Durable and Defensive: A Look at Consumer Staples ETFs

If investors can get past valuations in the consumer staples sector, there are a raft of low-cost ETF options offering access to the space.

A version of this article was published in the February 2016 issue of Morningstar ETFInvestor. Download a complimentary copy of ETFInvestor by visiting the website.

U.S. consumer staples stocks performed well in 2015. In aggregate, this defensive sector returned nearly 7%, as measured by the performance of

Morningstar's equity analysts believe that what drove staples firms' performance last year is the same dynamic that has fueled their valuations during the ultralow-interest-rate environment of the past few years: The sector's healthy dividends have captured the interest of income-seeking investors. Historically, consumer staples stocks have been sensitive to interest-rate hikes because most staples firms can't grow their earnings fast enough during economic expansions to offset the negative impact of rising rates. However, during this most recent expansion, rates have remained at historically low levels. Meanwhile, staples firms have enjoyed robust cash flows stemming from U.S. growth, a slow recovery in Europe, and cost-cutting measures. The upshot in 2015 was that staples firms were generally sporting dividend yields in the 2.5%-3.0% range, even as their stock prices rose. In fact, XLP's dividend grew 9.5% in 2015.

What's next for staples firms isn't clear. If growth slows and the United States falls into a recession, investors may retreat to the safe haven of the staples sector and its perceived durability. In addition, the staples sector always has the potential to produce healthy performance from innovation, product extensions, prudent acquisitions, and cost-cutting. On the other side of the coin, the space currently trades at the high end of historical valuation multiples, and with the slowdown in emerging markets, many large-cap staples firms have been struggling to hit their historical benchmark of 5% organic growth. In addition, further interest-rate hikes would be bad for staples firms, because when rates rise, investors might revise their required returns upward, compressing valuations. The result could mean investors head elsewhere for yield.

The Lay of the Land Some investors have difficulty distinguishing between the consumer defensive, or consumer staples, sector and the consumer discretionary sector. Put simply, staples firms make products consumers generally buy regardless of economic climate, such as tobacco, toilet paper, laundry detergent, toothpaste, groceries, and diapers. Such firms typically have relatively steady revenue growth and cash flows. In contrast, discretionary firms rely on consumers spending on bigger-ticket items. These firms include restaurants, media companies, apparel firms, and makers of luxury goods.

Just four similarly sized subsectors make up the vast majority of the consumer staples sector. The largest subsector is food and staples retailing, where the biggest firms are

The final subsector of any size in the consumer staples sector is tobacco; the largest firms here are

From a fundamental standpoint, there are several important dynamics that affect the consumer staples sector. The sector's cash-flow-generating abilities and general resilience have been well documented. As a result, income-seeking investors count on consumer staples firms to provide consistent cash flows. Right now, the sector's dividend yield is hovering around a healthy 2.5%, slightly higher than its historical average. Another factor that investors considering staples firms should keep in mind is foreign currency, as many large staples firms sell into overseas markets. A stronger dollar has meant currency headwinds for consumer staples firms with strong overseas sales, while a weaker dollar has historically been a boon for those firms.

While the staples sector has seen some merger and acquisition activity in recent years--such as the merger that created

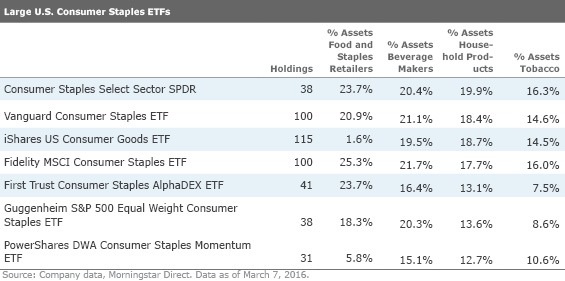

Market-Cap-Weighted Consumer Staples ETFs There are four large exchange-traded funds focused on the U.S. consumer staples sector. Three of them track market-cap-weighted indexes, which means that the largest firms hold the most sway. Given the fact that all three funds track cap-weighted bogies, it is hardly surprising that all three ETFs have produced very similar long-term performance.

By far the largest and most liquid staples ETF is XLP, which holds all 38 consumer staples firms found in the S&P 500, from Procter & Gamble all the way down to

An even cheaper option is the broader

Most investors should avoid the third market-cap-weighted staples ETF,

Still another market-cap-weighted consumer staples ETF to consider is the low-cost

Strategic-Beta Consumer Staples ETFs

There are also a handful of strategic-beta ETFs covering the consumer staples sector. By far the largest is

Another strategic-beta option is

Finally, there is

Strategic-beta consumer staples ETFs largely have outperformed cap-weighted consumer staples ETFs in recent years. For example, FXG has meaningfully outpaced cap-weighted competitors during the past three- and five-year periods (although it's lagged them during the past year). RHS and PSL have outperformed all cap-weighted consumer staples ETFs during the past one-, three-, and five-year periods. One caveat: It's hard to judge PSL's longer-term performance, because the ETF was recast in February 2014 to begin tracking a Dorsey Wright-managed index based on momentum. However, its early performance has been promising.

Sector Valuation The U.S. equity market has had a bumpy ride in 2016. Despite recent market volatility, however, the consumer staples sector remains richly valued relative to almost every other U.S. equity sector. Morningstar's fair value estimate for ETFs is a helpful way to quickly give investors an aggregate, asset-weighted fair value estimate of the stocks covered by Morningstar that are held in an ETF's portfolio.

According to Morningstar's equity analysts, XLP was trading at 102% of its fair value as of March 7, 2016, while VDC also was trading at 102% of its fair value, IYK was trading at 99% of its fair value, FXG was trading at 108% of its fair value, and RHS was trading at 107% of its fair value. (Morningstar does not assign a price/fair value ratio for FSTA or PSL.) These valuations are fairly full as compared with all other U.S. equity sectors, except the utilities sector. In fact, apart from the utilities sector, other U.S. equity sectors were trading at between 86% and 100% of fair value as of March 7, placing the consumer staples sector far from the median of the sector valuation spectrum.

In summary, the consumer staples sector has historically been a defensive sector that has offered investors a safe haven during periods of market volatility. More recently, it has also been prized by income-seeking investors because of its relatively healthy cash flow stream. While the sector appears richly valued right now, income-oriented investors might want to keep a close eye on it in the event that the market's slide results in more-compelling valuations.

Disclosure: Morningstar, Inc.'s Investment Management division licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)