What Should You Do With Your Emerging-Markets Fund?

Stay put, but make sure your fund does not have an outsized China exposure.

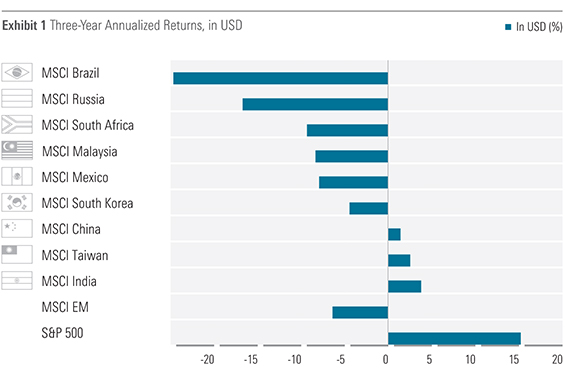

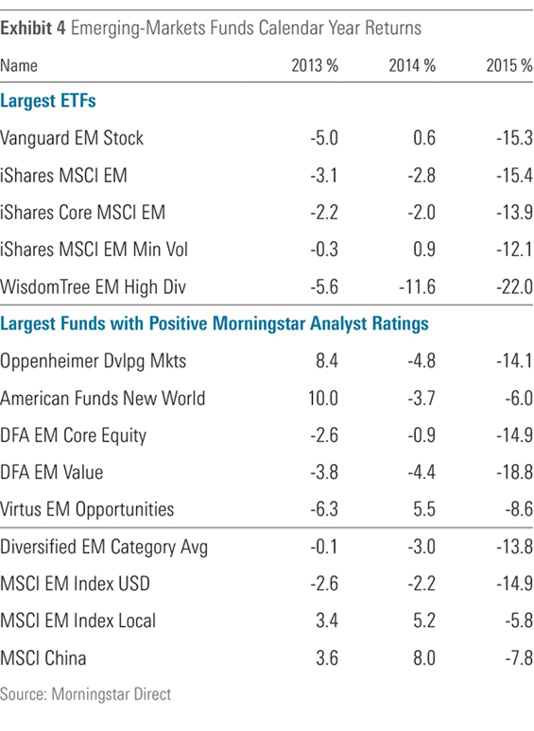

Investors may be tempted to give up on their emerging-markets equities funds, as many of them have been down for three consecutive calendar years while U.S. markets have been strong. On average, emerging-markets funds have declined 5.7%, annualized, over the past three years through Dec. 31, 2015, compared with the S&P 500’s 15.1% annualized return over the same period (thanks to a 32% return in 2013 and a 14% return in 2014, which helped offset a weak 1.4% return in 2015).

Generally speaking, it is not a good idea to dump an asset class when times are tough. But it might be helpful to dig into what’s been happening over the past few years, to get a better understanding of the complicated dynamics that drive the performance of emerging-markets funds.

Emerging Markets: A Diverse Asset Class "Emerging markets" is a blanket term. The group is made up of about 20 countries, each with its own distinct policies, currencies, economic orientation, and companies. So while emerging-markets funds have been declining over the past three years, there have been large performance differences among the individual markets.

Generally, the countries that have been underperforming are commodity exporters such as Brazil, Russia, and South Africa (see Exhibit 1). Declining commodity prices have been a significant headwind for the economies of these countries, with Brazil and Russia actually reporting a decline in gross domestic product in 2015.

- source: Morningstar Analysts

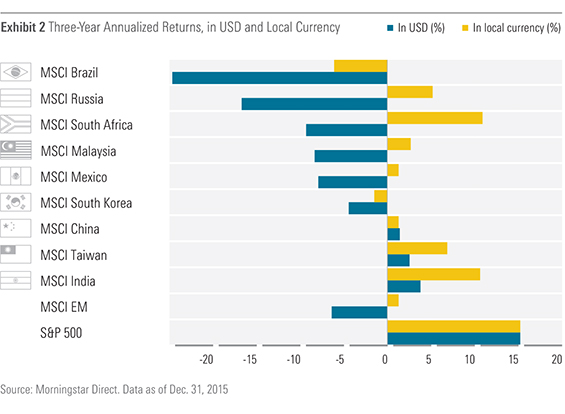

But a key reason for emerging-markets funds' dismal returns has been the rising U.S. dollar. This is because the value of foreign investments, when translated into U.S. dollars, falls as foreign currencies decline in value against the dollar. Most notably, over the past three years, the Brazilian real, Russian ruble, and South African rand have each declined about 50%, cumulatively, against the U.S. dollar.

To see the impact of these currency declines on market returns, Exhibit 2 compares the annualized three-year returns of individual countries in U.S. dollars (blue bars) and in local currencies (red bars). Countries that experienced sharp declines in the value of their currency against the dollar exhibited the largest difference in local-currency returns versus U.S. dollar returns.

In fact, without currency translation effects, the MSCI Emerging Markets Index would have generated a positive 1.2% annualized over the past three years (through Dec. 31, 2015). In contrast, the benchmark returned negative 6.4% annualized over that span—which includes currency translation effects, as the index is priced in U.S. dollars.

The Impact of China In Exhibit 2, the MSCI China Index's returns in local currency and U.S. dollars are almost identical. This is because the Chinese currency is soft-pegged to the dollar. As a result, China is one the few major markets (among emerging and developed countries) whose U.S. dollar-based returns were not significantly negatively affected by the rising U.S. dollar.

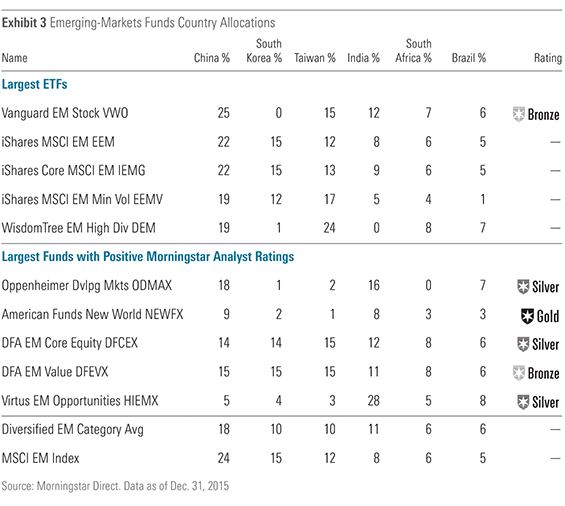

The Chinese equity market, as defined by the MSCI China Index (comprising Chinese firms listed in either Hong Kong or New York) is significantly larger than other individual emerging markets. As such, Chinese stocks account for roughly one fourth of the portfolios of funds that track the MSCI Emerging Markets Index (or other market-cap-weighted indexes).

However, most actively managed Morningstar Medalists in the diversified emerging-markets Morningstar Category generally have a much smaller allocation to Chinese stocks, mainly because a 25% allocation to one emerging market can be quite risky (see Exhibit 3). In addition, many companies in China are government-controlled and may not always operate in the best interests of minority shareholders.

Unfortunately, betting against China over the past few years may have hurt relative returns, as China outperformed the MSCI Emerging Markets Index (thanks to the lack of negative currency translation effects). But in 2016 China is off to a rocky start, and is significantly underperforming other emerging markets, so funds underweight in China are now benefiting.

We also note that China is planning to continue loosening its currency’s peg to the U.S. dollar in the coming years. Should the Chinese yuan weaken against the U.S. dollar, funds with large allocations in China (namely, index funds) could be significantly affected, especially relative to funds with smaller China allocations.

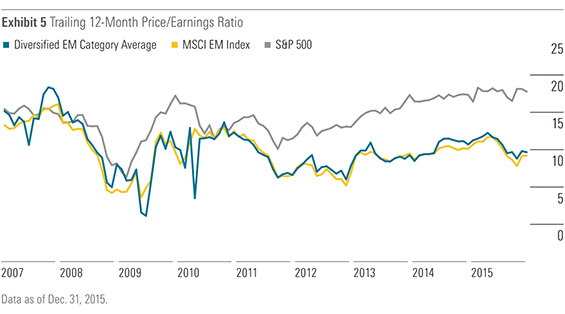

Valuations The price declines in emerging-markets funds may suggest that valuations are growing more attractive. Unfortunately, much of the declines were a result of negative currency translation effects. In the three years through December 2015, the MSCI Emerging Markets Index (in U.S. dollars) declined 18% cumulatively but rose 2.5% in local currencies.

As for valuations, over that period, the MSCI Emerging Markets Index’s trailing 12-month price/earnings multiple remained fairly range-bound (see Exhibit 5). In fact, emerging markets, as a whole, have been trading fairly range-bound since the 2008 global financial crisis and do not seem particularly cheap given their slowing growth outlook.

- source: Morningstar Analysts

Should You Invest in a Currency-Hedged Emerging-Markets Fund? The U.S. dollar's rally over the past several years has helped drive strong flows into currency-hedged exchange-traded funds. Given the significant drag from currency translation effects on emerging-markets funds, should investors consider a currency-hedged emerging-markets fund?

The answer is no, mainly because of costs. These funds use currency forwards to hedge their foreign-currency exposure, and this cost to hedge can be roughly estimated as the difference in short-term rates between the U.S. dollar and a foreign currency. With 14%-plus short-term interest rates in Brazil, and mid- to high-single-digit rates in a number of countries in Asia, hedging can be costly. During the past three years, the annual drag from hedging the MSCI Emerging Markets Index has been about 300 basis points.

Conclusion Emerging-markets funds may not be seeing brighter days anytime soon, especially given the weak global growth environment and the strong U.S. dollar. At this time, the U.S. dollar may appear to be entering overvalued territory. Historical evidence has shown that currencies can deviate from their fair value in the short term but tend to move back toward fair value over the long term.

With that in mind, long-term investors should stay the course and maintain their targeted asset allocations. If an investor wants to make a change in their emerging-markets allocation, I would suggest avoiding funds with a large China weighting, given the uncertainty around the country’s growth, reforms, and currency regime in the near and medium term.

Disclosure: Morningstar, Inc.'s Investment Management division licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/de44b91c-c918-4e53-81c3-ce84542f3d36.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/de44b91c-c918-4e53-81c3-ce84542f3d36.jpg)