Basic Materials: The Recent Commodity Rally Shouldn't Give Investors Hope

As China's investment-fueled boom falters, investors must look elsewhere. Hello U.S. housing.

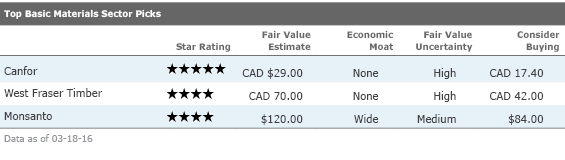

- In aggregate, basic materials stocks look somewhat overvalued, with the average company under our coverage trading at a 12% premium to our fair value estimate. That's not to say that we don't see pockets of significantly undervalued companies in the sector.

- Despite the recent rally in some commodity prices, our outlook for commodities related to Chinese fixed-asset investment remains negative. In particular, we see significant downside in iron ore, where we expect prices to fall by half as Chinese steel demand wanes and scrap supplies surge.

- Price outlooks are relatively better for commodities related to the Chinese consumer. Gold is one such commodity. However, we would preach caution on the recent safe-haven gold rally. In our view, resurgent investor demand rests on shaky footing.

- With faltering Chinese growth likely to wreak havoc on investment-oriented commodities, we look to U.S. housing as a pocket of opportunity. We believe housing starts will be driven higher during 2016, underpinned by our demographic forecast, wage growth, and higher loan volumes. Our long-term housing starts forecast remains considerably bullish versus consensus.

Despite the rally in commodities over the past several weeks, our outlook for commodities related to Chinese fixed-asset investment remains negative. Overcapacity and a worryingly high debt/GDP ratio make it unlikely that China can match its prior fixed-asset growth rates. We forecast, at best, 1.5% growth in Chinese fixed-asset investment during the next five to 10 years.

Iron ore provides perhaps the best example of the effect of China's slowdown on investment-oriented commodities. Beaten-down iron ore prices have prompted investors to wonder whether we've finally reached a bottom. The recent recovery in iron ore to $60 per metric ton, up from $40 in December, might suggest as much. However, we're not convinced, and we expect iron ore prices to fall by half to $30 over the long run. While iron ore conditions ought to improve on the supply side, we are increasingly concerned about the demand side, especially in China. Our updated outlook for Chinese steel demand and steel scrap availability suggests the market hasn't yet seen the worst for iron ore.

We remain relatively bullish on commodities tied to the Chinese consumer, with gold as a prime example. Gold started out 2016 with a bang. After a lackluster 2015 that saw prices plummet to roughly $1,050 per ounce (levels not seen since 2010), gold skyrocketed by nearly $200 per ounce in a little over a month in a "flight to safety." However, resurgent investor demand for gold rests on tenuous circumstances. Historically, "safe haven" rallies have proved short-lived, and we see near-term downside if fears of a severe recession prove unwarranted.

In the longer term, the outlook for gold remains bright. We expect jewelry demand to overtake investor demand as the "prime mover" for the gold market. Encouragingly, Chinese and Indian jewelry purchases remained strong in the fourth quarter of 2015. We still forecast gold rising to $1,300 per ounce by 2020, driven by increasing jewelry purchases from China and India that more than fill the gap left by waning investor demand.

We see U.S. housing as a pocket of opportunity for the materials sector. Seasonally adjusted starts have fallen since their November peak of 1.18 million to around 1.1 million in January. Permits also declined from 1.28 million to around 1.2 million over the same period. Still, permits increased by 13.5% year over year, pointing to what we believe will be a substantially stronger 2016 housing market.

We remain confident that a strong summer building season will lead to nearly 1.3 million starts in 2016, with demand underpinned by favorable demographics, wage growth, and higher loan volumes. In the longer term, we expect starts to peak at 1.9 million in 2019 before returning to our long-term forecast of 1.5 million starts in 2024.

Canfor

(

)

We like Canadian lumber producer Canfor for its leverage to U.S. housing. As housing starts march higher, so too should lumber demand, driving up industry capacity utilization and, with it, prices. Our bullish housing outlook is predicated on the notion that tighter labor markets and looser mortgage availability will unleash enormous pent-up demand from the extended housing bust. Canfor is particularly attractive in light of recent poor share price performance, which is disconnected from fundamentals. As of March 10, shares are down 45% since midyear 2015. In U.S. dollar terms, the decline is nearly 50%. It's true that lumber prices are down from midyear, but much of this is attributable to demand seasonality and lower U.S.-dollar-denominated Canadian production costs. Meanwhile, momentum continues to build for U.S. housing, and we see nearly 90% upside in the stock.

West Fraser Timber

(WFT)

Lumber and panel producer West Fraser is well positioned to take advantage of rising U.S. housing demand. Nearly 40% of lumber capacity now resides in the Southeast United States, close to its core end use, U.S. housing. A swelling portion of the population is now entering their peak home-buying years, and this will be further incentivized by easing loan standards and rising wages. West Fraser trades at a nearly 45% discount to our fair value estimate as a result of lower pricing, attributable weaker seasonal demand, and lower U.S.-dollar-denominated Canadian production costs. As the U.S. housing market continues to gain strength, West Fraser is poised to benefit greatly.

Monsanto

MON

We think Monsanto is the undisputed leader in seeds and genomics, which is more akin to the pharmaceutical industry than other agriculture markets. The firm has built a wide economic moat on the back of its intangible assets in seeds, from biotech traits (which are licensed broadly to competitors and create high margins and returns on invested capital) to its best-in-class seed breeding operation, which contributes to industry-leading yields. The company has demonstrated that it can raise prices, even in years when corn and soybean prices drop, primarily through introducing higher-yielding seeds and new biotech traits.

Falling crop prices and an ill-advised pursuit of Syngenta have driven Monsanto's stock down to attractive levels. Over the long run, we think the market will focus on Monsanto's ample stand-alone growth opportunities. Our view of the company is bolstered by our forecast for caloric intake in emerging markets, which will put stress on crop yield improvements globally and should play to Monsanto's strengths.

More Quarter-End Insights

Stock Market Outlook: Stocks Start to Look More Attractive

Credit: Corporate Bond Markets Recuperate

Consumer Cyclical: China Growth Concerns Present Buying Opportunities

Consumer Defensive: Lofty Valuations Persist, but a Handful of Bargains Remain

Energy: Don't Expect a Quick Recovery for Crude Prices

Financial Services: Global Bank Rout Is Overdone

Healthcare: Drug Reform Worries Are Overblown

Industrials: An Uneven Start to 2016, but Compelling Values Remain

Real Estate: Companies With Enduring Demand Will Persevere

Tech, Telecom & Media: Long-Term Opportunities Amid Software's Storm

Utilities: Dividends Still Attractive, but Headwinds Remain

/s3.amazonaws.com/arc-authors/morningstar/6518ca15-698e-4020-8ab8-565600d029c7.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T3GL43HDAFE4XKUGIENW4D5DDI.jpg)