Value Investors Are Vexed

Value's decade-long slump is testing contrarians' patience.

A version of this article was published in the January 2016 issue of Morningstar ETFInvestor. Download a complimentary copy of ETFInvestor here.

The concept of value investing dates back at least as far as the 1920s, when Benjamin Graham and David Dodd first began teaching finance at Columbia University. The fundamental principles of value investing were later enshrined in the duo's classic "Security Analysis," first published in 1934. [1] The idea is painfully simple: Buy securities at prices below their intrinsic value and wait patiently for their market price to reflect their true worth. Or as my grandfather used to tell me, "Investing is simple, buy 'em cheap and sell 'em dear. Did I mention that it's not easy? Good luck!"

The approach, so elegant in its simplicity, ultimately evolved into a religion of sorts. Many of Graham and Dodd's disciples, most notably Warren Buffett, rank among the most successful investors of all time. However, despite having basic intuition and legions of followers on their side, it wasn't until 1992 that Graham and Dodd's theory gained a rigorous empirical backbone. That was the year Eugene Fama and Kenneth French published their seminal work, "The Cross-Section of Expected Stock Returns," [2] which introduced the concept of the value premium. The pair found that stocks trading at low price/book multiples tended to outperform those trading at high multiples over long time horizons. Fama and French showed that value was real, it was significant, and it could generate excess returns. However, their version of value was hatched in academia, a realm free of pesky issues like fees, trading costs, and taxes--real-world problems that might affect investors looking to harness the value premium.

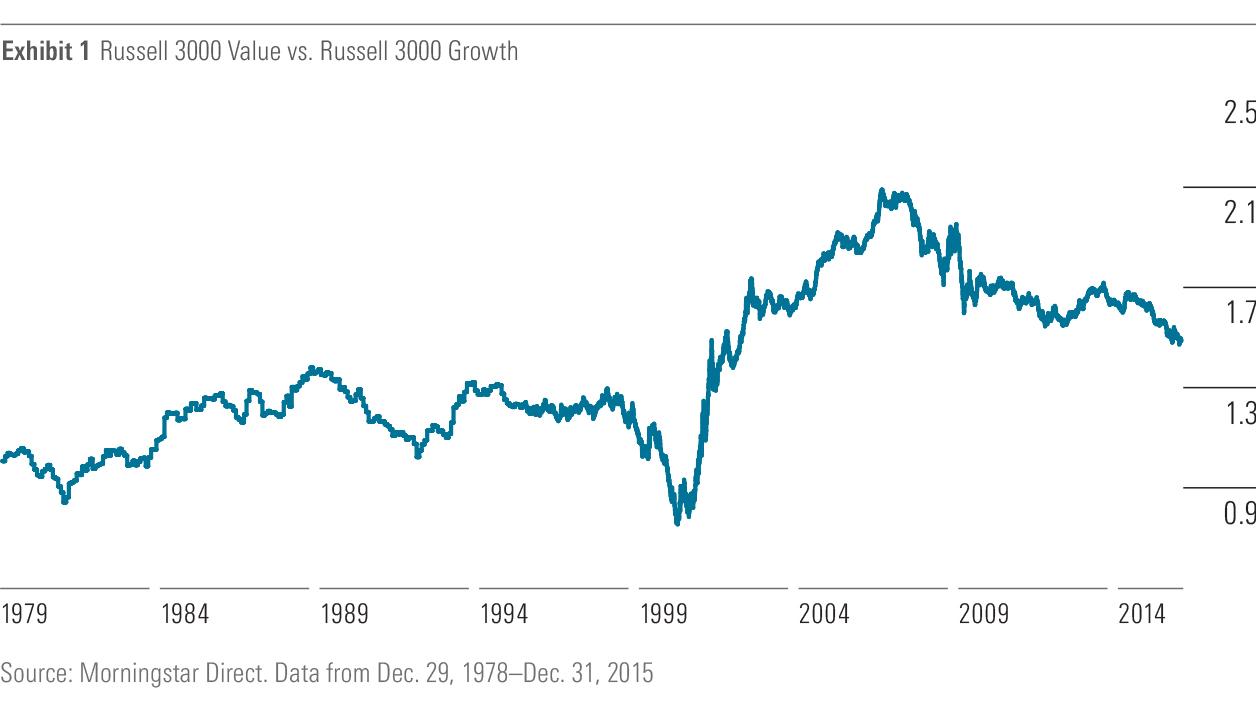

Value "style" indexes were ultimately born out of these ideas. These indexes were at first designed to be style-appropriate benchmarks for active managers, and it was only later that they were adopted by index funds and exchange-traded funds. Their performance can give us a sense of the real-world value premium available to investors. From Dec. 29, 1978, [3] through March 13, 2016, the Russell 3000 Value Index gained 12.05% on an annualized basis while the Russell 3000 Growth Index grew by 10.78% annualized. This 1.27% annual value premium, compounded over decades, netted a substantial increase in ending wealth. A $10,000 investment in the value index grew to $688,108.29 as of the end of March 13, 2016; the same 10 grand invested in the growth index yielded $450,446.95--a 53% difference. Clearly, Graham and Dodd were onto something.

Value Has Fallen Behind Value investing is simple in theory, difficult in practice. Today, value investors find themselves in the middle of a particularly tough stretch. Exhibit 1 is a relative wealth chart that plots the performance of the Russell 3000 Value Index versus the Russell 3000 Growth Index. When the line slopes up, the value index is outperforming. When it slopes down, the growth index is outperforming. You'll notice that value got the best of growth for a stretch of six-plus years emerging from the aftermath of the tech bubble, but ever since the second half of 2006, value has been giving ground. From Aug. 8, 2006 (the value index's growth-relative peak in Exhibit 1), through Dec. 31, 2015, the Russell 3000 Growth Index has outperformed its value counterpart by 3.89 percentage points on an annualized basis. Value investors may be using their well-worn copies of "Security Analysis" as a doorstop and logging in to their Amazon Prime accounts (always a good value!) to order a copy of Philip Fisher's (the so-called Father of Growth Investing) "Common Stocks and Uncommon Profits." [4]

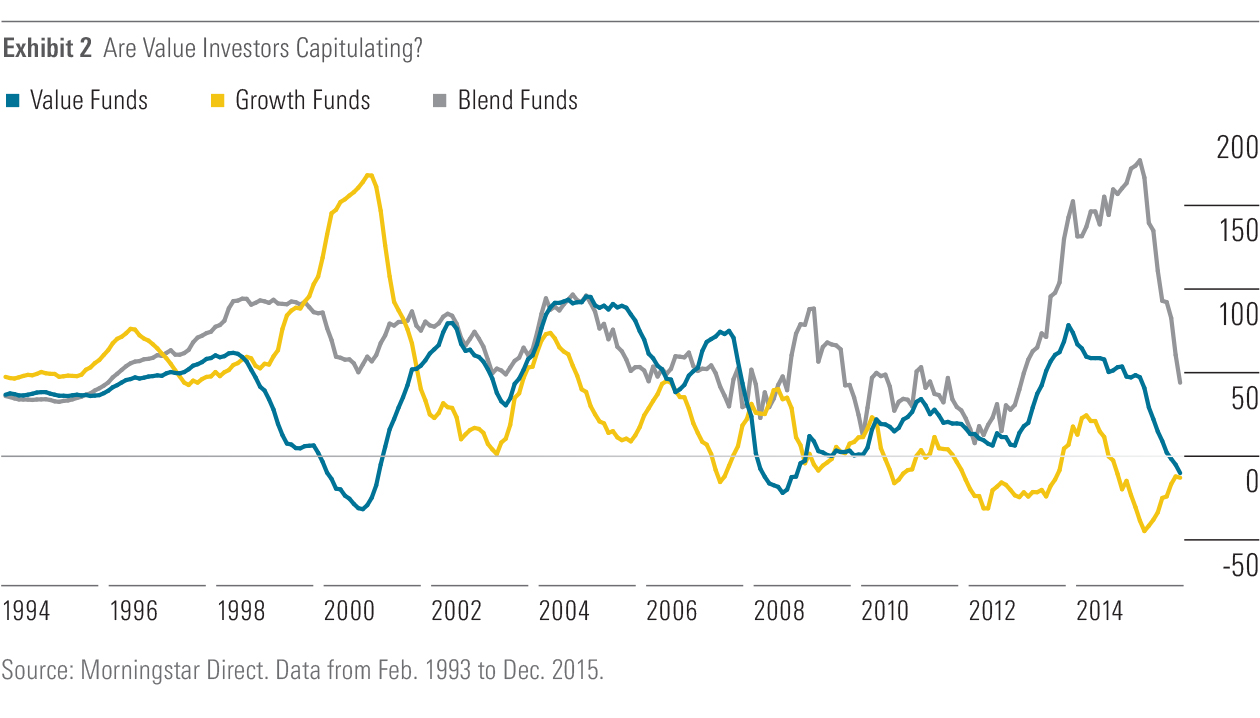

And It's Falling Out of Favor In fact, there is evidence that some value investors are beginning to capitulate after years of watching growth outperform. Exhibit 2 plots trailing 12-month flows of investor capital into and out of value, growth, and blend mutual funds and ETFs across large-, mid-, and small-cap stocks dating back to the beginning of 1994. As of the middle of 2015, the trend turned negative for value funds, perhaps signaling that after nearly a decade of underperformance, value investors are throwing in the towel.

Does Value Still Work? Yes, value investing still works. I believe it always will because it is 1) intuitive and 2) at least partly driven--in my opinion--by bad investor behavior that will persist indefinitely. In fact, I believe the current outflows from value-oriented funds are evidence of exactly the type of behavior that will ensure that the value premium will be with us for a long time to come.

This is how it plays out in practice: Fed up with years of underperformance, value investors will flee value funds and drive up prices elsewhere only to subsequently come down with a case of buyer's remorse as their new funds of choice disappoint. Value will inevitably rebound, and those "value" investors will invariably chase performance back in the same direction they came from. The net result of this isn't pretty for the performance-chasers, but their flightiness could yield long-term rewards for the steady hands--the true value investors. Remember: It's simple, but it ain't easy.

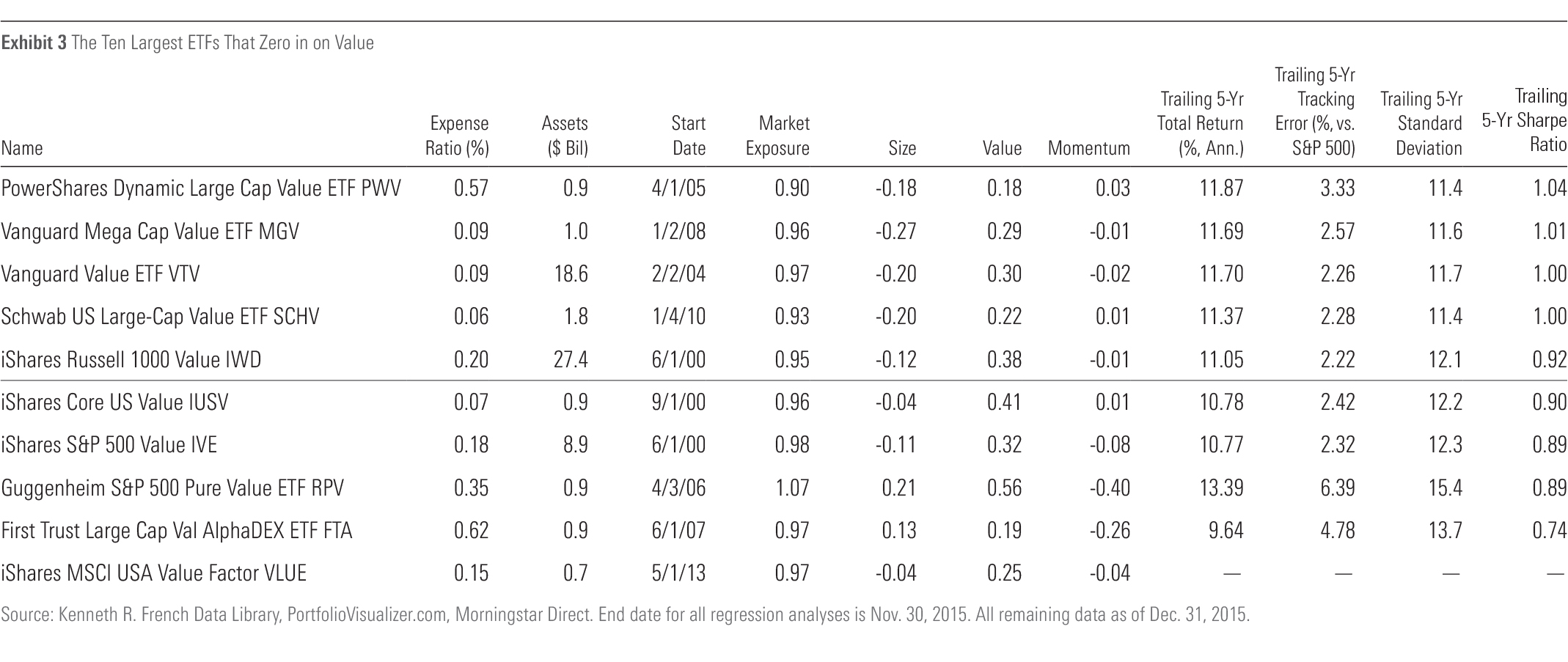

The Value Menu There are a host of ETFs that look to home in on value. The plain-vanilla ones track broad, market-cap-weighted benchmarks that tilt toward value stocks by splitting their parent indexes into growth and value camps. Others look to more cleanly isolate the value premium by focusing on stocks that demonstrate the strongest value characteristics. Exhibit 3 contains data for the 10 largest value-centric U.S. large-cap equity ETFs on the menu today. It should be noted that there are a host of other ways to build a benchmark that will yield a meaningful exposure to the value factor (for example, weighting constituents on the basis of fundamental measures of value like earnings, dividends, or book value). However, for the purposes of this analysis, I've chosen to focus on funds tracking indexes that are constructed using more-traditional, explicit measures of value (for example, price/book).

There are important differences among these apparently similar funds that are important to understand. First, each fund's benchmark index may have different value factors that it takes into consideration. For example, in the case of

It is also critical to understand how these funds' bogies weight their underlying constituents. For example, IWD's benchmark weights its members by their market capitalization.

What matters even more than the nitty-gritty details of index construction is investors' fortitude. Some of these funds might be easier to stick with than others. For example, while RPV had the best absolute returns over the five years ended Dec. 31, 2015 (it actually outstripped the Russell 3000 Growth Index during that span), it was a bumpy ride, as evidenced by the fund's substantially higher volatility versus its peers'. So on a risk-adjusted basis, the fund was actually near the bottom of the pack. While a fund like RPV might provide more-potent exposure to the value factor and the potential for greater absolute long-run returns, it comes at the cost of greater volatility. The real risk facing investors is that this added measure of volatility results in the type of bad behavior that I described earlier.

These characteristics matter when it comes to fund selection. Even after a near-decade-long drought, value is alive and kicking. But successful value investors have to be able to hold tight in order to reap the long-term rewards that value investing can offer.

[1] Graham, B., & Dodd, D. 1934. "Security Analysis." (New York: McGraw-Hill)

[2] Fama, E.F., & French, K.R. 1992. "The Cross-Section of Expected Stock Returns." Journal of Finance, Vol. 47, No. 2, P. 427.

[3] Note that this predates the July 1, 1995, inception of both the Russell 3000 Value Index and the Russell 3000 Growth Index. Performance figures from Dec. 29, 1978, through these benchmarks inception represent back-tested performance.

[4] Fisher, P. 1958. "Common Stocks and Uncommon Profits." (New York: HarperCollins).

Disclosure: Morningstar, Inc.'s Investment Management division licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)