Under the Hood of 5 Multifactor Funds

All these funds attempt to reduce the risk of underperformance by diversifying across multiple 'factors,' but there are important differences among them.

A version of this article appeared in the December 2015 issue of Morningstar ETFInvestor. Download a complimentary copy of ETFInvestor here.

Historically, characteristics such as low valuations, strong recent performance, and high profitability have each been associated with higher long-term stock returns. There are well-documented economic explanations for each of these effects (or factors), suggesting that they may persist in the future. But each of them is cyclical and can experience extended periods of underperformance. This can make individual factor funds difficult to stick with.

Several fund companies have recently launched multifactor strategies to address this problem. These funds attempt to reduce the risk of underperformance by diversifying across multiple factors with low correlations to one another. While these funds may appear similar on the surface, there are important differences among them that will affect their performance.

Goldman Sachs ActiveBeta U.S. Large Cap Equity ETF GSLC This fund is the cheapest of the bunch. The index it tracks is composed of four subportfolios, each of which targets stocks on a different factor: value, momentum, quality (profitability), and low volatility. The index combines these factor portfolios in equal weightings. This approach is akin to holding four separate factor funds. It does not take into account the overall style characteristics of the combined portfolio but offers the advantage of simplicity and transparency.

The selection universe is composed of the 500 largest U.S. stocks by market capitalization. Each subportfolio over- or underweights these stocks based on the strength of their style characteristics. This approach gives the fund a smaller-cap tilt than the S&P 500 even though it doesn't explicitly emphasize small size. While it may exclude the lowest-scoring stocks, the fund is designed to offer broad exposure to the large-cap U.S. market. It currently holds more than 430 out of the 500 stocks in the eligible universe, and just more than 93% of the portfolio overlaps with the S&P 500. The index is rebalanced quarterly, but it applies an adjustment to mitigate unnecessary turnover.

The fund measures each stock's value characteristics based on book/price, sales/price, and free cash flow/price. (It substitutes earnings/price for free cash flow/price in the financials sector.) The value subindex matches its sector weightings to those of the eligible universe. The other three subindexes do not constrain their sector weightings in this manner.

Momentum tends to work well when value doesn't, and vice versa. Therefore, combining these two styles can offer good diversification benefits. The fund's index measures momentum based on risk-adjusted (where risk is defined by market sensitivity and volatility) performance over the previous 12 months, excluding the most recent one. This risk-adjustment may increase the fund's exposure to stocks whose momentum is more likely to persist and slightly reduce risk.

Quality can also diversify value, which tends to favor less profitable names. The fund's index assesses quality based on gross profits/total assets. (It uses return on equity for the financials sector.) Similar to positive momentum stocks, stocks with high profitability tend to trade at higher valuations than their less profitable counterparts. Because the fund allocates half of its portfolio to these two sleeves, it has a less pronounced value orientation than many of its peers.

The low-volatility sleeve of the portfolio emphasizes stocks with low volatility during the past year. It modestly tilts the portfolio toward more-defensive names, which could hurt performance during bull markets but should help during market downturns. In the long term, this sleeve should not offer a significant return advantage over the broad market, though it will likely offer a more favorable risk/reward trade-off. Alternative funds that do not incorporate low volatility may offer slightly higher expected returns.

Because the fund is only allocating a fourth of the portfolio to each of these sleeves, the fund's style tilts are modest in aggregate. In fact, the managers strive to keep tracking error relative to the S&P 500 low (around 2%), which reduces the risk that it will significantly underperform. Even if the factors it attempts to capture don't pay off in the future, its low expense ratio won't hurt performance. The fund currently charges 0.09%, net of a 0.15% fee waiver. It's a bargain either way. Transparency strengthens the case for this fund.

iShares FactorSelect MSCI USA ETF LRGF IShares FactorSelect MSCI USA ETF follows a more complex approach. The index it tracks attempts to maximize the portfolio's overall exposure to the value, momentum, (small) size, and quality factors, while maintaining a comparable risk profile to the broad MSCI USA Index, which includes large- and mid-cap stocks. To accomplish this, it uses an optimizer that takes each stock's factor exposures and the correlations into account to select stocks from the MSCI USA Index and assign weightings under a set of constraints. These include limiting individual security and sector tilts relative to the parent index, limiting exposure to nontargeted factors, and capping one-way turnover at 20% at each semiannual rebalance.

While the underpinnings of the model are transparent, it is more difficult to trace the construction of this portfolio than GSLC's. The FactorSelect exchange-traded fund also owns a much smaller slice of the market than GSLC. Its holdings currently represent just 18% of the assets in the S&P 500.

There are some differences in how these two funds measure value, momentum, and quality, but one approach is not clearly better than the other. MSCI measures value based on each stock's forward price/earnings, price/book, and enterprise value/operating cash flow relative to its sector peers. Similar to GSLC, LRGF attempts to introduce this value tilt without deviating from the market's sector weightings.

This fund also attempts to offer sector-neutral exposure to the quality factor. It targets stocks with high return on equity, low debt/equity, and low earnings-growth variability relative to their sector peers. While this approach does not narrowly focus on profitability, it skews the portfolio toward more-profitable names, similar to GSLC.

MSCI's momentum and (small) size factors ignore sector membership. The former is based on relative performance during the past six and 12 months and risk-adjusted returns (where risk is measured as market sensitivity) during the past two years. Size is straightforward. By itself, size is the weakest of the major factors, but it should work better in combination with other factors like value and quality.

Is this more complex approach worth the trouble? Back-tested performance data suggest that the fund's multifactor index would have slightly outpaced the simple average return of the four indexes that iShares' individual factor ETFs track. There are some minor differences between the construction methodology of the individual factor indexes and the multifactor index that could distort this comparison. However, LRGF's holistic approach to portfolio construction may offer some real (albeit modest) return advantages. For example, stocks that are both cheap and profitable may offer higher expected returns than stocks with only one of those characteristics. While stocks that score well on both counts do indeed receive greater weightings in a simple subindex averaging approach (similar to GSLC's), LRGF targets a smaller segment of the market. As a result, it has greater exposure to those stocks that look attractive on multiple dimensions.

Overall, LRGF offers stronger style tilts than GSLC, which could give it a return edge. However, this (along with its exclusion of the low-volatility factor) can also make it riskier, despite its attempt to match the market's risk profile. LRGF's higher 0.35% expense ratio and limited trading volume detract from its appeal.

Stronger Style Bets

The managers refresh the portfolio each month. They use the average security weightings of the target portfolios during the past few months to smooth out turnover, but they may deviate from this model when transaction costs exceed the expected benefits of trading. There are no hard limits on turnover, which will likely be much higher here than at GSLC and LRGF. Because this fund pursues its targeted style tilts more aggressively than its peers, it will likely offer higher returns over the long term. But it may also be riskier.

As a mutual fund, AQR Large Cap Multi-Style does not benefit from the in-kind redemption process that its ETF counterparts enjoy, so it will likely be less tax-efficient. However, there is a tax-managed version available, AQR TM Large Cap Multi-Style QTLLX. While the institutional share class has a stated $5 million minimum investment, AQR waives the minimum for investors who access the fund through a financial advisor.

Lower-Risk Options Similar to AQR Large Cap Multi-Style, JPMorgan Diversified Return U.S. Equity ETF JPUS (0.29% expense ratio) assigns composite style scores to large- and mid-cap U.S. stocks based on their value, momentum, and profitability (return on equity) characteristics. But it measures each stock's style characteristics relative to its category peers and offers broad exposure to the market, only filtering out the lowest-scoring stocks. In fact, about 82% of its portfolio overlaps with the Russell 1000 Index.

However, the biggest difference is that the JPMorgan fund weights its holdings by the inverse of their volatility during the past year, so that the least volatile stocks receive the largest weightings in the portfolio. This gives the fund a defensive posture that should help it weather market downturns better than most, but it could detract from performance in bull markets.

While it targets a narrower subset of the market, iShares Enhanced U.S. Large-Cap IELG (0.18% expense ratio) may also be a compelling multifactor option for risk-averse investors. It targets stocks with attractive value, quality, and smaller market-capitalization characteristics and currently attempts to offer 95% of the volatility of the Russell 1000 Index. It achieves this volatility reduction through its weighting approach. But the managers limit the portfolio's sector tilts to 10 percentage points of the Russell 1000 Index. IELG will likely offer lower long-term returns than LRGF because of its targeted volatility reduction and exclusion of the momentum factor.

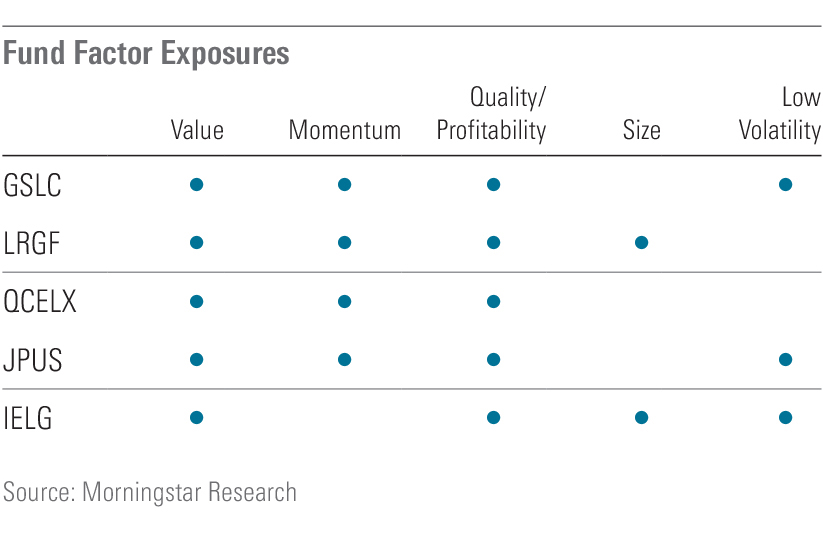

The table below summarizes the factors that each fund attempts to capture.

/s3.amazonaws.com/arc-authors/morningstar/56fe790f-bc99-4dfe-ac84-e187d7f817af.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/56fe790f-bc99-4dfe-ac84-e187d7f817af.jpg)