Why Fund Costs Are Dropping

Vanguard is a big reason, but not the only one.

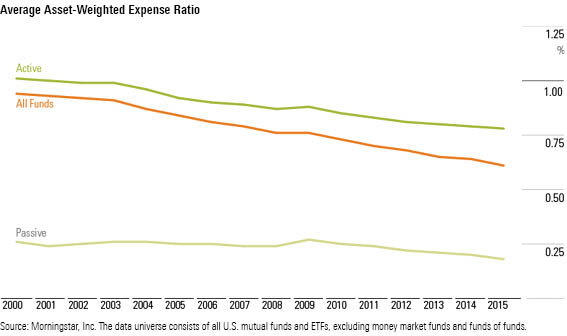

Downhill All the Way This week, Morningstar released its annual study on mutual fund expenses. (Take a look; it's an easy read, and very informative.) The report's title reveals its punch line: "Average Fund Costs Continued to Decline in 2015." Yes they did, as measured by dollar weighting, which gives bigger funds their due, and thus addresses the question of the typical investor experience. (In contrast, computing an equal-weighted average would indicate what the typical fund does.)

The question is why. One response was offered in a fund-industry trade publication: "Thank Vanguard." There's plenty of truth to that. Month after month, Vanguard sells more shares than any company before it, thereby extending its position as the world's largest fund provider. And Vanguard's funds continue to be far cheaper than most. Moving the needle of a group average requires many new samples, each differing sharply from the norm, and each coming from the same direction. Enter Vanguard.

But while Vanguard has spearheaded the change, and is its biggest mover, there is more to declining expenses than just Vanguard. The average cost paid by fund investors is falling across the industry, for multiple reasons. (The following charts were purloined from the expense study.)

Let's start by looking at the overall descent.

The slide began at the start of this century (in the 1990s, which are not pictured, fund expenses were flat). From 0.94% in 2000, the dollar-weighted average has slipped at a rate of 2 basis points per year, reaching its current mark of 0.61% in 2015. If the slope remains steady, the average expense ratio will turn negative in 2046, at which time funds will pay their shareholders for the privilege of running their assets.

Probably not--that was an illustration of the error of extending a trend line, not a serious prediction. (Although who saw this coming?) But at this stage, there's no telling when the bottom will be reached. The expense average will not become negative, but there's plenty of room between its current level of 61 basis points and zero, and no sign that the reduction has finished.

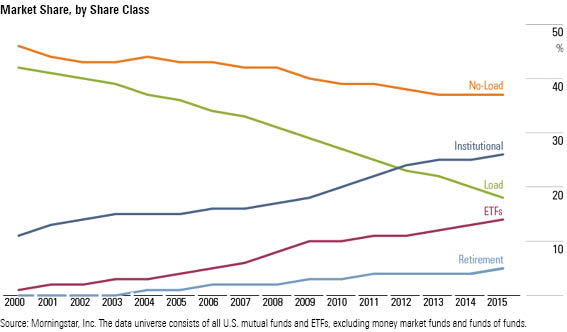

The Evolution of Advice One reason for the drop has been a change in the share-class mix. The assets allocated to load shares, the most expensive of share-class types, have plummeted from more than 40% of the fund industry in 2000 to less than 20% today. Meanwhile, exchange-traded funds have gone from almost nothing to 15%. Finally, retail no-load shares have lost ground to institutional shares, which also carry no load but have lower ongoing expenses.

The movement, of course, owes to the change in how financial advice is priced. As more advisors charge directly for their services, demand for low-cost shares that carry neither front-end loads nor ongoing 12b-1 fees increases and demand for traditional retail classes slumps. Today's customers of financial advisors hold much cheaper funds, on average, than did the customers of the two previous generations.

(However, as the expense study states, this shift requires an important caveat. We know, without question, that the average fund cost paid by investors is falling. That may not be so for their total costs, which include not only the fees levied by funds, but also those owed to advisors.)

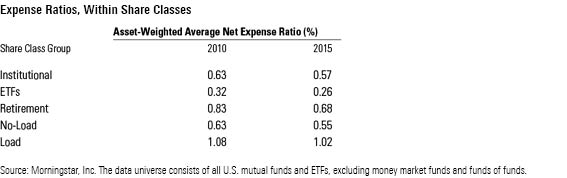

Active to Passive Within each share class, the trend is also lower. During the past five years, the average asset-weighted expense ratio of each share-class type has fallen, by 6 basis points for load funds (a small move) and ETFs (a big move, given that the ETF expense ratio started at a modest 0.32%) to 15 basis points for the retirement shares that are held by 401(k) plans. Among the share classes, there are no exceptions to the general rule.

The movement within share classes, as with the movement of the mix, arises mainly from forces outside the fund industry. Although fund companies sometimes do cut the costs their of existing funds, and commonly will launch new funds that are priced more cheaply, the main mechanism for driving down the costs within the institutional, retirement, and no-load fund groups has been the substitution of active funds with passive competitors.

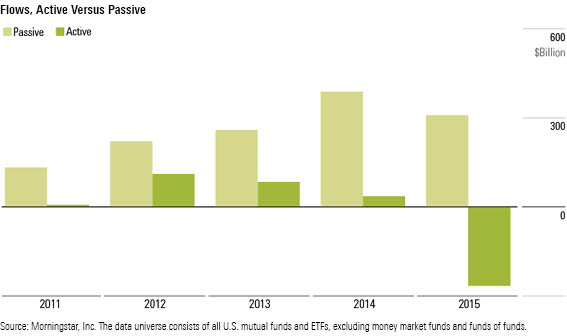

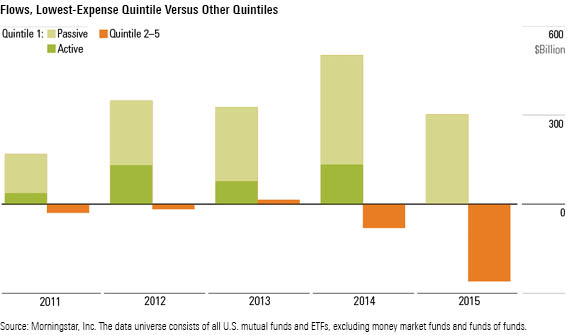

Passive management has consistently won that battle since the 2008 financial crisis, with last year being its bloodiest victory yet. Passively managed funds (mutual funds and ETFs, excluding money market funds and funds of funds) enjoyed just over $300 billion of net inflows, while active funds suffered the mirror image in redemptions. At that rate, passive funds will account for more than 100% of the industry's total assets in … never mind.

The Lean Get Fed There is a bright spot for active funds. If they are cheap, they can prosper. Although active funds overall were smacked by redemptions in 2015, those active funds with expense ratios that placed them in the lowest quintile among all funds (that is, both passive and active) held their own. They did not gain new assets, on the whole, but they didn't they lose them, either. And during the previous four years, they received positive inflows, even as higher-priced active funds did not.

As these pictures demonstrate, most of the fund industry is on the outside, noses pressed against the window, wondering how to get back inside. There are three paths for success: Get cheaper, get cheaper, and get cheaper.

John Rekenthaler has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)