Tech, Telecom, and Media: Long-Term Opportunities Amid Software's Storm

The tech sector looks modestly undervalued overall, but we'd be selective across investment ideas.

- The tech sector looks modestly undervalued to us at a price/fair value estimate ratio of 0.92, but we'd be selective across investment ideas.

- We see long-term opportunities as we sift through software's storm

- We still see the programmatic advertising wave surging.

- Even with the evolution of the television bundle, there's still plenty of profit in couch potatoes for wide-moat media firms.

- Telecom merger rumors continue to swirl in Europe, but don't get excited.

The S&P 500 is down slightly to date, but it has been a rocky ride for the index, down as much as 11.4% in the first month and a half of the New Year before recovering a bit. In line with the broader market, technology stocks faced a sharp sell-off, and margins of safety began to arise within several sub-sectors of tech, only to almost fully recover. As of mid-March 2016, we view the tech sector as modestly undervalued at a price/fair value estimate ratio of 0.92.

Despite some choppiness across the global macroeconomic landscape, many management teams have remained upbeat and relatively optimistic about their operations and opportunities heading into 2016. Many large tech firms are struggling to reinvent themselves and drive organic growth from new avenues (funded through existing cash flow), while other fast-growing niche players are hoping to disrupt the hierarchy by taking advantage of adoption in analytics, cloud, and engagement (social-media advertising).

Companies leveraged to a single product, like Tableau DATA, have crashed, but those with broad product and customer exposure have held up quite well. Firms with exposure to the smartphone market have faced some tough times, as

We See Long-Term Opportunities as We Sift Through Software's Storm

Software shares have taken a beating this quarter, catalyzed by subpar earnings from a number of high-flying stocks, most notably Tableau and

In our view, Adobe's successful transition to the cloud and subsequent investment in its marketing cloud platform will yield significant growth opportunities in markets where we believe the firm holds a competitive advantage. Guidewire has become the premier vendor for legacy software replacements among property and casualty insurers, having inked deals with nearly half of the world's largest insurance companies. Guidewire's solutions are mission-critical to the policy life cycle, and the firm has the ability to increase lifetime customer value through cross-selling to additional business lines and upselling add-on applications.

We Still See the Programmatic Advertising Wave Surging

As we highlighted last quarter, we still think that investors should pay attention to a massive shift in the digital advertising industry toward programmatic advertising (the automated buying and selling of advertising inventory), a trend that we believe highlights the distinct competitive advantages of

These new technologies are detrimental to companies such as Yahoo because marketers now have the ability to target audiences in a more precise, identifiable, and efficient way across multiple web properties. Quite simply, technology has leveled the playing field by providing marketers with reach, obviating the value of Yahoo's generic traffic, where little is known about the users. In our view, the rich customer data that Google and Facebook possess is even more valuable in a programmatic world, particularly as these companies seem to be operating walled gardens. We also believe that wide-moat firms such as

The Evolution of the Television Bundle: There's Still Plenty of Profit in Couch Potatoes for Wide-Moat Media Firms The television ecosystem is constantly evolving, and the traditional bundle model has come under pressure recently, but we believe investors have over-reacted to fears that a sudden shift in consumer behavior is about to occur. In our view, the changes taking place today are a continuation of the fragmentation that has been occurring over the past several decades. Penetration of traditional television service has steadily eroded, following a peak somewhere around the end of the past decade. Perhaps counterintuitively, the industry's growth accelerated sharply during the worst of the financial crisis and has steadily deteriorated since. We ascribe this blip to the limited video alternatives available at the time, aggressive price promotion among several providers aiming to protect their customer bases (especially the phone and satellite companies), and the fact that television service is inexpensive relative to other forms of entertainment.

But the market is different today than it was just a few years ago. We find that younger age cohorts are driving the majority of the decline in traditional television penetration. Younger consumers are increasingly viewing traditional content in nontraditional ways, but we still believe younger consumers simply don't value the traditional television bundle as much as prior generations have.

Looking ahead, the key question is how the media industry can evolve to combat the challenges currently facing the traditional television business. We expect consumer purchase decisions will fragment into network choices, where cable companies such as

As new firms continue to come into the television market, we expect that video on demand and subscription video on demand will steadily grow in importance as these entrants innovate around television distribution. We have introduced a new four-pillar framework through which we evaluate each company’s positioning amid the changing media landscape. The four criteria are: known brands and studios; access to a strong library of content; lower dependence on traditional advertising; and higher international exposure.

We prefer media firms with strong production studios in both film and television, along with a deep content library. As the bundle evolves, we expect the most-watched networks to survive and even flourish. Their content and sports rights provide a leg up in discovery, as consumers already watch and monitor their channels.

In addition, we are looking for companies with lower exposure to one of the traditional sources of revenue: advertising. We expect that new television platforms will prioritize the customer experience over ad loads, putting pressure on traditional ad revenue. Also, advertisers are steadily shifting budgets to digital formats that are more easily measured.

Finally, strong companies should have exposure to the faster-growing international markets where high-quality Internet access is less pervasive, providing a longer runway for traditional distribution models.

We believe five companies--Comcast,

Telecom Merger Rumors Continue to Swirl in Europe, but Don't Get Excited

Telecom merger rumors continue to swirl in Europe, but we don’t place much credence in many of them.

However, Orange has entered talks to acquire

). Orange believes such a deal would be reviewed by the French telecom regulator rather than by EU regulators because of both companies having greater than two thirds of their European revenue in France. If it is reviewed in France it might get through, as the French government is concerned about unemployment. Bouygues and

) have both laid off lots of employees since Iliad entered the market in 2012, and such a merger would likely bring more stability to the sector as well as employment. However, if the deal goes to the EU, we continue to believe it doesn't have a chance. We expect the rumor mill to continue to churn, but we’d encourage investors to maintain an eye on underlying fundamentals and not get caught up in market speculation.

We are moving into crunch time on the EU regulator's ruling for the proposed acquisition of

) 3 U.K. unit, which is expected in the second half of April. A decision on its Italian unit's proposed merger with

Although we expect more rumors between now and then, we believe the likelihood of any official merger announcements in Europe before then to be quite low. In general, anticipation surrounding global mergers and acquisitions across the telecom industry is reflected in higher stock prices in many cases. There are still pockets of value across the global telecom space, but most come with baggage in the form of lagging sales growth, higher legacy costs, or poor macroeconomic conditions, so we encourage investors to be highly selective.

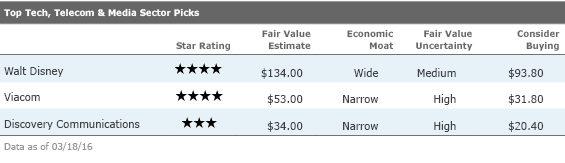

Walt Disney

DIS

Although Disney is a media conglomerate, we view the company as two distinct yet complementary businesses: media networks, which include ESPN and ABC, and Disney-branded businesses, including parks, filmed entertainment, and consumer products. The crown jewel of Disney's media networks segment is ESPN. It dominates domestic sports television with its 24-hour programming and profits from the highest affiliate fees per subscriber of any cable channel. The Disney Channel also benefits from attractive economics, as its programming consists of internally generated hits with Disney's vast library of feature films and animated characters. We expect the unique content on ESPN and Disney Channel will provide the firm with a softer landing than its peers as viewing transfers to an over-the-top (OTT) world over the next decade.

Viacom

VIAB

Viacom holds a valuable portfolio of cable networks with worldwide carriage, a large production studio, and a deep content library. In our view, two of the company’s networks, Nickelodeon and MTV, particularly benefit from strong brands. Despite increased competition, we think Nickelodeon will continue to thrive as a major player in the children's TV segment, given its scale and reputation. MTV also faces more competition than ever from other entertainment options for teenagers and young adults, including social media, short-form Internet videos, and OTT streaming. However, MTV still enjoys a positive worldwide brand with teens and young adults.

Discovery Communications

DISCA

Discovery Communications produces and owns unique content with proven appeal to audiences across cultures and languages. This transnational appeal provides the company with the ability to repurpose the content across multiple platforms and international borders. Discovery is leveraged to benefit from increased pay-TV penetration internationally as it already generates 50% of its revenue and 45% of its EBITDA outside the U.S.

More Quarter-End Insights

Stock Market Outlook: Stocks Start to Look More Attractive

Credit: Corporate Bond Markets Recuperate

Basic Materials: The Recent Commodity Rally Shouldn't Give Investors Hope

Consumer Cyclical: China Growth Concerns Present Buying Opportunities

Consumer Defensive: Lofty Valuations Persist, but a Handful of Bargains Remain

Energy: Don't Expect a Quick Recovery for Crude Prices

Financial Services: Global Bank Rout Is Overdone

Healthcare: Drug Reform Worries Are Overblown

Industrials: An Uneven Start to 2016, but Compelling Values Remain

Real Estate: Companies With Enduring Demand Will Persevere

Utilities: Dividends Still Attractive, but Headwinds Remain

/s3.amazonaws.com/arc-authors/morningstar/5c8852db-04a9-4ec5-8527-9107fff80c09.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T3GL43HDAFE4XKUGIENW4D5DDI.jpg)