Energy: Don't Expect a Quick Recovery for Crude Prices

Markets have rebounded recently, but much uncertainty remains, meaning near-term prices could remain ugly or deteriorate further.

- We continue to believe that crude oil prices are well below the levels required to encourage sufficient investment to meet demand beyond 2017, and our midcycle per-barrel price outlook remains at $70 Brent and $64 West Texas Intermediate.

- But near-term prices could remain ugly or deteriorate further. Back in February a handful of producer countries, including Saudi Arabia and Russia, agreed to freeze output at January 2016 levels to help realign supply and demand. Markets rebounded as a result, but much uncertainty remains, most notably about whether Iran's likely refusal to follow suit will derail the pact or whether actual production in these countries will match agreed-upon levels.

- Upstream capital budgets in the United States have fallen sharply again this year as producers struggle to align budgets with cash flows. Reduced investment will translate to stronger output declines. This should help bring global markets back into balance as well but how quickly depends on the success of the production freeze initiative described above. Either way, it won't happen overnight.

- Sharp curtailments in oil-directed drilling activity could also reduce U.S. natural gas production growth in the near term. But the wealth of low-cost inventory in areas such as the Marcellus and Utica still points to continued growth through the end of this decade and beyond.

- Abundant supply is holding current natural gas prices low, but in the long run we anticipate relief from incremental demand from liquefied natural gas exports as well as industry. Our midcycle U.S. natural gas price estimate is unchanged at $4 per thousand cubic feet.

Energy investors are still grappling with the critical question: How long will it take for the oil industry to work through the current period of oversupply and rebalance itself? U.S. output is likely to decline this year due to heavily reduced capital spending. Consequently, while global demand is expected to grow by around 1.2 mmbl/d in 2016, global supply is expected to remain fairly flat (and it won't grow in 2017 either if oil prices average less than $50 per barrel this year as expected). However, the magnitude of the current oversupply is such that global stockpiles will continue growing through mid-2017 in all but the most optimistic scenarios.

What does that mean for crude prices? U.S. producer commentary indicates that many will start completing backlogs of deferred wells and even adding rigs if WTI oil goes north of $45. Therefore, near-term rallies above that level probably aren't sustainable. But the likelihood of strong declines this year is also waning. We expect production outside of OPEC and the U.S. to surprise to the downside, with the recent lowered output targets from Mexico and Colombia being the start of a trend, rather than one-off events. Therefore, we expect WTI prices to hold steady in the $35-$45/bbl range for the next 12-18 months (with the caveat that the scaling back of economic forecasts in consumer countries, especially China, is a key risk that could trigger further weakness). Beyond that we anticipate a gradual rebound to the midcycle levels outlined above, which are consistent with long-run marginal costs.

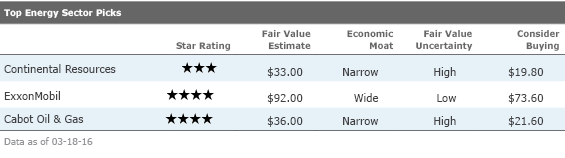

Continental Resources

CLR

Continental is our top pick in the U.S. oil-focused exploration and production group. Continental played a key role in the early development of the Bakken Shale and now holds 1.2 million net acres prospective in this prolific oil play. The company has added a second string to its bow with the ongoing delineation of the South Central Oklahoma Oil Play. Even at today's prices, wells drilled in these areas offer attractive returns, and Continental's positions will take at least 20 years to work through. The firm has a strong liquidity reserve and is still expected to be free cash flow neutral in 2016.

ExxonMobil

XOM

We view ExxonMobil as offering the best combination of value, quality, and defensiveness. Exxon will see its portfolio mix shift to liquids pricing as gas volumes decline and as new oil and liquefied natural gas projects start production. The company historically set itself apart from the other majors as a superior capital allocator and operator, delivering higher returns on capital than its peers as a result.

Cabot Oil & Gas

COG

On the gas side, Cabot controls more than a decade of highly productive, low-cost drilling inventory targeting the dry gas Marcellus Shale in Pennsylvania. Fully loaded cash break-even costs are less than $2.50 per mcf, which should allow the firm to remain on strong financial footing over the next several years.

More Quarter-End Insights

Stock Market Outlook: Stocks Start to Look More Attractive

Credit: Corporate Bond Markets Recuperate

Basic Materials: The Recent Commodity Rally Shouldn't Give Investors Hope

Consumer Cyclical: China Growth Concerns Present Buying Opportunities

Consumer Defensive: Lofty Valuations Persist, but a Handful of Bargains Remain

Financial Services: Global Bank Rout Is Overdone

Healthcare: Drug Reform Worries Are Overblown

Industrials: An Uneven Start to 2016, but Compelling Values Remain

Real Estate: Companies With Enduring Demand Will Persevere

Tech, Telecom & Media: Long-Term Opportunities Amid Software's Storm

Utilities: Dividends Still Attractive, but Headwinds Remain

/s3.amazonaws.com/arc-authors/morningstar/17f48ad3-acb4-4abc-982b-fb3b14ceda2f.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HE2XT5SV5ZBU5MOM6PPYWRIGP4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/17f48ad3-acb4-4abc-982b-fb3b14ceda2f.jpg)