Who Is Really in It for the Long Haul?

Most investment shops reward managers for short-term results, and few consider performance beyond five years.

A version of this article was published in the February 2016 issue of Morningstar FundInvestor. Download a complimentary copy of FundInvestor here.

Morningstar has consistently stressed that shareholders of actively managed mutual funds must maintain long-term investment horizons. Short-term market fluctuations can cause even the most skilled managers to perform out of step with competitors at times. It's more likely that talented managers can identify long-term drivers of value, and investors should prepare to wait patiently for their theses to play out.

Likewise, investment firms should compensate their managers based on long-term performance. Most firms tie manager bonuses directly to fund performance versus an appropriate benchmark or peer group. However, firms evaluate results over different measurement periods; some emphasize shorter time frames, while others focus on the long haul.

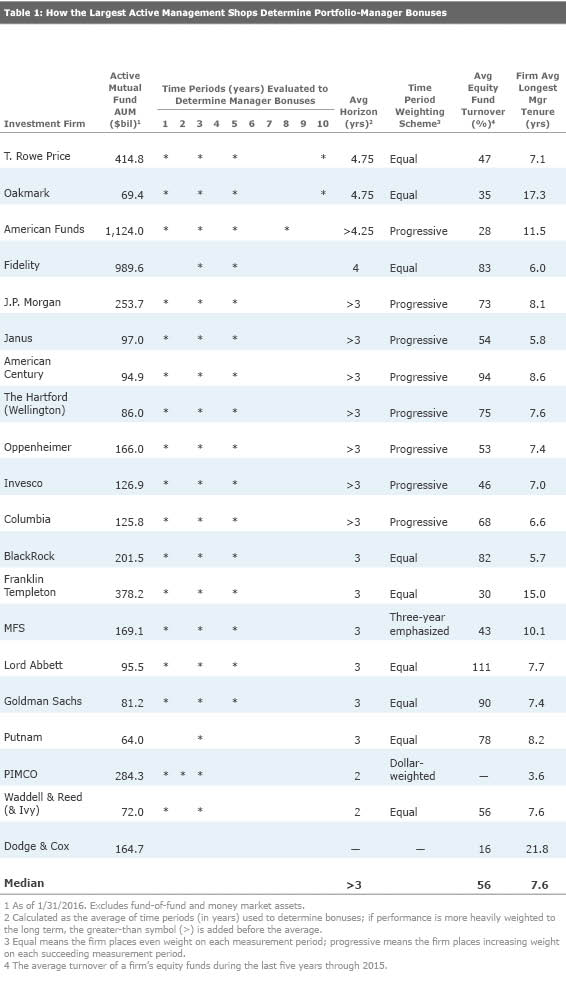

This study compares the performance time periods that the most-prominent active investment shops use when determining manager bonuses. Table 1 includes the 20 largest managers of active mutual funds, excluding firms that utilize multiple subadvisors, which contend with numerous compensation plans. Most of the information below came directly from each firm's Statement of Additional Information.

The majority of investment firms' compensation plans base portfolio manager bonuses on performance over one-, three-, and five-year periods. Very few asset managers take a longer-term view. In fact, of the 20 asset managers listed above, only three explicitly consider returns beyond five years.

An Exceptional Focus on the Long Haul T. Rowe Price and Oakmark stand out for their long-term focus. Both base compensation on fund performance relative to appropriate benchmarks or peer groups over one, three, five, and 10 years, with an equal weighting on each time frame. Their inclusion of a 10-year evaluation period is unusual in the industry and is in shareholders' best interests, considering the long-term nature of most mutual funds.

American Funds' structure also stands out in its long-term orientation, which has been one of the keys to its investment success. The firm pays bonuses based on one-, three-, five-, and eight-year returns relative to a benchmark and competitors. (Prior to 2016, the firm determined bonuses by evaluating returns over one, four, and eight years, with greater weight placed on the four- and eight-year periods.) As shown in Table 1, the firm uses a progressive weighting scheme, meaning it places increasing weight on each succeeding measurement period, which also represents an industry best practice.

While there's still room for improvement, the industry in general has increasingly favored the long term. For instance, Wellington, which serves as the subadvisor for all of The Hartford's funds and many prominent Vanguard funds, historically compensated managers based on one- and three-year results. However, in 2012, it began phasing in five-year returns, which will be fully implemented by the end of 2016. More recently, J.P. Morgan has added a 10-year measure when evaluating managers, though that language has not been added to the firm's SAI.

Can't Shake the Short Term Despite the general trend to favor longer-term returns, short-term results continue to influence bonuses at most firms. Of the asset managers included in Table 1 that determine bonuses based on performance, all but two--Fidelity and Putnam--consider one-year returns when determining bonuses. The former rewards managers for three- and five-year returns, while the latter only looks at results over three years. Their decision to eschew near-term performance is commendable.

Two firms stand out for having manager compensation structures with unusually short-term focuses. Waddell & Reed skippers receive bonuses based on one- and three-year results relative to peers, with an equal weighting on both periods. The firm has a history of not keeping up with industry best practices; Morningstar has previously criticized it for poor oversight of its captive advisor network and subpar risk management. Additionally, PIMCO's compensation plan is based on one-, two-, and three-year performance versus predetermined benchmarks. A compensation structure that stresses longer-term investment performance would better align managements' interests with those of fund shareholders.

An Outlier Dodge & Cox represents the only firm in Table 1 that does not explicitly link bonuses to fund performance. It believes that tying compensation directly to returns might adversely promote competition instead of constructive teamwork. Instead, the firm focuses on a variety of factors, such as caliber of investment ideas, industry insight, and long-term contributions to the firm. (Most other investment shops also consider those factors in addition to performance.) Morningstar generally favors a compensation structure that specifically links portfolio-manager pay to long-term fund results, but there is no reason to question Dodge & Cox's focus on the long haul. During the past five years, the firm's equity funds had an average turnover of just 16%.

Does Compensation Structure Influence Portfolio Turnover or Manager Tenure? One might expect firms that emphasize long-term returns to have funds with low portfolio turnover, and vice versa. That appears to be the case in some circumstances. American Funds, Oakmark, and T. Rowe Price's equity funds had below-average turnover during the past five years as compared with other firms in Table 1. However, the relationship is weak in other instances. For example, Lord Abbett and Franklin Templeton utilize the same compensation structure, though the former had an average turnover of 111% versus 30% for the latter.

It would also be reasonable to assume that including a longer assessment period leads to greater retention of managers by encouraging skippers to stay put. That seems to be the case with Oakmark and American Funds, though T. Rowe Price's average manager tenure ranks lower than most peers' in Table 1. PIMCO has the shortest average tenure of the bunch, but that owes largely to Bill Gross' recent departure.

/s3.amazonaws.com/arc-authors/morningstar/41940ba6-d0f1-493c-af96-52ad9419064e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/41940ba6-d0f1-493c-af96-52ad9419064e.jpg)