Sustainable Funds Are Walking the Walk

Morningstar's Sustainability Rating confirms that funds seeking to invest in sustainable companies have been finding them.

The new Morningstar Sustainability Rating gives those investors interested in sustainability a way to evaluate the extent to which their fund managers are directing their capital to companies with strong sustainability performance. The rating applies to all funds, provided at least 50% of their assets are in companies covered by Sustainalytics’ ESG ratings.

Among the funds that we would expect to do well in the ratings are those that explicitly hold themselves out as being committed to sustainable investing. In the past, we’ve had to take their word for it. But, thanks to the Sustainability Rating, we now can evaluate whether they are walking the walk or just talking the talk.

For this analysis, I started with the U.S.-based funds listed in our database as socially conscious and removed those that are faith-based and focused solely on exclusionary screening. While many of the remaining funds still employ some exclusionary screens, most incorporate the positive consideration of ESG factors in their process or explicitly focus on sustainability themes. That left 160 funds, referred to as “ESG funds” below, with 106 having sufficient coverage to receive a Sustainability Rating.

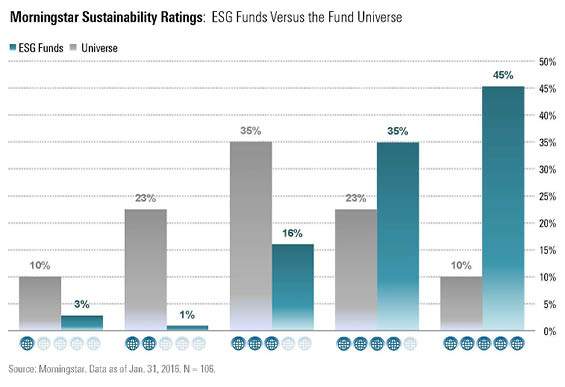

The results are impressive, if not surprising, and clearly support the notion that ESG funds are investing in companies with strong sustainability performance to a much greater degree than funds in the overall universe. Nearly half of the ESG funds--45%--received the highest Sustainability Rating. That compares with only 10% of funds in the overall universe (the ratings are normally distributed within each Morningstar Category, with 10% receiving the highest--and lowest--ratings). And 80% of intentional ESG funds have ratings of High or Above Average, compared with only a third of the overall universe.

Investors can find intentional ESG funds with ratings of High in 13 different categories. Among the leaders in the large-blend Morningstar Category are two Morningstar Medalist funds, Silver-rated

On the other end of the scale, only four funds out of 106 scored Below Average or Low. By comparison, one third of the overall universe falls into those two ratings groups. These include a small utilities fund (Miller/Howard Infrastructure FLRUX);

Many ESG funds not only have good Sustainability Ratings but also engage in active ownership activities, such as voting proxies based on predefined ESG guidelines, sponsoring or co-sponsoring shareholder resolutions, and engaging with companies they hold to discuss ESG-related practices.

That said, these funds represent only a sliver of the fund universe, both in the United States and globally. Most investors interested in sustainability have some, if not all, of their investments in conventional funds.

Our Sustainability Ratings provide a way for investors to evaluate what’s in their portfolios and to decide what level of sustainability performance meets their preferences. Some may find their conventional funds have high enough sustainability performance to satisfy them, while others may want the added assurance of adding intentional ESG funds to the mix.

Jon Hale has been researching the fund industry since 1995. He is Morningstar’s director of ESG research for the Americas and a member of Morningstar's investment research department. While Morningstar typically agrees with the views Jon expresses on ESG matters, they represent his own views.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)