The Sad Tale of Concentrated Value Funds

They need index fund competitors.

Small Is Beautiful? Patrick O'Shaughnessy's article, "Alpha or Assets," advocates "targeted" indexing. As O'Shaughnessy points out, most index fund providers build their lineups to accommodate scale, by creating funds that hold large numbers of securities. Such a decision makes perfect sense for traditional index investing, which seeks to replicate the showing of entire markets.

The approach may, however, be a drawback with the new wave of strategic-beta (or "smart-beta") indexing. Those funds carry implicit performance promises. In some fashion, their promoters suggest, they will outdo traditional index funds. In short, strategic-beta funds are the indexed version of active investing, living on the suggestion of outperformance, and dying if that suggestion goes unfulfilled. As such, they might be better served by trimming their portfolios to own only the most-attractive issues. They might wish to target.

That all makes sense, but it's important to note that we've been here before. Twenty years back, similar arguments were made for concentrated stock funds, which, as targeted index funds would later do, proclaimed the virtues of holding stripped-down portfolios. The story offered by concentrated-fund managers was compelling: Rather than force portfolio managers to spread their insight among hundreds of stocks, let them invest solely in their favored few. Many nodded in agreement, and purchased such funds.

Less for Less Their results have been … unimpressive.

Let's examine O'Shaughnessy's area of interest, value investing. O'Shaughnessy demonstrates that focused index strategies that restrict themselves to a segment of the value-stock universe--those companies that sell at the very lowest price multiples, regardless of their stock-market capitalizations--handily outgained the general value-stock universe over the time period of 1964-2015.

The usual caveats about the limitations of back tests apply to funds that will be created based on that information. However, that caveat does not apply when looking backward at the existing cadre of concentrated value-stock funds. Those funds have already enjoyed the luxury of operating during a period that rewarded focus. One would think, therefore, that they would have scored top returns, as they could have held only the truly cheap stocks, while the diffuse funds watered down their performances by diversifying into the moderately cheap.

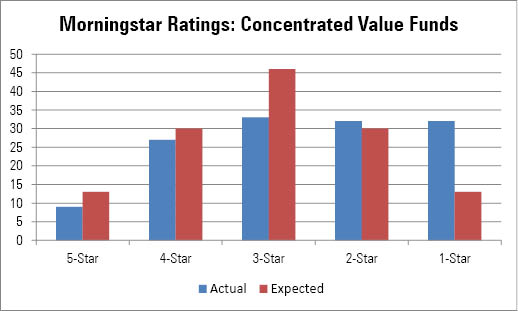

Think again. In recent years, concentrated value funds have been worse, not better, than the average value-stock fund. Morningstar Ratings show the picture. Although the stars, as with back tests, can be perilous when used to forecast future performance, they're fine at capturing what did succeed. A highly rated fund is one that beat most in its investment category, as measured by total return and volatility, and including the effect of costs. Quite reasonable.

Concentrated value funds--that is, funds with fewer than 50 stocks in their portfolios--failed the test. When compared with the star rating's overall distribution, concentrated value funds have fewer 5-, 4-, and 3-star ratings, more 2-star ratings, and far more 1-star ratings. Thirty-two concentrated value funds receive Morningstar's bottom rating, with nine scoring at the top. That is a notably poor showing, given that the star-rating calculation generates equal amounts of each rating for value funds overall.

Source: Morningstar.

Not This Time Close followers of this column may wonder if this outcome owes to Dunn's Law. That rule states that the purer the fund, in the sense of being truest to the style of its investment category, the better the fund's relative performance when its style fares well, and the worse if not.

That can sound rather tricky when stated in the abstract, but the applications are easy to understand. If stocks surge, a fully invested index fund is likely to beat less purely invested active funds. The opposite occurs when stocks fall. Similarly, a concentrated value fund that has a particularly high exposure to the value "factor" should be expected to beat less-pure value funds when value leads the way, and to trail when it lags.

Dunn's Law would be a good defense for concentrated value funds, were it not for three problems.

One is that although large-company growth stocks have whipped their value rivals in recent years (for reasons that I believe to be fundamental, rather than faddish), the same has not held true with medium-size and small companies. Over the trailing three-, five-, and 10-year periods, the three styles of value, growth, and blend have posted very similar returns. Thus, Dunn's Law does not apply to concentrated value funds that do not primarily own large companies.

Second, it's not as if concentrated value funds earned their keep when the tide flowed their way. From 2003 through 2007, as the economy enjoyed a prolonged uptick, value stocks led the charts. But concentrated value funds failed to keep pace. To be sure, they did not trail by much, but trail they did, across all three size groupings. As usual, they also were moderately riskier. Less return, more risk, thus lower star ratings. We've seen that picture elsewhere.

Finally--and the critical point--Dunn's Law does not apply in this particular case, because concentrated value funds don't buy especially cheap stocks. On average, their portfolios sell at the same price ratios, whether measured on earnings, book value, or sales, as do the portfolios of other value funds. Whatever the managers of concentrated value funds have done in the attempt to add (ahem) value, it was not to emphasize the stocks that were shown to be superior by research.

Next in Line Which brings us back the topic of Friday's column: targeted indexing is an idea whose time has come. Will targeted index funds improve upon strategic-beta funds? You got me; I can no more answer that than to say whether most strategic-beta funds will beat the original index funds. But what I can say is that concentrated managers, with value investing and elsewhere, haven't used their focus effectively. It's time to see if targeted indexing can do the job better.

John Rekenthaler has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LUIUEVKYO2PKAIBSSAUSBVZXHI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)