Market Volatility Diminishes in April

Commodities and materials stocks dominate performance statistics

Market activity in April was muted compared with the high volatility experienced in each month of the first quarter. World equity markets' returns generally averaged between 0.4% (for the S&P 500 and emerging markets) and 2.5% (in Europe). Japan's results were in the middle with a 1.4% rate of return. More soft economic news hit U.S. and emerging-market issues, while monetary easing and better economic reports in Europe contributed to Europe's modest outperformance. Debt markets had a greater dispersion of returns in April versus stocks, with high-yield bonds returning almost 4% while the U.S. Aggregate Bond Index, which includes government and corporate debt, returned a much more modest 0.4%. U.S. corporate and emerging-market debt landed in the middle of this range. In a very general way, bonds did nearly as well as stocks for the month, but with more volatility.

However, commodities did the best of all in April, returning 8%–10% for the month. Much of that improvement was due to oil prices, which continued to go up in April. However, much of the oil price improvement was related to a series of events that pressured short-term supply. Fires in the Canadian oil sands region of Canada and oil-related labor actions in several countries—most notably, Kuwait—and ongoing issues in Venezuela and Nigeria kept prices going up during April. There was also some evidence that perhaps U.S. shale oil production was beginning to slow. We would caution that shale oil projects seem to be easier to restart than some of the older technology fields. Rising oil prices did not have as positive a magnetic effect on equity markets in April as they did in February and March, perhaps because of this stop-start ability, as well as the temporary nature of some of the oil field production issues. In other words, energy and equities decoupled for a month. However, high-yield debt, which includes a heavy energy component, did better than stocks and other forms of debt, but not as well as oil itself.

April Was More About Individual Company and Sector Reports, not Macro-Level data In general, sector-specific events seemed to influence markets of all types, more than any broader risk off trades that characterized the first half of the first quarter and risk-on trades that characterized the second half. However, in the United States, value stocks and smaller stocks did better than their larger, more growth-oriented brethren, though not by a lot. It was another bad month also for the FANG stocks (Facebook up 3%, Apple down 14%, Netflix down 9%, and Google (now Alphabet, down 7%) which drove so much of market performance in 2015. On the other hand, it was a great month for both energy and basic materials, which both outperformed broad markets and all other categories, both gaining over 7%. Obviously, higher oil prices and a knock-on effect in other categories, plus as a weaker dollar helped these formerly downtrodden categories. Consumers, who appear to be clinging to their cash, hurt April's market performance with consumer discretionary and staples categories averaging a 1% decline.

Weak Economic Data in China and the U.S Suppress Positive Impacts of Higher Energy Prices Economic data for March and April have not been wonderful in the U.S. and China, though European hard data (versus sentiment surveys) has been healthier. In the U.S., consumption, GDP, and employment data have come up short relative to expectations of just a month ago. Chinese purchasing manager results are still disappointing and China seems to be making noises about clamping down on some lending practices. Furthermore, recent Chinese government speakers appear to be suggesting that the government is not anxious to introduce large new stimulus measures and seems willing to accept slow growth.

Europe's GDP growth accelerated to an annualized growth rate of 2.4% in the first quarter of 2016, an unexpected acceleration from fourth-quarter levels. Still, both businesses and consumers in Europe keep waiting for another shoe to fall, whether it is Brexit (the potential exit of the U.K. from the European Union) or falling exports to China, or another terrorist event. So despite better recent results in many European reports, the mood and sentiment reports remain somber at best.

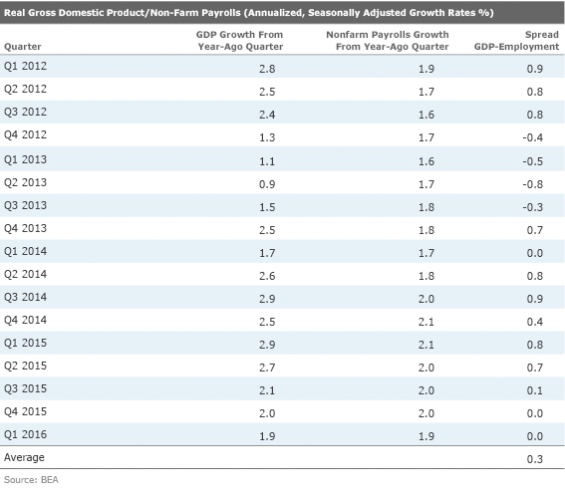

U.S. Employment and GDP Data Suggest Some Slowing, but No Disaster The U.S. GDP report for the first quarter showed sequential, annualized growth of just 0.5%, creating more long-term growth worries that hurt U.S. equity markets in April. We believe hard-to-adjust seasonal factors and weather effects overstated some of the slowing, though it is hard to deny that growth seems to have eased, at least a little, even on reliable year-over-year measures. By year-over- year measures, GDP growth was a better 1.9%, yet even that was noticeably below the 2.4% growth rate for all of 2015.

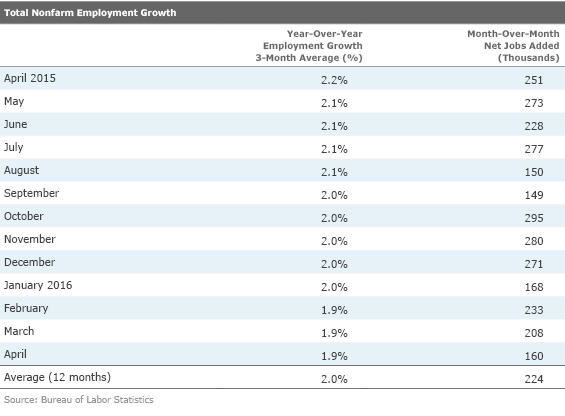

Confirming those growth fears was a seemingly disappointing employment report for April that indicated that just 160,000 jobs were added in April compared with the 12-month average of 224,000 jobs. While the timing of the slowdown surprised most economists, employment growth has run ahead or the same as GDP growth for several quarters, which is not a sustainable state of affairs.

We suspect that U.S. job growth could average fewer than 200,000 per month for some time, to bring GDP and employment growth back to their more normal relationship. The employment report wasn't all doom and gloom, nevertheless. Hourly wages were up 2.5% year over year, hours worked were up, and the fastest-growing sectors seemed to be those that offered better wages and hours, including professional business services and healthcare.

Demographic, Not Central Bankers, Will Determine Future Growth and Market Returns In sum, we believe a combination of slowing population growth and an aging population, which is more frugal and consumes less, will continue to weigh on world economic growth. In an age of shrinking labor pools, workers and consumers are likely to fare better even as corporate profits begin to feel the weight of higher pay and the inability to raise prices. The world is gradually coming around to our view that slow growth isn't a problem easily cured by low interest rates or other government actions. Even our longer- term U.S. economic forecast of 2.0%–2.5% looks suspect with a current population growth rate of just 0.7% and recent dismal productivity figures. While worries are building that a corporate profit slump could make matters worse, we don't believe that slump will imminently drive us into a recession.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7TFN7NDQ5ZHI3PCISRCSC75K5U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/QFQHXAHS7NCLFPIIBXZZZWXMXA.jpg)