Do 529 Plans' Age-Based Funds Draw the Short End of the Diversification Stick?

Morningstar's annual college-savings plan study compares diversification between target-date retirement funds and 529 plans' age-based options.

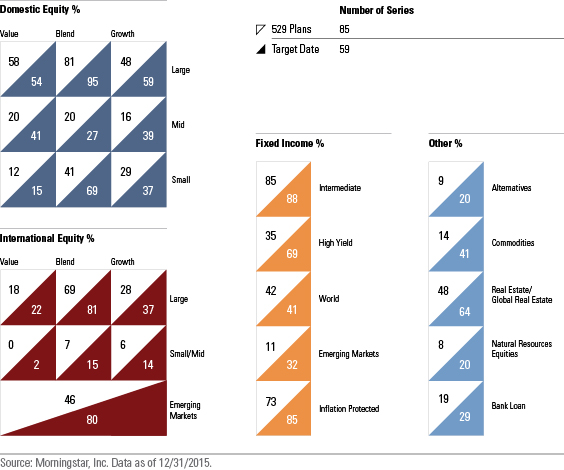

On May 26, 2016, Morningstar released its annual report on 529 college-savings plans. In the report, we take a deep dive into diversification within age-based options, which are the most popular investments in 529 plans. Age-based portfolios share many of the same characteristics as target-date retirement funds. Both gradually move from an emphasis on equities to fixed income over time, and they aim to provide investors with a single, well-diversified portfolio. As such, we looked at how diversification compares between the two types of strategies. Exhibit 1 shows the percentage of target-date series with underlying funds in various Morningstar Categories compared with exposures held by 529 plans' age-based options. Some 529 plans offer multiple age-based tracks; the exhibit counts a plan as having exposure to a category as long as at least one age-based track has a fund in the category.

Of course, there are legitimate reasons why an age-based portfolio for college savers should look different compared with a target-date fund. Target-date investors have more than four decades to save for retirement, whereas 529 investors have about half as much time to grow capital. Moreover, target-date investors have much longer expected withdrawal periods. As such, 529 age-based portfolios tend to take on less risk than target-date funds, especially near the end of the accumulation period and during the withdrawal phase. For instance, the typical 529 investor has about 15% in equities at college enrollment, whereas the typical target-date investor has about 40% in equities at retirement. Even so, comparing 529 age-based portfolios with target-date retirement funds helps put the diversification that college savers are receiving into context.

Exhibit 1: Percentage of Series With Underlying Fund Representation, by Morningstar Category

Exhibit 1 has some limitations that apply to 529 age-based portfolios and target-date retirement funds alike. Some underlying strategies have meaningful exposure to securities outside of their category. For instance, large-blend funds can have significant exposure to small-cap stocks as well as value and growth securities. And the exhibit doesn't capture the level of investment in these categories; the actual allocations may be trivial in some cases and have a limited impact on the overall portfolio. Nevertheless, we believe the figures provide a good starting point for deeper analysis.

Less Exposure to Peripheral Asset Classes Exhibit 1 demonstrates that 529 age-based portfolios certainly provide adequate exposure to core asset classes, like large-cap U.S. equities, international stocks, intermediate-term bonds, and inflation-protected securities. However, compared with target-date retirement funds, they tend to have less exposure to more-specialized asset classes.

The 529 age-based options commonly invest in intermediate-term bond funds for fixed-income exposure. Compared with target-date funds, however, far fewer plans--35% of 529 plans versus 69% of target-date series--incorporate high-yield bond funds in their age-based portfolios. That's one of the largest discrepancies in exposures between 529 plans and target-date funds. Age-based portfolios also tend to tread lighter in other less common asset classes, including commodities, alternatives, and bank-loan strategies.

These findings aren't entirely surprising. Some of the more peripheral asset classes carry meaningful risks, and given 529 investors' relatively shorter time horizons, they might not realize the expected diversification benefits offered by these areas, especially if college savers begin late. Meanwhile, many 529 plans also seek to provide investors with simple, easy-to-understand investment options, and therefore they avoid these less common asset classes.

A Closer Look at Emerging-Markets Exposure

The exhibit above might suggest that 529 plan age-based portfolios have significantly less exposure to emerging-markets stocks and bonds than target-date retirement funds. However, the exhibit is misleading in that regard. A number of plans, for instance, gain emerging-markets stock and bond exposure through broad Vanguard index funds. Seventeen plans use

Increases in International Exposure As a point-in-time snapshot, the exhibit also doesn't reflect changes in diversification. On this front, a number of plans that use Vanguard as their investment manager increased their international exposure in 2015. The firm recommended increasing both equity and fixed-income international exposure across age-based portfolios and single-fund solutions. This was a firmwide decision, based on Vanguard's research that shows international exposure closer to the global market cap provides worthwhile diversification. Across Vanguard's target-date series, for example, non-U.S. equity exposure increased to 40% from 30%, and non-U.S. fixed-income exposure increased to 30% from 20%.

However, not all Vanguard-advised 529 plans made the same jump. States generally must approve asset-allocation decisions, and some have been reluctant to follow Vanguard's advice. For instance, Arkansas and New York have declined to implement Vanguard's recommended international allocations within their direct-sold plans, without providing convincing investment-based rationale for their decisions. Ideally, states should partner with program managers or consultants with sound asset-allocation capabilities, and work in tandem to bring their best thinking to the portfolios.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)