5 Small-Cap Medalists for Your Radar

It's necessary to be selective, but there are some good actively managed small-cap funds still open to new investors.

Small-cap stocks offer unique challenges and opportunities for active managers. These stocks attract less attention than their larger counterparts. This should lead to more frequent and potentially larger deviations from fair value, creating greater opportunities for savvy investors. Yet, similar to their large-cap counterparts, most small-cap active managers failed to beat their index peers over the trailing 10 years through June 2015, according to Morningstar's most recent Active/Passive Barometer report (1). This isn't surprising because, in aggregate, active managers' portfolios look a lot like their index peers and they carry higher fees. But there are some compelling options.

Finding them can be challenging because responsible shops close their funds to new investors as they reach capacity to prevent asset bloat, which could increase transaction costs or force the managers to modify their strategy. And because assets gravitate toward successful managers, some of the best strategies are closed to new investors. So small-cap investors need to identify skilled managers early or invest with managers who have recently reopened their funds, typically after a period of lackluster performance. The cost of making a mistake can be higher here than among large-cap funds because most small-cap funds have a bigger fee hurdle to overcome. Greater mispricing in this market segment can also hurt unskilled investors more.

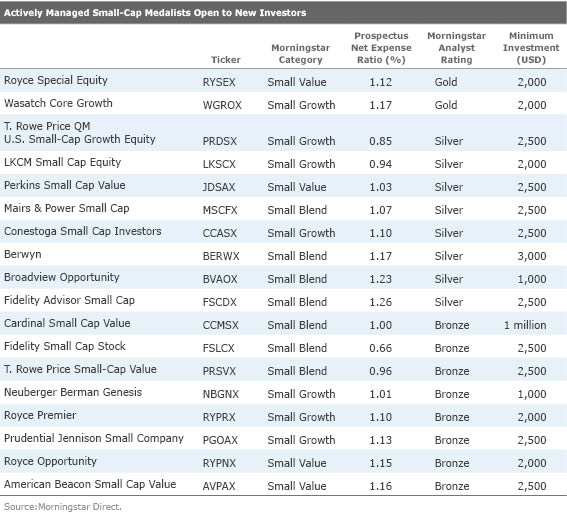

Fortunately, there are several actively managed small-cap medalist funds that are still open to new investors. This is a good place to start a manager search.

Top-Rated

They've delivered over the long-term. From the end of December 2000, when Taylor took the helm, through February 2016, the fund outpaced the Russell 2000 Growth Index by 2.96 percentage points annualized, with comparable volatility. However, most of that outperformance was concentrated from January 2001 through July 2002, when the fund benefited from its underweighting of technology stocks and overweighting of financial-services stocks, on top of strong stock selection. Because this portfolio looks very different than the Russell 2000 Growth Index, it can also go through stretches of considerable underperformance, as it did from July 2005 through November 2008. However, the fund has rewarded patient investors. It's also reassuring to know that the managers share investors' experience. They both have more than $1 million invested in the fund.

Royce Special Equity is a conservative strategy that was recently reopened to new investors. Managers Charlie Dreifus and Steven McBoyle target stocks with high returns on capital, strong balance sheets, attractive valuations, and conservative accounting practices. They won't pay up for future earnings growth. Instead, they look for companies that are generating attractive earnings before interest and taxes (EBIT) relative to enterprise value, using the lower of trailing one-year EBIT or estimated EBIT over the next year. They aren't afraid to make concentrated bets and will allow the portfolio's cash balance to climb when they can't find bargains. The portfolio typically holds 40 to 60 names, and just more than half of its assets are currently invested in the top 10 holdings. These positions exert significant influence on the fund's performance.

The managers' focus on highly profitable, conservatively managed business has helped the fund weather market downturns better than its peers. Its downside capture ratio since its May 1998 inception is among the lowest in the small-value Morningstar Category. And despite its concentrated portfolio, it has exhibited significantly less volatility than the Russell 2000 and Russell 2000 Value Indexes. But it has also tended to lag during market rallies. This pattern has translated into attractive long-term performance. Over the trailing 10 years through February 2016, the fund outpaced the Russell 2000 and Russell 2000 Value Indexes by 1.27 and 2.13 percentage points annually, respectively. This defensive strategy will likely continue to offer attractive long-term relative performance by conserving capital during market downturns. Dreifus has more than $1 million invested in the fund.

Other Defensive Options

Risk-averse investors looking for a better diversified defensive strategy should consider

Jamie Harmon has run Fidelity Advisor Small Cap since the end of October 2005 and currently has more than $1 million invested in the fund. He looks for reasonably valued small-cap companies with steady growth and predictable businesses, but relaxes his quality standards in special cases where valuations are particularly attractive. Harmon's focus on steady and predictable firms contributed to the fund's attractive performance in market downturns during the past decade, but so too did the fund's 26% cash position in late 2008. This wasn't entirely a market-timing call, as several of the fund's holdings were acquired by other firms at that time. The fund is currently more heavily invested than in 2008 but should continue to hold up better than most of its peers during market downturns, as it has during the past five years.

Neuberger Berman Genesis offered good downside protection while keeping cash in the mid- to low-single digits during the past decade. Its team of five managers targets small-cap stocks that dominate a competitive niche, generate strong and consistent free cash flows, have limited debt, and have what they consider reasonable valuations. But the managers will pay up for highly profitable firms with strong competitive advantages, putting the fund in the small-growth category. Reflecting this quality focus, the average return on invested capital of the fund's holdings is consistently among the highest in its category.

Asset bloat is a concern. The fund currently has around $10 billion in assets, making it one of the largest small-cap funds. And that's after experiencing $6.8 billion in outflows during the past five years. Such a large asset base may limit the managers' options. If they want to put 1% of the portfolio work in a new small-cap name, they would likely end up owning a considerable share of it, resulting in potentially high market-impact costs of trading. The managers generally keep turnover low, which helps address this problem. They often hold positions for years, even as their market capitalizations grow. As a result, a considerable portion of the portfolio is invested in mid-cap stocks. Four of the five managers have more than $1 million invested in the fund.

Low-Cost Active

Fidelity veteran Lionel Harris manages this fund and currently has more than $1 million invested in it. He looks for small-cap firms with durable cash flows, strong management teams, multiple paths to success, and reasonable growth, which gives the fund a modest growth tilt. This is a well-diversified portfolio that generally limits its sector tilts to 5 percentage points of the Russell 2000 Index's. Harris got off to a rough start in his first two years but has since posted much stronger performance. From the beginning of his tenure in November 2011 through February 2016, the fund slightly outpaced its benchmark with lower volatility.

The table below lists all actively managed small-cap medalists currently open to new investors (2).

(1) The success rates for the small-blend and large-blend categories were comparable (22.8% and 22.0%, respectively). In contrast, the success rates for the small-value and small-growth categories were higher than the corresponding large-cap figures, though they still fell short of 50%. Click here to view the full report.

(2) Excluding DFA funds.

For a list of the open-end funds we cover, click here. For a list of the closed-end funds we cover, click here. For a list of the exchange-traded funds we cover, click here. For information on the Morningstar Analyst Ratings, click here.

/s3.amazonaws.com/arc-authors/morningstar/56fe790f-bc99-4dfe-ac84-e187d7f817af.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/56fe790f-bc99-4dfe-ac84-e187d7f817af.jpg)