Mother of Flowmageddon

Outflows across a complex can be damaging to fund parent companies.

A version of this article was published in the March 2016 issue of Morningstar FundInvestor. Download a complimentary copy of FundInvestor here.

In my "Flowmageddon" article that ran a couple of weeks ago, I mentioned that outflows can be damaging to the parent company--not just an individual fund. This week, I'll delve into that ground.

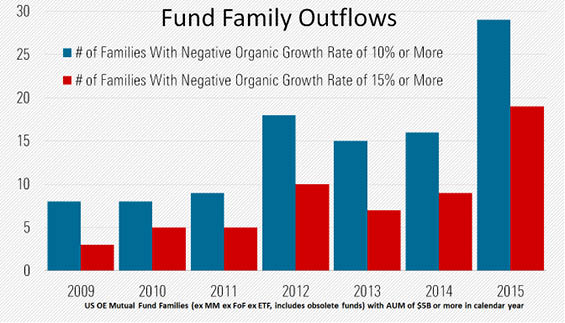

The impact of redemptions on a fund company is less obvious than at an individual fund, but still quite real. It's a challenge that is facing more fund companies than usual. I pulled the 50 largest calendar years of outflows in percentage terms to hit any fund company in the past 20 years. Remarkably, 10 of the 50 came in 2015. The next biggest year was the bear-market year of 2008, when five firms had big redemptions. (I limited the search to firms that had at least $5 billion in assets to begin the year.) The 10 biggest percentage drops in open-end funds from 2015 had outflows that ranged between 17.8% and 26.0% in a single calendar year. Fund companies can certainly rebound from such an event, and they have, but it does present new challenges. Asset management is a high-profit, low-debt business, and that means fund companies generally have some slack before flows hurt them.

Source: Morningstar.

Marsico Capital is one firm that has suffered a slow burn as redemptions and poor performance have gradually eaten away at its standing and led to departures in investment personnel. Marsico had an unusually high level of debt because of a 2007 deal in which it bought control back from

More broadly, outflows can spur staff cuts, harm a firm's reputation, hurt performance, and make it tougher for a firm to recruit top talent. Let's take a look at those that are most worrisome among the 10 suffering outflows.

Third Avenue's 26% outflow tops any firm over the past 20 years. Having a fund in the headlines because of a mismatch of flows and holdings liquidity will do that to you. The firm faces an investigation and changes at the top, and investors are fleeing the rest of the firm's funds besides the one that imploded. The reasoning is fear that problems at the firm will lead to big changes or possibly key departures at the other funds. Third Avenue is owned by

Wasatch shed about 19% of assets, and that's a concern given its emphasis on small-cap stocks in most funds. The good news is the firm endured a sizable drop in assets under management a decade ago but was able to keep its investment team intact and rebounded nicely. Still, I worry when I see this in small-cap land.

Longleaf Partners is owned by the managers of its funds along with some other employees, so the firm is pretty well insulated from short-term issues. If it were publicly traded you can be sure that changes would be forced on the team. Still, it's enduring its worst performance slump ever and has seen 24% in outflows. I think Longleaf can withstand more, but what it really needs is a rebound in fund performance.

Calamos' CLMS outflows come at a bad time for the publicly traded firm. John Calamos Sr. was thought to be handing over the reins to Gary Black until the two parted company. That left a big hole in transition plans at a time when performance has been poor and investors are leaving in droves. The firm saw 18% of AUM go out the door in 2015. On March 14, 2016, the firm named John Koudounis as CEO effective April 4. Koudounis had been CEO of Mizuho Securities USA before taking the helm at Calamos.

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)