The Hedge Fund Manager's New Clothes

Multistrategy funds of hedge funds have offered retail investors little for their high fees.

The last year and a half has provided the first real test for most liquid multialternatives funds to prove their mettle, and while few funds have truly stood out in a positive way, one group in particular stands out for its impotence: multistrategy funds that allocate to various hedge fund managers. The funds are a subset of a broader group of multistrategy funds within the multialternative Morningstar Category.

These strategies are designed as alternative allocation vehicles. Managers combine alternative strategies, like long-short equity, global macro, and managed futures, into a single fund that can act as the core of an alternative sleeve of a larger portfolio. There are other methods to achieve this, such as a mutual fund of liquid alternative mutual funds, but for the purposes of this article, we will focus solely on managers that are bringing their experience in building hedge-fund-of-fund strategies to a mutual fund. Their goal is typically to reduce overall portfolio volatility by offering diversification to a traditional portfolio of long-only stocks and bonds and to improve risk-adjusted returns. Most don't have specific return targets or benchmarks. They tend to target positive risk-adjusted returns regardless of the direction of broader equity and fixed-income markets.

The mutual funds leverage the manager research and due diligence of the existing hedge fund businesses to build multistrategy portfolios within mutual funds. While there were a handful of funds offering this type of strategy to investors before 2013, many of the funds have launched within the last three years. As of the end of February 2016, we count around 30 funds running this type of strategy, and in total they manage approximately $18 billion. In theory, the appeal is that by already having a footprint in hedge funds, these managers can attract top-flight managers to run more-liquid versions of their strategies in a mutual fund format. The catch is not only do the managers have to be able to run a more liquid version of their strategy to meet the requirements of a daily liquidity vehicle, they also have to be willing to accept a flat management fee and forego any performance fee. Some managers, like those of

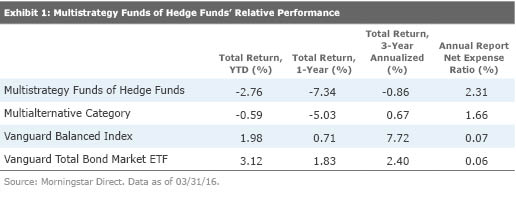

Even though these strategies offer hedge fund managers without their typical performance fee, the overall fee investors are being charged for this structure is very high, and so far, investors have very little to show for it. Exhibit 1 shows the performance of the substrategy compared with the broader multialternative category and a pair of traditional benchmarks over various time periods. The exhibit also shows the average annual report net expense ratio for the strategy compared with other options.

Clearly these strategies have struggled to overcome their high fee hurdles. Their 2.31% average expense ratio is 65 basis points more than the category norm. It's also worth noting that hedge funds themselves have had a rough time during the past few years. The HFRX Global Hedge Fund Index lost money in both 2014 and 2015 and has similarly struggled through the first two months of 2016.

There are a few reasons we can point to for the struggles of these multistrategy funds. For one, there seems to be a lot of commonality between the funds when it comes to strategy weighting. Several of the funds in the category, for example, were overweight event-driven strategies relative to their neutral positions. Event-driven strategies seek to take advantage of things like merger activity, spin-offs, and stock buybacks. The general line of thinking behind these allocations was that in a slow-growth world, companies would have to turn to some kind of financial engineering, like making an acquisition or spinning off a business, to generate returns for shareholders. The funds from Neuberger Berman, J.P. Morgan, Goldman Sachs, and Arden all had sizable exposure to event-driven strategies in 2014 and 2015. As of July 31 2015, JPMorgan Multi-Manager Alternatives JMMAX had a nearly 30% allocation to event-driven strategies, for example. It was the same size at the end of February. Event-driven strategies also have the added benefit of being easily transferable to a daily liquidity vehicle, since most involve large publicly traded companies that tend to have liquid stocks and corporate bonds. The main difference between an event-driven strategy in a mutual fund versus a hedge fund would be the amount of leverage used, with the mutual fund version running at much lower leverage levels.

Events To Forget

Event-driven strategies have struggled, however, as merger spreads have widened amid economic uncertainty, particularly in the energy sector, and as healthcare stocks that were popular with event-driven managers for their aggressive acquisition strategy, like

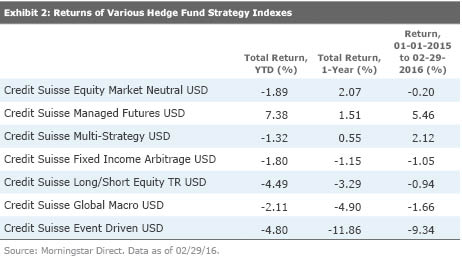

Exhibit 2 details the performance of various hedge fund strategy indexes through the end of February, which shows just how poorly event-driven strategies performed relative to others, particularly during the past year.

Subadvisor Struggles In addition to strategy tilts that didn't work out, some managers suffered on the manager-selection side as well. Arden Alternative Strategies, for example, had an allocation to Whitebox Advisors, which ran a market-neutral equity strategy. In December 2015, Whitebox announced it was closing its three liquid alternative mutual funds, all of which produced very poor performance in 2015. Also in 2015, BlackRock Multi-Manager Alternative Strategies BMMAX saw one of its subadvisors, event-driven-focused Loeb King Capital Management, return capital to shareholders and convert to a family office after a spell of bad performance.

Slim Pickings

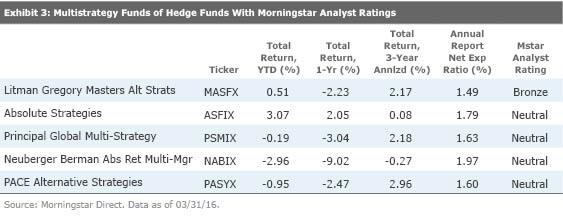

Currently, we only recommend one fund out of this peer group.

It also helps that the Litman Gregory team doesn't try to time hedge fund strategies, which has tripped up many peers in recent years. It has a roughly equal-weight allocation to its four main subadvisors, which is based on its conviction that each manager will be able to achieve strong risk-adjusted returns with little correlation to one another over the long term. So far it has worked well. The fund's three-year annualized returns of 2.17% through the end of March 2016 top more than 75% of all peers in the category.

Exhibit 3 shows the funds that we currently cover that run this type of strategy. All performance figures are through March 31.

The short track record of most of these mutual funds suggests that investors should give the strategy time to prove itself over a full market cycle. The high fees make it hard to justify waiting around, though, given there are other ways to achieve some of the desired results of these funds, like increasing an allocation to investment-grade bonds to lower overall portfolio risk. We think investors are better served keeping these funds on the sideline.

For a list of the open-end funds we cover, click here. For a list of the closed-end funds we cover, click here. For a list of the exchange-traded funds we cover, click here. For information on the Morningstar Analyst Ratings, click here.

/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)