Currency Hedgers Behaving Badly

Some newly minted currency hedgers seem to lack the fortitude necessary to reap the long-term benefits of hedging currency risk.

A version of this article was published in the March 2016 issue of Morningstar ETFInvestor. Download a complimentary copy of ETFInvestor here.

I've made no secret of my skepticism of currency-hedged exchange-traded funds. In "To Hedge or Not to Hedge?" from the August issue of ETFInvestor, I opined on the billions of dollars of investors' capital flowing into currency-hedged ETFs and concomitant flurry of product development in the space: "In my opinion, the bulk of these flows reflect performance-chasing behavior. Going long Japanese stocks while shorting the yen and going long European ones while shorting the euro are some of the only trades that have 'worked' lately."

Since that time, both trades have soured, and there is mounting evidence that many investors are now headed for the exits.

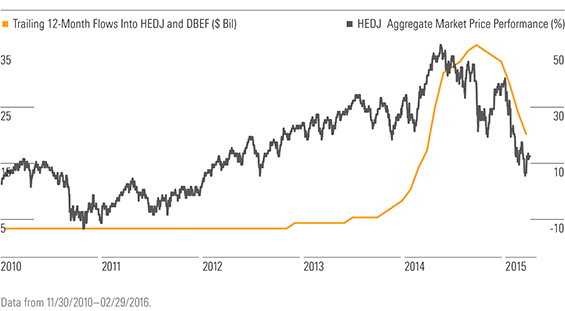

As you can see in the accompanying chart, aggregate trailing 12-month flows into the two largest currency-hedged international-equity ETFs, HEDJ and

Meanwhile, product development has continued at a breakneck pace. There have been more than three dozen new currency-hedged ETFs launched since the August issue went to press, including a raft of new "adaptive" or "dynamic" funds from iShares and WisdomTree. These funds' underlying benchmarks will regularly adjust their levels of currency exposure in response to changes in a variety of well-known currency indicators (carry, for example). The implicit assumption in this latest wave of currency-related strategies is that a set of index rules will somehow succeed where generations of living, breathing foreign-exchange managers have had mixed results--at best.

This is not to say that hedging currency risk has zero merit, but I believe that investors (and indexes) have a near-zero chance of regularly and effectively timing currency movements. As I said in the August issue: "Ultimately, investors' ability to stick with an approach to managing currency risk in the long haul will matter far more than the method they choose." Recent asset flows data seem to be signaling that many newly minted currency hedgers are more fickle than steadfast.

Disclosure: Morningstar, Inc.'s Investment Management division licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)

/d10o6nnig0wrdw.cloudfront.net/09-25-2023/t_f3a19a3382db4855b642d8e3207aba10_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)