It's Flowmageddon!

Outflows add to the challenges facing active stock fund managers.

A version of this article was published in the March 2016 issue of Morningstar FundInvestor. Download a complimentary copy of FundInvestor here.

Something big is happening.

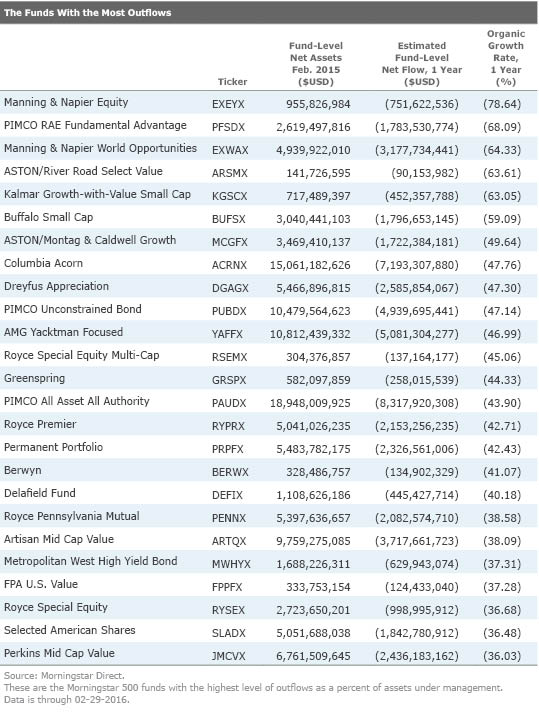

A striking 18 Morningstar 500 funds suffered outflows of at least 40% of assets under management in the trailing 12 months ended February 2016, 61 shed 25% or more, and 168 had outflows of 10% or more.

Also, in January we saw something we rarely see: a firm that subadvises a fund we covered was liquidating. It isn't just that

If we had just endured a brutal bear market, then the wave of redemptions would be par for the course. But this comes after a tremendous equity rally and therefore is unprecedented. True, we began 2016 with a sharp sell-off, but the outflow trend was well-established before that.

The simple answer to this riddle is competition from exchange-traded funds. ETFs have gained the upper hand in the active/passive debate, even over open-end index funds, which generally offer comparable cost benefits. More advisors are switching to ETF-focused strategies, and, when they get a new client, they quickly sell the weakest-performing active funds--possibly all the actively managed funds--in the client's current portfolio. Self-guided investors are moving to ETFs, too.

Although you can find an ETF for just about any category or asset class, the outflow trend has largely been centered on domestic-equity funds. Actively managed bond funds still pull in nearly all the new flows in that asset class, and active foreign-equity funds still have positive inflows. The argument for passive investing applies similarly to all asset classes, but that isn't how it has worked in the investing marketplace. That said, there are some quirks to bond indexes, such as a heavy government weighting in the Barclays Aggregate and challenges in tracking high-yield and muni indexes that do limit appeal on the fixed-income side.

The trend has more positives than negatives. Investors are moving to lower-cost investments, and that ought to benefit their long-term returns. Competition is heating up for investors' dollars, and, to the extent that they are throwing off subpar actively managed funds for solid low-cost ETFs, that's a good thing. On the other hand, some of the cost savings is going to advisors who preach the benefits of low-cost ETFs but then charge additional fees that bring the investor's total cost back closer to what they were paying for their active funds.

This presents fund investors with a new challenge in monitoring and selecting investments. You've got to watch flows. Although actual flow data isn't available in many places for individual investors, back-of-the-envelope comparisons of year-to-year net assets should be sufficient to spot those funds truly under duress. Take into account returns. Compare what the assets under management are with what they should be if flows were flat and you'll get a sense of which funds face challenges. We also tackle these issues in our analyses, and we adjust Morningstar Analyst Ratings accordingly, so you can take cues from our ratings as well.

There are two big immediate challenges presented by outflows and several more-subtle long-term issues. Let's start with the immediate issues:

Soaring Trading Costs Typically, it costs an equity fund something like 10 or 20 basis points to make its trades over the course of a year. That includes brokerage commissions but also the impact on the stock price. A sizable fund might not have any impact with small trades, but, if it wanted to trade, say, a 4% position, it would likely drive up the price on purchase and drive it down on the sale. So, there's a significant cost to doing such trades.

There are quite a few variables at work in these issues, but the key ones are: How liquid are the fund's holdings, how big is the fund, and how much does the manager need to trade? You can get a handle on this by considering the liquidity of the fund's holdings. Smaller caps are less liquid and large caps are more liquid. High-yield bonds and bank loans are less liquid and high-quality bonds are more liquid. (PIMCO Total Return's enormous redemptions had little impact if any because it had lots of cash, near cash, and easily tradable derivatives.) In extreme cases, we've seen a vicious cycle in which flows hurt performance, and that spurs more outflows.

Big Portfolio Shifts One way to manage redemptions is to sell off the really liquid stuff to start, which results in lower trading costs to begin with. Of course, it means the portfolio's nature has been changed, and a second wave of redemptions, if it occurred, could have disastrous effects because the fund would have to sell less-liquid holdings. At PIMCO Total Return, we kept a close eye on cash and near-cash debt. We saw that PIMCO was continuing to sell from across its portfolio in order to avoid altering the portfolio mix or painting itself into a corner.

On the other hand, Bruce Berkowitz mainly used cash and sold smaller holdings to meet redemptions rather than sell off huge positions in

The really big trading-cost hit is rare, but we've seen it in funds that invest in rather illiquid bonds that suddenly no one wants. Third Avenue Focused Credit TFCIX is a more recent example, with very low-quality energy bonds, and we saw a couple of high-risk mortgage funds melt down in 2008 as well.

Secondary Issues Some less dramatic issues include taxes and fees. Your tax bill can rise substantially because a fund manager has to sell to meet redemptions, thus realizing gains, but then those gains are distributed to a smaller shareholder base. In a prolonged sell-off, a fund will likely have losses to offset gains, but that isn't the case today for most domestic-equity funds, as they are up significantly during the past several years, even though they have struggled in 2016.

Smaller assets under management can mean higher fees, because many funds have management-fee breakpoints that lower expenses as assets rise. Unfortunately, these work in reverse, too, so watch out. If a fund's prospectus net expense ratio was printed more recently than the annual report expense ratio, it may offer a clue as to whether fees are rising.

Management shakeups are another knock-on effect. Even if you decide to stick it out, the fund company may feel compelled by redemptions to take action. Sometimes those changes are clearly an improvement, but more often you are getting a less experienced manager. We saw this at

Finally, an entire fund complex can be affected by redemptions at a number of funds. I'll tackle this issue in a future column.

Manning & Napier Equity's EXEYX 79% outflow is remarkable even for a slumping fund. The total dollar value of outflows was a modest $750 million, however, which shouldn't be a problem for a large-cap fund like this one, but I do have worries about the firm.

I'm worried about the $1.8 billion in outflows that's cut

Greenspring GRSPX has suffered outflows of 44%, and that worries me. Normally, allocation funds are built to handle quite a lot of money--and outflows--because they own large-cap stocks and high-quality bonds. But Greenspring favors small-value stocks and high yield, which makes for a bit of headwind when flows are strongly against the fund.

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)