Utilities' Dividends Still Attractive, but Headwinds Remain

Even though the utilities sector appears fairly valued, there are pockets of opportunities and potential pitfalls that investors must watch carefully in the coming months.

- Our global utilities sector coverage is trading at a 1.01 market-cap-weighted price/fair value ratio as of mid-March. We think U.S. regulated utilities are the most overvalued, trading at a median 11% premium to our fair value estimates. However, most of the international utilities and U.S. power producers we cover are trading below our fair value estimates.

- U.S. utilities' 3.7% median dividend yield represents a historically attractive 170-basis-point premium to the 10-year U.S. Treasury yield. Some high-quality utilities are trading with dividend yields that are double those of the 10-year U.S. Treasury.

U.S. utilities have sprinted out of the gate in 2016, up 11% through mid-March, including dividends, making it the best-performing sector and far outperforming the flat S&P 500. But utilities investors have had twitchy buy-sell trigger fingers during the last three years. A hint of economic strength or higher interest rates could send the sector into a tailspin, as it did during the first half of 2015 when the Morningstar Utilities Sector Index fell 14% in five months. This could create buying opportunities for long-term investors seeking high-quality, growing dividends with yields above 4%.

Meanwhile, European utilities continue to struggle primarily because of their greater exposure to weak economies and energy markets. Power prices and conventional power generation margins continue to fall. We think slowing renewable energy growth could offer some respite, but that might not be until 2017 or beyond. The planned corporate splits for German utilities

(

) and

The key worry in the U.S. is weak power demand, which fell year over year in 2015 for the fifth time in eight years, according to Energy Information Administration data. Before 2008, electricity demand had fallen only three times year over year since data records began in 1949 and averaged 4.8% annual growth. Weak demand could be a headwind for utilities with weak regulation, large industrial customers, and usage-based rates.

Dominion and Fortis joined the acquirers' club during the first quarter. We think Fortis' proposed acquisition of ITC Holdings is the most likely to close among the sector's other deals because of the limited impacts on state-level customer bills. But regulatory intervention in other pending deals will be critical to watch through the year. Exelon's two-year struggle to acquire Pepco and NextEra's 16-month struggle to acquire

Duke Energy

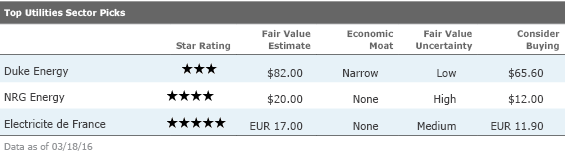

DUK

Duke Energy became the largest utility in the United States after it merged with Progress Energy in 2013. We think the market has focused too much on the weak Latin American unit and pricey Piedmont Natural Gas acquisition. Rather, we believe investors should pay attention to Duke's strong management team, which has long focused on regulated capital investment opportunities, supporting our 5.5% earnings growth estimate, divesting noncore no-moat assets, and driving efficiencies across all its businesses. In 2016-20, we anticipate $42 billion cumulative capital investment, of which nearly $30 billion is growth capital supporting our earnings growth estimate. We anticipate that Duke will be able to recover these costs through constructive regulatory outcomes. Adding Piedmont boosts its growth potential further.

NRG Energy

NRG

NRG's stock has suffered mightily since mid-2014 and now looks attractive again. We think NRG offers investors high-quality assets and attractive cash flow that management uses to fund a modest dividend, reduce debt, and buy back shares. Debt reduction is a priority for new CEO Mauricio Gutierrez, who has cut investment and the dividend substantially, anticipating at least two years of challenging power markets. NRG has reduced some of its risk by securing some $2.8 billion of pretax cash flow during the next three years from contracted or capacity revenue. It should get another $150 million of dividends from NRG Yield. Combine this cash flow with the countercyclical earnings from its retail business, and we don't think NRG's cash flows are as cyclical as some of its peers'. On a normalized basis, we think NRG can earn $3.6 billion EBITDA (including NYLD), up from our estimated $2.4 billion trough in 2017.

Electricite de France

(

)

EDF is one of the world's largest energy companies, controlling the French power grid along with a massive global generation fleet. Its French nuclear fleet comprises 58 plants, and it operates the largest power supply business in France. Investments in France's regulated electricity grid and renewable energy, along with new capacity-market revenue, should drive 2% annual EBITDA growth through 2019. This, in turn, should support a healthy dividend, most of which goes to the French state, owner of nearly 85% of shares. EDF's performance is heavily influenced by French regulation and structural reforms to European power markets, both of which are subject to political meddling. Even with our expectations for a modest rise in French tariffs and substantial lost customers as France moves toward a different pricing scheme, we still think the market is overly pessimistic. EDF also has potential upside from newbuild nuclear in the United Kingdom and possibly China.

More Quarter-End Insights

Stock Market Outlook: Stocks Start to Look More Attractive

Credit: Corporate Bond Markets Recuperate

Basic Materials: The Recent Commodity Rally Shouldn't Give Investors Hope

Consumer Cyclical: China Growth Concerns Present Buying Opportunities

Consumer Defensive: Lofty Valuations Persist, but a Handful of Bargains Remain

Energy: Don't Expect a Quick Recovery for Crude Prices

Financial Services: Global Bank Rout Is Overdone

Healthcare: Drug Reform Worries Are Overblown

Industrials: An Uneven Start to 2016, but Compelling Values Remain

Real Estate: Companies With Enduring Demand Will Persevere

Tech, Telecom & Media: Long-Term Opportunities Amid Software's Storm

/s3.amazonaws.com/arc-authors/morningstar/ea0fcfae-4dcd-4aff-b606-7b0799c93519.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ROHC7ZXJXZU7LIKGTTYJTD667I.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ea0fcfae-4dcd-4aff-b606-7b0799c93519.jpg)