High-Yield Bond Funds Show Signs of Life

High-yield bonds have shown signs of stabilization, but investors should proceed with caution.

The surprising failure of Third Avenue Focused Credit in December 2015 left many high-yield bond investors shell-shocked. The collapse highlighted concerns around the lack of liquidity in the asset class. Several credit-oriented hedge funds shut down in the months following the Third Avenue debacle, most likely the result of leveraged bets on some of the dicier parts of the junk-bond market.

As we've written, traditional high-yield bond mutual funds are unlikely to experience a similar fate. But there's no denying it's been a difficult year for even the most conservatively run funds in the space.

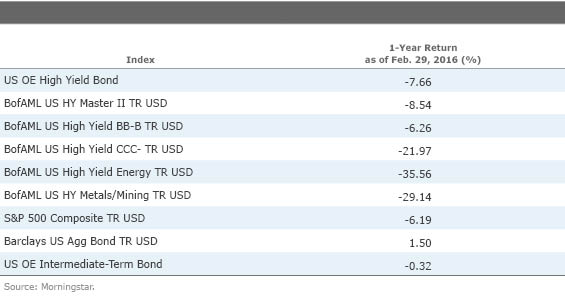

As the table below suggests, most of the pain from the high-yield sell-off came from lower-rated CCC bonds and energy-related issuers. Higher-quality BB and B rated bonds performed better but were not immune to the broad-based sell-off in the sector.

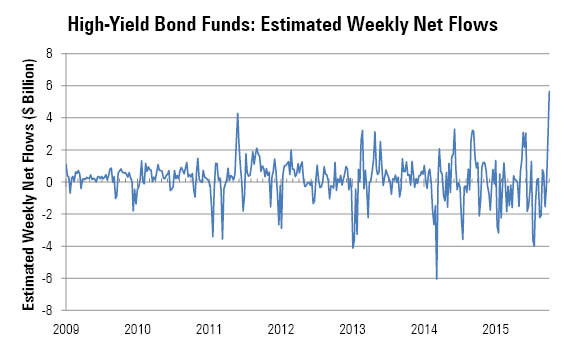

Despite the poor returns during the past year, recent weeks have seen a noticeable shift in sentiment toward high-yield bonds. In fact, weekly flow data suggests that investors are returning to the space.

Source: Morningstar Analysts

The $5.6 billion of inflows for the week ending March 2, 2016 (estimated based on funds that have reported flow data through this date) was the largest weekly inflow since at least 2009, which is as far back as Morningstar's weekly flow data go. Several factors are likely driving this change in sentiment. Investors that are looking to put cash to work following the decline in equity markets might prefer high-yield bonds over stocks, as the sector provides strong income and is highly correlated with equities without the associated volatility. Other technical factors might have also led to the dramatic inflows, including pension fund rebalancing. Further, analysts are likely starting to incorporate 2015 fourth-quarter earnings into their models that for the most part reflect decent underlying trends (excluding energy- and commodity-related firms, where bond prices arguably already reflect serious fundamental deterioration).

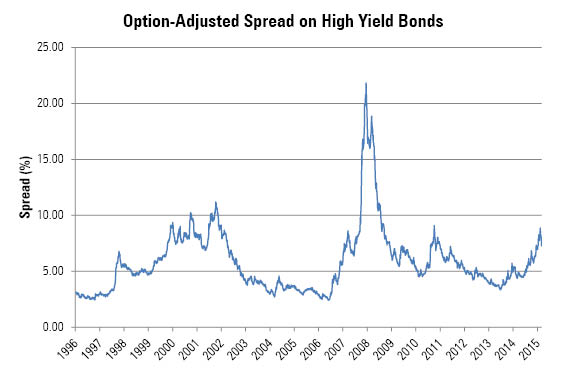

The shift in sentiment has provided high-yield bonds with a bit of a breather. After a grueling sell-off for much of December, January, and early February, high-yield bond spreads narrowed during the past couple of weeks but still appear attractive relative to Treasuries and other asset classes. The chart below shows a wild ride for spreads over the history of the junk-bond market.

Source: BofA Merrill Lynch, retrieved from Federal Reserve Bank of St. Louis

After hitting their post-financial-crisis high of 887 basis points over Treasuries on Feb. 11, 2016, the market has turned around; spreads compressed to 728 basis points as of March 3, 2016. The BofA Merrill Lynch U.S. High Yield Index generated an impressive (for bonds) 3% return in that short amount of time. Even after the rally, the index is yielding an attractive 8.7%, but it would be naive to expect a return anywhere near those levels for 2016 as default rates are widely expected to continue to increase and recovery value in the energy sector is uncertain.

Although the rebound is still young, recent trends suggest stabilization, and investors are smart to look at the space again given that valuations are more attractive than they've been in a long time. We suggested in a previous article that investors wanting high-yield exposure with less default risk and volatility should consider managers that avoided the energy sector and don't make heavy use of CCC rated bonds in their portfolios. This advice still holds. Valuations in the most beaten-down parts of the high-yield market may appear attractive, but the commodity-related sectors are vulnerable to further credit deterioration. The article cited above included three suggestions for higher-quality high-yield bond funds. We stick by those suggestions--except for one fund,

Neuberger Berman High Income Bond NHILX

This fund is managed with a team-based approach, which helps to minimize disruptions and provide management continuity without dramatic changes to the process. The fund's massive analyst team and portfolio managers use fundamental research and relative valuations to minimize downside while still participating in upside during strong high-yield markets. The team looks for potential upgrade candidates and avoids credits with declining fundamentals in order to minimize the likelihood of defaults. Since current lead manager Tom O'Reilly was appointed to the fund in October 2005, the fund's returns top more than 90% of its peers' in the high-yield bond Morningstar Category.

Vanguard High-Yield Corporate VWEHX

By design, this fund lands at the conservative end of the junk-bond group when it comes to credit risk. The fund's investment philosophy is informed by the asymmetrical risk/reward profile of the high-yield bond market: Investors can lose all or a significant portion of their investment when a company goes belly-up, but upside is limited, especially for a bond purchased at par. Unlike many of its competitors in the high-yield category, this fund's team has kept the bulk of its assets in BB rated fare since 2010, and the fund remains lighter than category rivals when it comes to bonds rated B and below, which has served this fund well.

PIMCO High Yield PHIYX

This fund's focus on bonds rated BB, and its Bank of America Merrill Lynch U.S. High Yield BB-B Rated Constrained Index benchmark, give it a more-conservative look than many of its high-yield rivals. Indeed, management treads more lightly in junkier bonds rated B and below. The fund will invest significantly in non-U.S. issuers, including emerging-markets-domiciled issuers. That leaves the fund with a slight overweighting to non-U.S. names relative to its benchmark. Manager Andrew Jessop invests mainly in cash bonds and uses smaller doses of credit default swaps to gain market exposure, particularly in the face of strong cash flows.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)