Real Estate: Companies With Enduring Demand Will Persevere

Despite recent increases in economic uncertainty, there are still attractive opportunities within the real estate sector.

- Morningstar's real estate sector is trading at a price/fair value estimate ratio of 0.93, roughly in line with the discount on Morningstar's aggregate coverage.

- We view recent themes in commercial real estate as generally defensive in nature. REITs are focused on repositioning and strengthening their portfolios, deleveraging and capital recycling, and finding attractive risk-adjusted redevelopment and development opportunities versus external acquisitions. Meanwhile, investors have displayed a flight to safety and continued hesitation about the potential implications of rising interest rates.

Moving into 2016, Morningstar's real estate coverage looks reasonably priced. The sector trades at a market-cap-weighted price/fair value estimate ratio of 0.93, roughly in line with the discount associated with our overall coverage. We believe that investors have already started pricing in near-term uncertainty, but that they should continue to be selective in the space; we expect increasingly uncertain economic conditions to continue affecting capital access and activity, asset pricing, and operating fundamentals throughout the year.

With the Fed raising the policy rate in December and further increases expected in the near term, the outlook of many REIT investors immediately turned negative. After all, higher interest rates could cause higher debt financing costs and put pressure on REIT cash flow metrics (such as funds from operations and funds available for distribution), which would pressure growth rates, cap rates, and return expectations. Also, to the extent that low interest rates have diverted investor funds to REITs searching for higher yield, the same funds could flow out of REITs if interest rates rise, further pressuring commercial real estate and REIT valuations.

Given the increased volatility in the domestic and global economies since the start of the year, though, we expect U.S. interest rates to remain historically low for an extended period. Investors continue to see the U.S. as a relative safe haven for investment capital, which has actually helped compress 10-year U.S. Treasury yields roughly 40-50 basis points since the beginning of 2016 to historical lows of roughly 1.8%. Additionally, the U.S. economy, which has been generally healthy of late, seems more and more vulnerable to a slowdown, which is likely to prompt policymakers to revisit where they want rates to go and how quickly they want them to get there.

That said, most REITs are in a much better position to weather potential broader economic turmoil than they were prior to the last recession. Many are now well capitalized with in-place long-term, low-cost debt, while some even still have the opportunity to refinance out higher-cost debt and lock in historically low rates through a potential downturn. Similarly, many REITs benefit from in-place long-term leases that can potentially be re-leased at higher current market rents, giving these firms embedded income growth, if not a safety cushion for future economic weakness. REITs are also trading out of weaker, more vulnerable assets into moatier assets with better long-term growth prospects, even suffering short-term dilution to do so. And as the operating performance and demand outlook for many REITs remain solid, albeit decelerating, asset values have largely stayed intact, mostly in line with Treasury yields.

Eventually, rising interest rates will be viewed as a signal of a strengthening economy, which could benefit real estate fundamentals, although we see that scenario as unlikely in the near term, given where we seem to be in the cycle. If effective debt yields ultimately rise relative to overall performance, we would expect asset values to be increasingly challenged. We already use a mid-4s long-term yield on the 10-year Treasury into the weighted average costs of capital used to derive our fair value estimates.

Nonetheless, perception oftentimes becomes a self-fulfilling reality. As investors and businesses become weary and return expectations decrease, a reduction in investment will help slow demand and reinforce negative outlooks. Logically, this has caused capital to flock to safer-seeming REIT names and assets. We generally recognize such firms as having reasonable leverage, moaty assets or businesses, demonstrated historical success across economic cycles, identifiable internal and external growth drivers, and reasonable margins of safety to our estimates of value. Although these are our preferred investment vehicles, we think it makes sense to focus not only on firms with these attributes, but also on those with well-covered dividends and strong prospects for growth over time.

Attractive investment opportunities are much harder to come by, though, as safety becomes more expensive. Companies such as

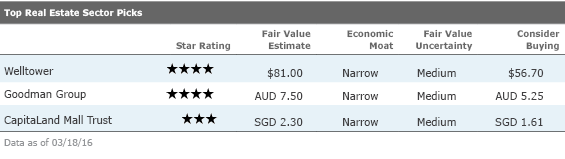

That said, we believe there are still attractively priced investment opportunities in the U.S. market. In particular, healthcare REITs--including Welltower, Ventas, and, for the especially risk-tolerant, HCP--remain among our favorites, given their robust demand outlook, positive industry trends, and pricing appreciably below our fair value estimates. Particularly moaty real estate service firms--such as

Few Australian property stocks are trading below our fair value estimates. We see the best growth opportunities in global industrial specialists Goodman Group and Westfield, the latter of which is continuing to reweight its portfolio toward premium malls in high-income areas.

Shares of Hong Kong developers and landlords have pulled back in recent months, owing to a pessimistic outlook in the residential sector and a poor retail environment, particularly in the tourism-driven luxury sector. As the bellwether and a pure play of the real estate sector,

) retreated 17% since third-quarter 2015, when residential prices peaked. HSI registered a 5% decline over the same time period. The company employs a flexible pricing strategy and full-cycle view, allowing it to achieve good sell-through regardless of physical market conditions. It focuses on quick asset turn and maintains a strong balance sheet, leaving ample opportunities for countercyclical land acquisitions. Since the reorganization in early 2015, the company is also not overly exposed to residential trading, as 45% of income now comes from rentals, hotels, and REITs. The shares are currently trading near 10 times earnings and 0.6 times book value, which is attractive compared with historical averages.

The share prices of Singapore REITs recovered earlier this year, as the pace of an interest-rate increase is likely to be slower than anticipated. We prefer defensive retail REITs as opposed to office property currently, given increased office supply in the near term. Completion of office construction will add 4.3 million square feet of new supply in 2016. With limited new supply of 0.4 million and 0.6 million square feet in 2017 and 2018, respectively, and no currently planned supply thereafter, we expect the large addition in 2016 to be slowly absorbed, averaging out to 1.06 million square feet annually over the next five years, in line with historical annual net office demand of 1.1 million square feet. Singapore's steady political and transparent regulatory regime underpins the city-state as a premier destination for global multinational corporations in setting up their regional headquarters. However, we expect the new supply to cap significant increases in office-rental growth in the near term.

Welltower

Healthcare REITs comprise one of the most attractive property sectors in our U.S. real estate coverage on a relative valuation basis, and Welltower is one of our favorites among the bunch. In general, U.S.-based healthcare REITs should benefit from some favorable, noncyclical tailwinds, including an expanding and aging population and potentially tens of millions of people added to the ranks of the insured because of the Affordable Care Act--all of which should drive incremental demand for healthcare real estate relative to historical levels. Additionally, healthcare is a property sector in which the vast majority of assets remain in private hands, so Welltower should have opportunities to further consolidate ownership. We think these current and long-term growth prospects provide investors with a compelling total-return opportunity in the current environment.

(

)

Goodman is one of the top three global industrial specialists. Income comes from owning, developing, and managing premium warehouses and business parks. Recent share price weakness is most likely due to concerns around its exposures to China and Brazil. We think these concerns are misplaced, as the balance sheet exposure to these regions is small (China comprises 7% of assets and Brazil just 1%), and the firm's development exposures to these markets are modest, as most have been presold and tenant demand remains robust for its higher-quality assets.

CapitaLand Mall Trust

(

)

CapitaLand Mall Trust owns a portfolio of high-quality malls around Singapore and boasts the city-state's greatest market share. Its malls are well managed, situated in densely populated areas, and close to mass transport hubs with high foot traffic. These attributes are attractive for its diverse tenant base, resulting in high retention rates and near-full occupancy across its properties. Nondiscretionary products and services, such as food and beverages, drive repeat customer visits and account for 30% of gross income. The high occupancy rate and staggered lease expiry profile help reduce rental cyclicality and are conducive to stable distributions to unitholders.

More Quarter-End Insights

Stock Market Outlook: Stocks Start to Look More Attractive

Credit: Corporate Bond Markets Recuperate

Basic Materials: The Recent Commodity Rally Shouldn't Give Investors Hope

Consumer Cyclical: China Growth Concerns Present Buying Opportunities

Consumer Defensive: Lofty Valuations Persist, but a Handful of Bargains Remain

Energy: Don't Expect a Quick Recovery for Crude Prices

Financial Services: Global Bank Rout Is Overdone

Healthcare: Drug Reform Worries Are Overblown

Industrials: An Uneven Start to 2016, but Compelling Values Remain

Tech, Telecom & Media: Long-Term Opportunities Amid Software's Storm

Utilities: Dividends Still Attractive, but Headwinds Remain

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PLMEDIM3Z5AF7FI5MVLOQXYPMM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/I53I52PGOBAHLOFRMZXFRK5HDA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CEWZOFDBCVCIPJZDCUJLTQLFXA.jpg)