Encouraging Signs for Target-Date Funds

Our annual study shows that investors are continuing to use these prominent retirement savings vehicles well and costs are coming down.

Morningstar recently released its annual report on target-date funds, which are among the most prominent investments for workers saving for retirement. There are encouraging signs that investors use these funds well, and the funds often serve as key lifelines to asset managers' bottom lines. In addition to looking at trends such as these, this year's report examines Morningstar's best practices in evaluating target-date series. Here's a summary of the report's key findings.

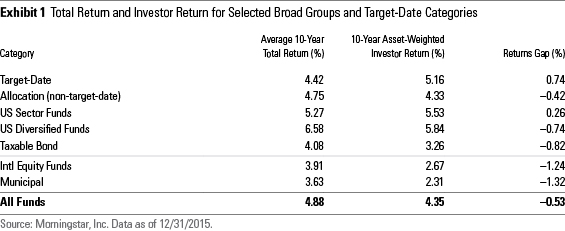

Reaping the Rewards of Disciplined Saving Properly evaluating target-date funds' performance is a complicated task, particularly given that these funds are intended as 60-year-plus investments designed to help workers be financially prepared for retirement. There are hints of a victory, though. Investor returns, a dollar-weighted return that takes into account cash inflows and outflows to measure the returns that investors actually experience, indicate that target-date investors generally buck a pervasive trend. Whereas most other broad categories show the effects of poor timing--investors tend to buy high and sell low--target-date investors largely avoid that fate. The return gap between a fund's investor return and published total return (see Exhibit 1) illustrates the point: Target-date investors have generally experienced results that are 74 basis points better than their funds' published total returns. Investors in other funds tend to experience negative return gaps.

The key to success stems from target-date funds' broad use within employer-sponsored retirement savings plans, as well as their status as a qualified default investment alternative within 401(k) plans. As such, the funds benefit from the consistent flows coming from regular paychecks. Target-date investors also tend to be more hands-off than most, and that behavior has worked to their advantage.

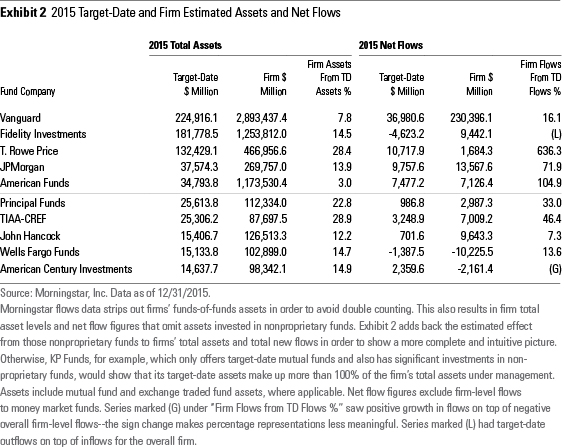

Relying on Target-Date Funds' Dependable Flows Target-date funds continued their multiyear growth trend in 2015 with an all-time high of $69 billion in positive net flows. Assets in target-date mutual funds grew to more than $763 billion by the end of 2015, up from $706 billion at year-end 2014. For firms with established target-date offerings, these funds often play a meaningful role in their business success. Exhibit 2 shows that of the 10 largest target-date mutual fund companies, target-date funds account for at least an estimated 20% of the mutual fund assets for T. Rowe Price, Principal, and TIAA-CREF. As such, flows--both in and out--can have a sizable effect on business results. T. Rowe Price and American Funds, for instance, would have had negative net flows in 2015 save the flows via the target-date funds. The figures are especially striking for firms that primarily offer actively managed investments, where target-date inflows have often become the primary source of new assets.

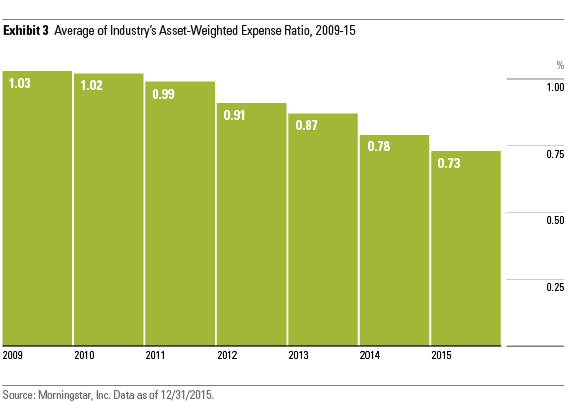

The Race to the Bottom in Target-Date Costs Investors continue to pay less for target-date funds. The asset-weighted expense ratio for more than half of target-date series declined in 2015, adding to the multiyear trend of declining fees. From 2014 to 2015, the average target-date series' asset-weighted expense ratio fell from 0.78% to 0.73%. Exhibit 3 captures the steady decline in fees during the past several years. The decline comes from investors seeking out low-cost options and investment managers lowering fees to stay competitive.

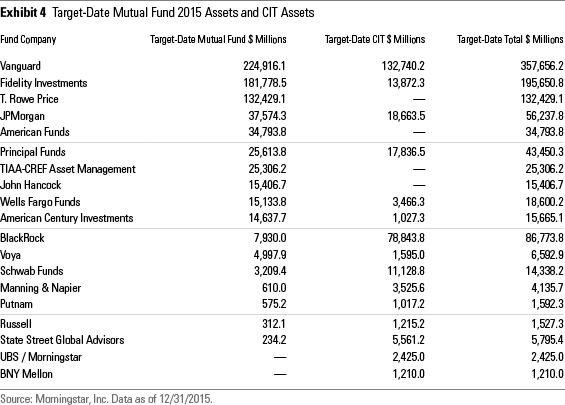

CITs Broaden the Competitive Landscape Morningstar manager research analysts currently cover and rate 25 of the industry's most prominent target-date mutual fund series. Collective investment trusts also have a large slice of the target-date pie, and Exhibit 4 shows the mutual fund and CIT assets for some of the market's largest target-date managers. (Investment firms voluntarily report CIT information to firms such as Morningstar. As a result, Morningstar's CIT database does not capture all target-date CIT offerings.)

Vanguard already had a healthy lead over rival Fidelity for target-date mutual funds, but considering its CIT assets, Vanguard lengthens its lead above all peers; it runs nearly $358 billion in target-date assets across both vehicles--no other fund firm appears to manage even $200 billion in target-date assets. BlackRock's target-date mutual fund assets don't put it among the market's top 10, but the firm stands within the top five players when considering its $79 billion in CIT assets. A number of firms, such as Schwab and Manning & Napier, manage significantly more in target-date CIT assets than target-date mutual fund assets.

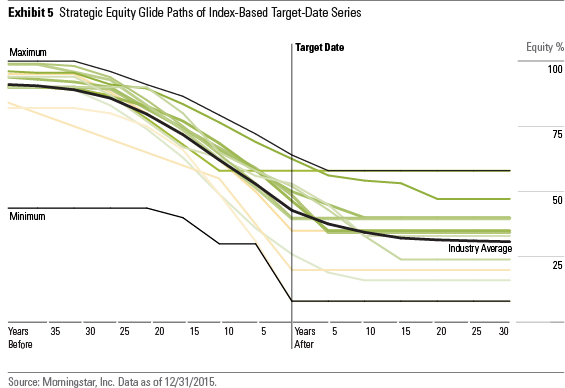

Limitations of Conventional Evaluation Methods Some investors may start their target-date selection process by grouping series according to wide-ranging characteristics, such as "active" versus "passive" and "to" versus "through" strategies. However, such broad classifications barely touch upon the nuances that drive target-date fund results. For instance, regardless of whether or not a series uses passively managed underlying strategies, all target-date managers make multiple active decisions in designing an asset-allocation glide path. A passive approach to target-date investing does not exist. Exhibit 5, which shows the wide range of strategic equity glide paths of target-date series that invest predominantly in index-based underlying strategies, illustrates the point.

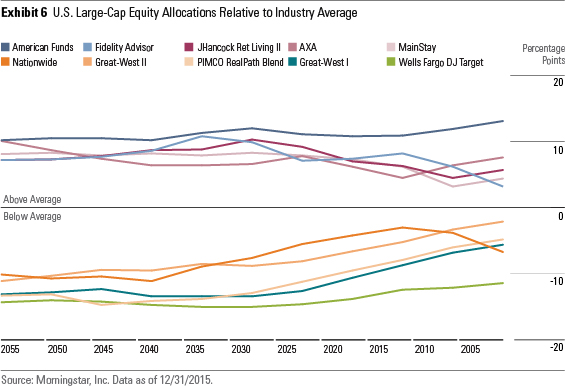

Identifying the Differences That Matter Instead, Morningstar manager research analysts pay close attention to each series' defining characteristics and how they contribute to or guard against the myriad risks faced by investors. This year's report builds upon Morningstar's previous work on the sub-asset-class glide path by identifying the sub-asset-class outliers that contribute to series' potential risk exposures. Knowing if a series has a relatively hefty stake in any particular subasset class, or if a series omits certain subasset classes altogether, can provide insight into the approach and help set performance expectations.

As an example, Exhibit 6 shows the five series with the biggest average overweightings in U.S. large-cap stocks as of Dec. 31, 2015, as well as the five series with the biggest average underweightings. The American Funds Target Date Retirement series stands out with an average 11-percentage-point overweight stake. The series draws upon all of the firm's top-rate equity offerings, yet the behemoth sizes of those funds limit them from taking meaningful positions in smaller-cap fare. The series' large-cap orientation has been a major driver of its peer-beating results in the past five years, but the underlying funds' large asset bases mean its target-date investors will be at a disadvantage when smaller-cap stocks lead the way.

/s3.amazonaws.com/arc-authors/morningstar/0c1d596a-78d2-477f-acfc-a1ff33479805.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/0c1d596a-78d2-477f-acfc-a1ff33479805.jpg)