No, Flexible-Stock Funds Are Not Better

Quite the opposite.

Bait and Switch

This past weekend,

The Wall Street Journal

that "mutual funds rally by not sticking to a style." The word "rally" caught my attention, quite sharply, as the stock market has mostly behaved otherwise, but it turns out that the

Journal

did not intend its headline literally. The article’s actual argument was that some flexible-stock funds are very good. All right, that

True that. The headline asserts the existence of a trend--the recent profits that have accrued to funds, in plural, for not sticking with one investment style--and then the article profiles the long-term results for the single fund of FPA Crescent. Which, ironically, hasn't been all that flexible, by the definition of the article itself. The author defines flexibility as movement between the Morningstar Style Box grids.

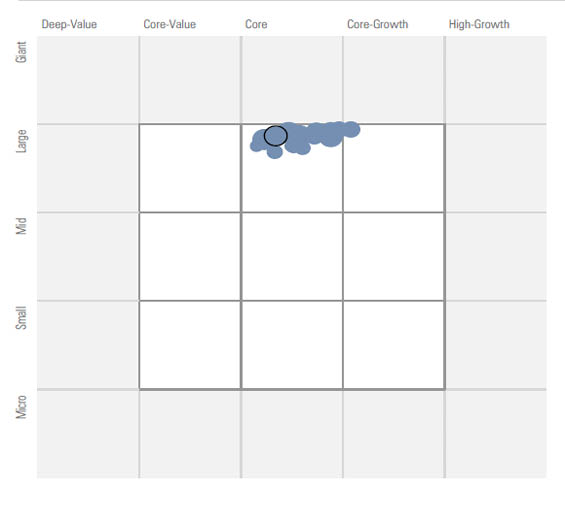

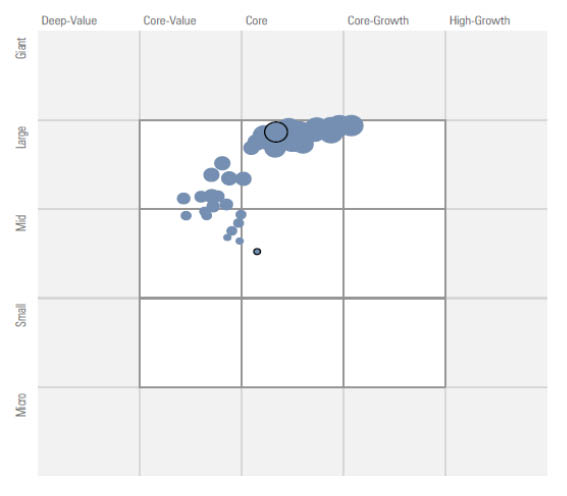

This is FPA Crescent's style trail over the past five years, using its holdings (as opposed to conducting a returns-based analysis). Each dot represents the portfolio's style position at a given time.

- source: Morningstar Direct

Not much motion going on there. However, the fund does exhibit more flexibility over the trailing 10 years, growing from mid-cap value to large value, and then drifting rightward to its present position of large core.

Sample Size of One So, I will buy the description of FPA Crescent as a flexible fund, particularly as it shifts among asset classes. And I certainly accept that it has been successful. Score 1 point for the author's thesis. But 1 point is far, far short of the required score. Is there some sort of general evidence that supports the notion that flexibly managed funds beat those that are style-consistent? In this column, we'll address that question, with respect to diversified U.S. equity funds.

Let's look at the past 10 years, through year-end 2015. Morningstar has a handy statistic called Style Consistency, which calculates how far portfolios move over a three-year time period, as measured by their average position on the Morningstar Style Box. (In other words, the statistic is a numerical summary of what the previous charts showed to the eye.)

Happily, the statistic is time-stamped, so that we can see how funds were positioned in the past. The task then becomes straightforward: Retrieve the funds' Style Consistency scores as of January 2006 and sort into quintiles. Those funds with the lowest Style Consistency scores were the most flexible entering the period and can reasonably be assumed to have been among most flexible over the ensuing decade. Conversely, those with the highest scores were the least flexible and most style consistent. We'll call those two groups Flexible and Consistent.

One possible danger: an accidental style effect. If, for example, small-company stock funds have higher style consistency than other flavors of funds, and small-company stocks have led the market over the past decade, then the Consistent bucket will show well. That would not make Consistent the better path for the future. It would merely be the approach that was in the right place over the past decade. Thus, we'll display the totals for each of the nine style-box sections (according to how the funds are currently classified). That will sharply reduce the chance of an accidental style factor affecting the outcome.

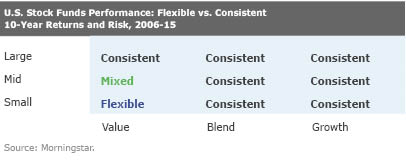

Now, the results. For each style-box section, I will be calculating (I have not yet done this, at the time of writing)--with the invaluable assistance of Morningstar's most excellent Michelle Swartzentruber--the average annual total return and the 10-year standard deviation for the Flexible and Consistent buckets. If a bucket wins on both accounts--that is, it has the higher return and lower risk--then I will list it in the chart as the sole winner. If the buckets split on the measures, then I will record it as Mixed. All right, off to do the work ...

Wow! The Flexible funds fared even worse than that chart suggests, because they were crushed in the large-cap categories that hold most of U.S. equity-fund monies. The Consistent funds beat them by 105 basis points per year in the blend category, 154 basis points in growth, and 132 basis points in value. In an industry where Vanguard has become the dominant player by delivering a 50-basis-point expense advantage (give or take), those 100-plus basis-point margins constitute an outright shellacking. Flexible funds were Ronda Rousey, and Consistent funds Holly Holm.

Yes, this table is not the final word on the subject. It uses a single time period. It uses a single definition of flexibility. It examines a single asset class. It contains survivorship bias. That said, the time period is long, the definition of flexibility is closely aligned with that used by the Journal's author, the asset class is the largest among U.S. mutual funds, and the victory margin is huge.

Meaning that it's pretty difficult to argue that flexible-stock funds are the superior breed. Yes, one could argue that the Flexible average has been poor but that the group contained an unusual number of strong funds that (the critical point!) could have been identified as such in 2006. There are always tales that can be told to gainsay data. But I leave that task for somebody else. The attempt would require much work, and it is, to put the matter gently, unlikely to succeed.

As with market-timing funds, and tactical asset-allocation funds, and go-anywhere funds, and concentrated funds, flexible-stock funds implicitly (and sometimes explicitly) promise superior performance in exchange for greater managerial freedom. It is a credible story. But in none of those other areas have the numbers supported the hypothesis. Nor do they appear to do so with flexible-stock funds.

John Rekenthaler has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WJS7WXEWB5GVXMAD4CEAM5FE4A.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NOBU6DPVYRBQPCDFK3WJ45RH3Q.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)