave PayPal and

Along with the additions to our holdings of Oracle, Berkshire Hathaway, Novartis, Zoetis, Wells Fargo and US Bancorp … we also added to our existing positions in PayPal Technologies, Discovery Communications and Celanese. We believe these are all outstanding businesses, and we were pleased to employ our longstanding approach of adding to positions when they trade below 75% of our intrinsic value estimates. As our clients are aware, there is a certain element of contrarianism in our philosophy--not in a strict sense that would have us simply trading against periodic swings in the market, but instead as a deeply held view that market values and intrinsic values often diverge by wide margins, calling upon us to act with conviction when opportunities arise.

Meanwhile, Ronald Canakaris from ASTON/Montag & Caldwell Growth offered the following on his addition to his holdings of PayPal, which his fund denotes as a technology holding (compared with Morningstar's view of the firm as a financial-services name):

The Fund benefited from good stock selection in the Information Technology sector, offsetting the drag from its underweight position relative to the Russell 1000 Growth Index. A new position was initiated in Microsoft, a hardware and software computer manufacturer. The company's easier comparisons from the XP refresh and growth in cloud properties should lead to reaccelerating near-term earnings growth. We re-established a position in Qualcomm, the mobile chip and technology pioneer, as we believe several of the headwinds to earnings growth in the past year (China royalties, chip share losses and margins, iPhone cycle) will soon turn into tailwinds, and the stock is attractively priced. MasterCard was reduced as the stock was trading near the upper end of its historical valuation range, while we added to positions in Facebook and PayPal on market weakness to take advantage of attractive valuations of these companies with solid earnings growth.

Sinegal believes that three major trends will drive developments in the payment industry over the next five years. First is the end-to-end facilitation of commerce. He notes that in the past, consumers tended to find out about products on television or through their co-workers, and then shopped at malls or stand-alone stores, and paid with cash or checks. Today, firms like

This would raise some questions then for our managers that have invested more heavily in Capital One Financial, with

While the financial-services sector grabbed much of the spotlight during the most recent period, the healthcare sector was not lacking for significant events either. The most notable of which were the continued demise of narrow-moat

BBH Core Select,

We initiated a position in Perrigo, a leading manufacturer of store-brand, over-the-counter (OTC) medications and difficult-to-produce generic prescription drugs. Perrigo fits well with our Core Select investment criteria, and we believe that it is well positioned in the healthcare industry given its focus on products that offer quality, affordable healthcare alternatives to consumers. We expect the Company to benefit over time from: i) increases in pharmaceutical usage as global populations age, ii) increasing penetration of store brands for OTC medications, and iii) the transition of existing drugs from prescription-only sales to OTC availability. A sharp decline in Perrigo's shares during April (following the announcement of a management transition and reduced earnings guidance for 2016) facilitated our purchase.

Morningstar analyst Michael Waterhouse believes that the shares, currently trading at 74% of our $130 per share fair value estimate, are undervalued. The company, in his view, has been the victim of both bad news and poor results, which have helped drive the price of the shares down considerably since the middle of last year. Waterhouse believes that Perrigo still possesses a narrow economic moat, but that the company's integration issues with Omega (which led to a noncash impairment charge during the most recent quarter), competitive pressure in its prescription drug segment (which suggests slower earnings growth ahead), and a transition in leadership (following CEO Joseph Papa's exit to run Valeant Pharmaceuticals) have created a number of critical challenges for the firm in the near term. Waterhouse notes that the elevation of the company's current president, John Hendrickson, to chief executive should be relatively smooth given his long history with the firm (having originally joined Perrigo in 1989) and his previous leadership roles within the firm.

While recent operating results have been less than satisfactory, Waterhouse believes that in the long term Perrigo can move past the setbacks in the Omega integration, as well as stabilize (and even potentially reverse) certain of the adverse growth and margin trends in its other segments. He believes that the company's consumer health business can support stable growth with little risk from reimbursement concerns or new entrants. Meanwhile, ongoing market penetration of private-label products, international portfolio expansion, and over-the-counter approvals for existing prescription drugs should help bolster growth. Waterhouse also believes that Perrigo's prescription segment, which has been a primary driver of recent growth and margin expansion, will remain an attractive contributor to performance despite increased competitive pressure. He still considers the firm's generic prescription topicals segment as a relatively attractive niche with limited competition. And despite the near-term issues with the Omega acquisition, the deal has made Perrigo a major player in the European over-the-counter market, providing it with the brand portfolio and salesforce necessary to compete in a fairly fragmented customer base of retailers in the region. While the interim may be painful, Waterhouse believes that management can eventually move beyond a number of these issues.

As for the top 10 sales by investment conviction, there continued to be a fair amount of outright selling, driven by holdings either becoming fully valued in the minds of our top managers or where the fundamentals of the company had changed meaningfully from the selling manager's original investment thesis. During the most recent period, four of the top 10 sales--UPS, Berkshire Hathaway, Boeing and no-moat

Four of the top 10 sales--Microsoft, Procter & Gamble, Berkshire Hathaway,

Turning to the details of our first quarter performance, our strongest contributor was Oracle, which rose by 12%. The shares gained steadily through much of the quarter, spurred by evidence of growing success in the cloud business and a solid earnings report in mid-March. The key investment debate surrounding Oracle over the last few years has centered around whether its cloud-based products could offset the slowing pace of growth in its mainstay on-premise software business. Adverse currency movements and the up-front cost commitment needed to support the growth in cloud services have added to the perception challenges Oracle has faced, at least in terms of its reported earnings, but our consistent view has been that underlying business trends and the management team's execution on controllable factors have been quite encouraging.

The Company's recent updates have shown a meaningful acceleration in contract signings and total contract value for the cloud business, spanning enterprise applications, middleware platforms and infrastructure as a service. As promotional pricing periods for cloud services begin to expire, we anticipate an accompanying uplift to paid contract value in some proportion. While sales growth in traditional software licenses and hardware will likely remain negative in the intermediate term, we expect that strong renewal rates for maintenance and support contracts combined with the aforementioned ramp in cloud revenues can drive solid overall growth this year. At the same time, we anticipate an uptick in operating leverage as sales costs moderate and scale benefits accompany increasing utilization of the data center infrastructure that supports the cloud offerings.

We remain pleased with Oracle's capital allocation discipline – in particular the Company's restraint on the acquisition front and its value-minded share repurchase activity. We added to our position twice in January at prices below $35. Oracle is now the second largest position in Core Select.

By the end of April, the total share count had been reduced, and Oracle dropped down to the third-largest position for the BBH Core Select fund. The managers at both

While there was an assortment of other sales among our top managers, none struck us as extraordinary, as most appeared to be the controlled trimming of already large positions, the booking of profits, or both. In most cases, the names that were sold were trading within 10% of our analysts' fair value estimates, with many being up in price over the past year. The most notable individual sales during the period were Sound Shore's complete elimination of its stake in AIG, Fairholme's outright sale of its stake in Berkshire Hathaway, both

If you're interested in receiving e-mail alerts about upcoming articles from The Ultimate Stock-Pickers Team, please sign up here.

Disclosure: Eric Compton has no ownership interests in any of the securities mentioned above. It should also be noted that Morningstar's Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IORW4DN3VVC3BC4JO7AQLSJTF4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ODMSEUCKZ5AU7M6BKB5BUC6G5M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TGMJAWO4WRCEBNXQC6RFO5TOAY.png)