Target-Date Funds: Getting Cheaper in a Hurry

The most investor-friendly segment of the fund industry.

Getting Better All the Time Morningstar's 2016 Target-Date Fund Landscape launched today. If you have a question about target-date funds, that report likely has the answer. And if you have no particular question but wonder how the industry's offerings stack up, the paper measures the various families for best practices. Something for everybody!

Slightly outside the scope of the paper, and the topic of this column, is how an outside force has buffeted the target-date business, causing it to become the fastest-moving, most customer-responsive segment of the fund industry. For the most part, fund companies are lumbering beasts, with their behavior controlled by the slow-moving, long-term factors of existing asset bases, brand strength, and distribution. Typically, mutual fund time is measured by decades. Among target-date funds, however, visible improvements occur each year. And the pace is only increasing.

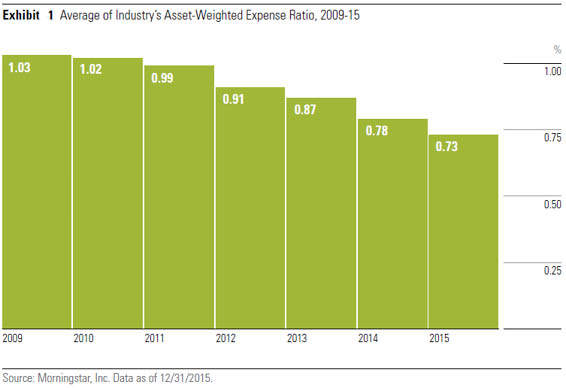

It's the Law The impetus has been legal. The fiduciary responsibility that is mandated by the Employee Retirement Income Security Act, or ERISA, spurred by the threat of class-action lawsuits, has motivated large plan sponsors like no mutual fund investors have ever been motivated before. They want their funds to cost less. They need their funds to cost less. They have the buying power to make that happen. And it is. Target-date expense ratios are plunging--

From 1.03% to 0.73%, in just six years!

As is customary in the fund industry, the biggest factor in driving down expense ratios came because new buyers voted with their wallets. Plan sponsors establishing 401(k) plans--or switching to different families from their existing providers--have shunned even midpriced target-date funds, opting instead for distinctly low-cost selections. Vanguard, of course, has benefited tremendously from that trend. The largest of the target-date providers, it stretches its lead with each passing month.

However, unlike what occurs within the rest of the fund industry, target-date costs are also squeezed, significantly, by their existing customers. Last year, the Supreme Court suggested that a plan sponsor’s fiduciary duty does not stop with selecting suitably priced funds but extends to swapping into lower-cost funds should such become available. They are very much becoming available.

Plan B Some fund companies have responded to the demand by creating a second, lower-cost share class for sponsors that have larger 401(k) plans. Such was Vanguard's approach in launching its Institutional Target Retirement funds last summer. One might think that the company's existing target-date funds were cheap enough, with expense ratios running about 0.16% (16 basis points) per year. The marketplace thought otherwise. Thanks to transfers from existing Vanguard customers, the new series already commands $50 billion in assets--6% of the entire target-date market, accumulated in 10 months.

Other families have rolled out passively managed series, or blends that are both active and passively managed. Either way, in addition to meeting the needs of clients who would prefer that their target-date funds be indexing, the second series addresses the issue of costs. As one might expect, passively run target-date funds tend to be priced lower than the blend funds, and the blend funds less than the fully active funds--

Instead of (or sometimes besides) offering a second, cheaper target-date family, several fund companies have taken the unusual step of cutting costs in their initial series. Fund companies rarely reduce their expense ratios, aside from mostly marginal improvements that come from scale. As with any for-profit business, they are loath to charge less for what they once charged more. Also, the mechanics of requesting permission from shareholders to change the prospectus can be awkward. But such belt tightening is becoming common. Last year, for example, 10 target-date series lowered their expense ratios by at least 5 basis points, with three of them doing so by more than 20 basis points. Adjust or die.

And die some have. In recent years, Legg Mason and Goldman Sachs have each killed their small, unsuccessful target-date families. But as the space is too important for those companies to leave vacant, they have re-entered the market with new target-date funds, featuring (of course) lower expense ratios than those carried by their initial entrants. Those target-date funds paid the ultimate price for being too costly: They were terminated.

Looking Forward All this begs three questions.

One--Will employees at smaller companies eventually reap the benefits enjoyed by those who work at larger firms? (There’s something peculiar about seeing giant companies argue with target-date providers over a few basis points, while investors unfortunate enough to be stuck in the priciest of the target-date families that serve smaller 401(k) plans are paying well north of 1%.) Yes, I think, but it will take a while. The waters are moving more rapidly for large plans than for small.

Two--Will the rest of the industry cut costs so aggressively? No, because as this column has stated, plan sponsors have more negotiating muscle than does the typical fund investor (or financial advisor), and they also face a legal danger that makes them insistent. That said, the overall fund industry will gradually be pushed in such a direction. The sales boom in exchange-traded funds and index mutual funds, along with the U.S. Department of Labor's new fiduciary standards for advice given to retirement accounts, will both drive down fund costs, more rapidly than has occurred until now.

Three--Why aren’t target-date funds purchased outside of 401(k) plans? Their performance has been good; their portfolios are suitable for tens of millions of investors who are accumulating assets and who do not yet have complicated financial situations; and their already low costs are becoming lower. In holding target-date funds, retail investors can free-ride on the expense-cutting efforts of the giant plan sponsors. Why not hop aboard?

To that question, I have no good rebuttal.

John Rekenthaler has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)