Financial Services: Global Bank Rout Is Overdone

Generally overblown fears of energy-related credit losses, global deflation, and potential interbank contagion are increasingly weighing on the sector.

- Our overall financial services sector valuation remains attractive at a price/fair value ratio of 0.78.

- We see concerns over the U.S. banking outlook as generally overblown, particularly with regards to energy exposure, lower-for-longer interest rates, and counterparty risks. We do expect 2016 to face headwinds from an earnings and capital perspective, as regulators could potentially rein in capital requests in the upcoming CCAR.

- In Europe, we see similarly overblown concerns though we acknowledge the recovery will be slow and difficult. We do see the recent ECB actions around negative interest rates as a positive for the group, however.

Global bank stocks have been routed over the past several months because fears of energy-related credit losses, global deflation, and potential interbank contagion are increasingly weighing on the sector.

We think the dour outlook is premature for several reasons. First, exposure to the energy sector--both direct and indirect--is more than manageable. Below-investment-grade energy bonds are pricing in losses of roughly 30%, which would result in losses of only 2.5% of equity value, or only one quarter's worth of earnings for a bank otherwise achieving a 10% return on tangible common equity.

Otherwise, most large U.S. bank balance sheets remain rock-solid, in our view. Underwriting standards, especially with respect to consumer loans, have been unusually conservative since 2008, and securities portfolios are now tilted toward short-term liquid assets rather than the idiosyncratic illiquid holdings that banks held too much of prior to the global financial crisis.

Furthermore, though declining long-term interest rates are problematic in the short term, we expect low mortgage rates--along with a sizable and aging population of millennials, easing mortgage credit standards, and a reasonably healthy employment market--to contribute to an eventual rebound of the housing market.

Finally, counterparty risk and notional derivative exposures are at the top of investors’ minds. Here too, we believe fears are overblown. Net exposures to individual asset classes, events, or counterparties are relatively manageable--especially in the case of interest rates that make up a bulk of reported notional exposures. Though capital worries are clearly affecting some global peers, we think insolvency fears are exaggerated from both a fundamental and practical perspective.

More likely is a bad year for bank earnings. We have long believed the Federal Reserve will be slow to raise rates, and market data suggests more increases are unlikely for the next year. At the same time, credit quality is likely to deteriorate, and a bear market would bode poorly for capital markets and wealth management revenue. These factors could result in 2016 earnings considerably lower than those posted in 2015, diminishing the importance of price/book multiples in the short run. We see the 2016 CCAR as the best shot at a potential positive catalyst but would not be surprised to see regulators rein in capital return requests if the global economy continues to totter over the next few months.

In Europe, we also see the sell-off as overdone for several reasons. First, for most European banks, the exposure to the energy sector--both direct and indirect--is manageable. Investment-grade energy bonds are pricing in losses of roughly 15%, which would result in losses of only 4.5% of common equity value, or six months of earnings for a bank otherwise achieving a 10% return on tangible common equity, and 3.6% or just above one quarter of earnings excluding the two most exposed European banks (

) and

). Enhanced disclosures on this issue are reassuring, and the high quality of most banks' portfolios suggest that losses could be lower than those suggested by the bond markets.

Second, while lower-for-longer interest rates will be a near-term headwind for European banks, we've long anticipated a slow improvement in the economic environment, and we think recent optimism with regards to a strong European recovery was too much. We further note that some of the hardest hit banks such as

) (where the CEO is under pressure to step down) have been some of the slowest to restructure post-crisis, indicating, in our view, a level of frustration by investors at the pace of restructuring within the Italian banking system. This is a signal to other European banks they will be penalized with low valuations until management teams undertake more aggressive changes or risk being ousted themselves, as we've seen recently with the changes at

).

Finally, counterparty risk and notional derivative exposures are at the top of investors' minds. Here too, we believe fears are overblown. Net exposures to individual asset classes, events, or counterparties are relatively manageable--especially in the case of interest rates that make up a bulk of reported notional exposures. Moreover, over-the-counter derivatives clearing is moving into central clearing houses so as to eliminate counterparty risk. European banks will be required to trade OTC interest rate swaps, the majority of the world's $700 trillion OTC derivatives, through central clearing houses in 2016 (and have been since 2012 in the U.S.).

We think Europe's recovery will remain slow and that interest rates will remain low in 2016 and likely 2017. An aging population and structurally high unemployment will make it difficult for the area to boost growth to precrisis levels, in our opinion, and the recently stronger euro will make it harder for the European Central Bank, or ECB, to hit its inflation target. The European Commission is forecasting that real GDP growth will remain flat in 2016 at 1.9% for the European Union, compared with World Bank forecasts that the U.S. could grow 2.7% in 2016. This, combined with Europe's low inflation and increased ECB easing, means European banks' already thin net interest margins are likely to face additional pressure. While low oil prices will be a tailwind for much of Europe (excluding oil-exporting countries like Norway), we see risks to the downside as turmoil in emerging markets (particularly China) cuts into exports from countries like Germany.

For long-term investors, we think weak 2016 earnings are already fully priced in and see recent prices as a buying opportunity.

Negative central bank deposit rates in the European Union, Sweden, Denmark, Finland, and Switzerland are meant to spur banks to lend rather than to park their cash at central banks, but we see them as a negative to earnings, as deposit margins have contracted sharply, particularly at Nordic banks. In response,

(

) and SEB Group have focused their efforts on beefing up fee-related businesses, engaging in expense-cutting efforts, including aggressively investing in digital initiatives that allow them to close more expensive branches while de-emphasizing lending. Most European banks appear ready to lend--fully loaded CET1 capital ratios tend to range from 11%-13%, compared with about 10% in the U.S.--but slow growth and risks to the economic outlook mean they see few good opportunities. Moreover, in some geographies like Germany, questions about the strength of banks' capital may be restricting banks' willingness to lend. This can cause a self-reinforcing cycle of slow growth and weak lending, as European firms are roughly three times as dependent on bank lending as are U.S. firms, which rely more on the bond markets. We're less worried about this prospect in Switzerland, one of the few banking systems we rate as "Very Good," as we think that its strong regulation and good competitive environment mean negative rates are more of a near-term headwind than a harbinger of distress.

While many European banks have diversified business models, where interest income is balanced by fee income, we think fee income streams are likely to be weak as well. Investment banking, asset management, and wealth management are especially important fee-generating businesses for European banks, and we think all are likely to report weak earnings in the near term. In investment banking, market volatility may boost trading volumes, but we think debt and equity underwriting are likely to remain weak. Most firms that wanted to refinance for lower rates have already done so, and equity issuances are likely to be very low until market conditions strengthen. Asset management and wealth management both have fee income streams that are highly dependent on client asset levels, and low equity market valuations will dent fee income. We may see outflows from certain sectors continue, as European offshore assets regularize and oil-dependent sovereign wealth pull funds to support their obligations at home. In recent years, European wealth managers had depended on strong inflows from emerging markets and Asia in particular, but we think these flows are likely to dwindle as these economies slow. Although we think investments in these geographies are likely to attract long-term investments, near-term performance is likely to disappoint.

The European Central Bank's actions March 10 should be reassuring to bank investors, in our opinion. We're especially pleased that the ECB has drawn a line under negative interest rates, noting that it was mindful that meaningfully harming the banks would be harmful for growth. The longer-term refinancing operations, known as LTRO II, will also be a positive for banks as the ECB will effectively pay banks to borrow money to lend into the real economy; this will help to offset the pain of negative interest rates. European banks rallied as the markets digested the good news, although we think they have further to go.

We think the impact of the ECB's actions on the real economy are less clear. Bond buying will lower corporate yields but will only spur borrowing if credit supply was the problem--not demand, as we suspect. Similarly, LTRO II may fail to spur additional lending, and we note that the U.K. funding for lending scheme, launched in 2012, was a mixed success and did not have the clear positive impact on small and medium-size enterprise lending that it was intended to. We continue to think monetary policy is reaching the end of its effectiveness, and structural reforms and fiscal stimulus will be necessary, however politically unpalatable. Growth in the eurozone was 0.3% quarter on quarter in the third quarter, and we think it's likely to remain low, perhaps around 1%-1.5% in real terms, in the medium term.

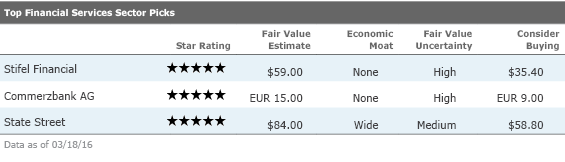

Stifel Financial

SF

Stifel Financial is a middle-market investment bank that has diversified its revenue stream and grown rapidly in recent years because of acquisitions. The company largely avoided exposures to subprime mortgages, employs only low-single-digit leverage, and adopted a bank holding company structure in early 2007. Whether management was lucky or prescient, the company looks better managed than many of its peers and seems poised for opportunistic growth.

The company has one of the best business mixes in the investment banking industry. More than 55% of net revenue comes from its wealth management business. Wealth management is fairly consistent and scalable, and can produce high returns on invested capital. Positive drivers could increase operating margins for the wealth management segment in the next couple of years, pushing them closer to 30%, up from the current 28% levels. These drivers include a rising stock market that could increase asset management levels, eventual higher interest rates and their effect on money market fund fee waivers, and the company's bank net interest margin.

Commerzbank

(

)

Commerzbank seems to be turning the corner after a number of difficult years post-crisis. With a new CEO in place, a largely successful rundown of noncore assets, and an improving outlook for small businesses in Germany, we think the bank's outlook and returns look very good. Concerns remain around energy exposure, the stagnant EU environment, and slowing Chinese growth, however.

STT

State Street is one of the two largest custodian banks in the United States, built on a series of large acquisitions begun in 2003. As a dominant player now boasting more than $28 trillion in assets under custody, State Street has the scale and scope necessary to serve institutional clients that few competitors can hope to match. Asset custody and asset servicing is a business with naturally sticky customers who are loath to risk changing providers and who value the one-stop shopping that State Street can provide. As such, it is a naturally high-return and highly scalable business. Despite these advantages, revenue growth has been a challenge in recent years as a result of persistently low interest rates and increasing client attention on fee levels. We expect fee levels to stabilize as the economic environment improves and that investors will see the benefit of the business's operating leverage as net interest margins eventually normalize. We expect returns on equity to improve from 9.7% in 2014 to around 15% in the medium term.

More Quarter-End Insights

Stock Market Outlook: Stocks Start to Look More Attractive

Credit: Corporate Bond Markets Recuperate

Basic Materials: The Recent Commodity Rally Shouldn't Give Investors Hope

Consumer Cyclical: China Growth Concerns Present Buying Opportunities

Consumer Defensive: Lofty Valuations Persist, but a Handful of Bargains Remain

Energy: Don't Expect a Quick Recovery for Crude Prices

Healthcare: Drug Reform Worries Are Overblown

Industrials: An Uneven Start to 2016, but Compelling Values Remain

Real Estate: Companies With Enduring Demand Will Persevere

Tech, Telecom & Media: Long-Term Opportunities Amid Software's Storm

Utilities: Dividends Still Attractive, but Headwinds Remain

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PLMEDIM3Z5AF7FI5MVLOQXYPMM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/I53I52PGOBAHLOFRMZXFRK5HDA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CEWZOFDBCVCIPJZDCUJLTQLFXA.jpg)