Ultimate Stock-Pickers: Top Managers' High-Conviction Picks

Before the market turmoil of 2016, buying activity remained low, but these top managers did put some money to work in firms with defensible economic moats.

By Greggory Warren, CFA | Senior Stock Analyst

It's hard to believe that it has been nearly seven years since we relaunched the Ultimate Stock-Pickers concept in April 2009. For those who may not recall, our primary goal when we revamped the concept was to tap into the transaction activity of some of the best mutual fund and insurance company investors we follow, and by cross-checking the most current valuation work and opinions of Morningstar's cadre of stock analysts against the actions of these Ultimate Stock-Pickers attempt to highlight investable ideas. While we've never lacked for buy and sell data from our top managers, it has always proved to be a bit more difficult to find good ideas selling at reasonable valuations that we could comment on quarter after quarter. That said, with more than 75% of our Ultimate Stock-Pickers having reported their holdings for the fourth quarter of 2015, we have got a pretty good sense of what stocks they had been buying before the global market sell-off, with many of these names now selling at much more attractive valuations.

It should be noted, though, that when looking at our Ultimate Stock-Pickers’ purchases, we tend to focus on both high-conviction purchases and new-money buys. We think of high-conviction purchases as instances where managers have made meaningful additions to their existing holdings (or made significant new-money purchases), focusing on the impact that these transactions have on their overall portfolios. We do, however, recognize that the decision to purchase any of the securities we are highlighting could have been made as early as the start of October of last year, with the prices paid by our top managers much different from today's trading levels. As such, it is important for investors to assess the current attractiveness of any security mentioned here by checking it against some of the key valuation metrics--like the Morningstar Rating for Stocks and the price/fair value estimate ratio--that are generated regularly by our stock analysts' research efforts.

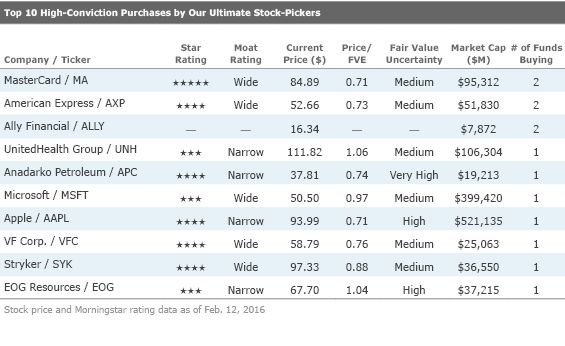

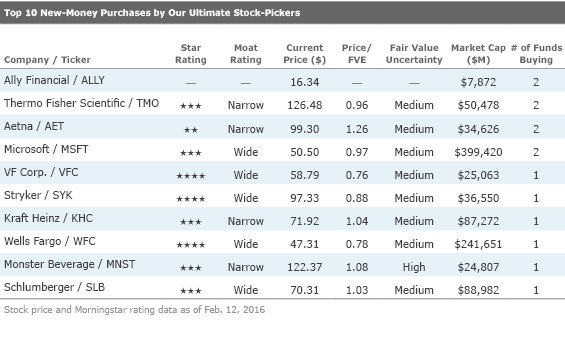

Our early read on the buying activity during the fourth quarter (and first part of the first quarter of 2016) has once again revealed a far smaller number of situations where our top managers have been buying individual stocks with conviction, or putting money to work in new names, than we've seen in past periods. This now marks the 10th straight calendar quarter where our top managers have generated incredibly low levels of buying activity. Of the conviction buying that did take place, most of it was focused on high-quality names with defendable economic moats--exemplified by the number of wide- and narrow-moat names in the top 10 list of high-conviction purchases (as well as when the list is expanded out to the top 25 purchases).

With regards to the list of top 10 high-conviction purchases, a continuation of the trend of lower levels of portfolio turnover amongst our top managers once again led to fewer overlapping conviction purchases. The fourth quarter of 2015 actually matched the

for the lowest level of conviction buying activity during the last tend calendar quarters, with the number of stocks being purchased with conviction by two of our Ultimate Stock-Pickers dropping down to three names (with the remainder being generated by single managers). Even so, four of the top 10 high-conviction purchases--non-rated Ally Financial (ALLY) and wide-moat

While we don't currently cover Ally Financial, the two Ultimate Stock-Pickers that were buying the stock during the fourth quarter--

During the quarter, we added a new position in Ally Financial…and we eliminated positions in Accenture, Amazon and Omnicom Group. Amazon has been a great holding for the Fund, and with the share price more than doubling in 2015, we believe the business is now fairly valued. With minimal reported earnings and a very high P/E ratio, Amazon may have looked like an unusual purchase for a value-based fund when we initiated a position in April 2014. We looked past reported earnings, which were tempered by large investments for future growth, and found that the scale and core earnings power of Amazon’s business were quite impressive and under-appreciated. Omnicom Group has also been a strong performer for the Fund. We have held Omnicom since late 2008, and we eliminated the position in the fourth quarter as the share price approached our estimate of fair value.

Ally was founded nearly a century ago as General Motors Acceptance Corporation. Its purpose then was to provide financing to GM dealers and retail customers. Today, Ally’s business is largely the same except that it is no longer owned by GM and now serves dealers and customers of many other automobile manufacturers, such as Ford, Chrysler and Toyota. Since Ally’s initial public offering in spring 2014, its shares have fallen over 20% while the S&P 500 has returned over 15%. Over this period, some investors have grown concerned that the business is at a cyclical peak, as U.S. auto sales are near record levels and credit losses are below long-term averages; as a result, some believe Ally’s earnings have nowhere to go but down. We believe cyclical pressures will be offset by continued internal improvements, such as funding cost reductions (as “legacy” liabilities are replaced with lower cost borrowings) and improving their capital structure. With Ally’s stock trading at just 80% of tangible book value, we believe Ally is a compelling addition to the Oakmark Fund.

Clyde McGregor of the Oakmark Equity & Income fund basically reiterated this commentary when talking about his fund's new-money purchase of the name during the fourth quarter. While we do not cover Ally, or many of the other specialty finance companies that are in operation, the big three credit card companies that we do cover--wide-moat

Mastercard and Visa were high-conviction purchases for the managers at

MasterCard (MA) is a global market leader in electronic payment processing, in which it partners with merchants and banks to complete electronic transactions. Our investment thesis is supported by the company’s powerful scale and network effect benefits. MasterCard earns a small percentage of the value of the billions of transactions it processes resulting in powerful operating leverage. Over time, we believe the continued global shift from cash-based to electronic-based transactions can drive solid revenue and free cash flow growth.

As for American Express, it was a high-conviction purchase for both

American Express—the largest new purchase in the Fund during 2015—provides charge and credit card products and travel-related services to consumers and businesses worldwide. The company is the number one credit/charge card issuer and merchant acquirer in the United States measured by billed business, and its network is the second largest after Visa. Historically, American Express has generated attractive returns due to its vertical integration and strong value proposition for high-spending customers.

Morningstar analyst Jim Sinegal covers the big three credit card providers, and at the start of this year put out an interesting report on the regulatory and competitive challenges facing the industry. He believes that card issuers' moats are at risk as the balance of power shifts to merchants and online commerce platforms and the options for consumers to store funds and obtain credit multiply. Sinegal thinks that a combination of heightened regulation and merchant control of customer relationships will necessitate a major shift in American Express' business model, and he recently lowered the firm's fair value estimate to $72 per share as a result. Meanwhile, Sinegal believes that merchant-friendly firms like MasterCard, Visa,

Microsoft was another name that was both a high-conviction and new-money purchase for a couple of our top managers, but neither of them offered much insight into their stakes. What we did see, though, was some rather detailed commentary from the managers at

Turning to the details of our fourth quarter performance, our strongest contributor was Microsoft, which rose by 29%. The shares were up sharply in October after the Company reported good quarterly results highlighted by solid growth in revenue and bookings, firming gross margins, tighter operating expenses and strong free cash flow conversion. With near-to-intermediate-term operating trends in the business suggesting that these key financial drivers are likely to persist, we believe that the visibility of the Company's earnings trajectory has meaningfully improved. With its aggressive push toward cloud-based services and platforms over the last several years, Microsoft represents a good example of a company that has embraced, rather than fought, a critical disruptive trend in its industry.

The Company has leveraged its longstanding relationships with enterprise customers, software developers and individual users to iteratively build cloud services that dovetail with its traditional offerings. Microsoft’s Azure platform now commands a strong position in the market for public cloud services at tremendous scale, second only to AmazonWeb Services. We believe that the addressable market opportunity for public cloud platforms will continue to grow rapidly and that Microsoft’s differentiated and enterprise-friendly approach will enable it to build a multi-billion dollar business in only a few years’ time.

Office 365 is another cloud-based service that has achieved critical mass and demonstrated the Company’s ability to successfully update and monetize an older product category in an annuity-based model with minimal friction and high levels of customer satisfaction. The successful release and growing activations of Windows 10 with its ‘pay once’ model and cross-device capabilities is another example of Microsoft’s embrace of creative destruction in its own business. These and other positive developments have improved investor sentiment toward the Company’s shares in recent quarters, as evidenced by a now meaningfully higher trading multiple relative to free cash flow per share and a much narrower discount to our estimate of intrinsic value. Accordingly, we trimmed our position during the fourth quarter.

Morningstar analyst Rodney Nelson wouldn't disagree with these actions on the part of the managers at BBH Core Select, believing the firm to be about fairly valued right now--trading at 97% of his $52 per share fair value estimate. After the company released its fiscal second-quarter earnings, he noted that Microsoft's fiscal 2016 continues to be defined by its ongoing shift into the cloud, with tangible signs that this transition is moving full steam ahead. Nelson highlights how much Microsoft has adjusted its strategy as enterprise workloads continue to shift to the cloud, and away from client/server models, with the billions of dollars that the company has invested in the Azure platform beginning to bear fruit, and its more open approach to delivering software in the cloud likely insulating the firm from a material technology disruption. While he is encouraged by the increasingly positive operational metrics for the firm's intelligent cloud, he thinks that the market is already pricing in the bulk of his growth assumptions.

As for VF Corp., the apparel and footwear company was a high-conviction new-money purchase for the managers at

In the fourth quarter, we initiated a position in VF Corp., an apparel and footwear company better known by its top brands: North Face, Timberland, Vans and Wrangler. We have long admired this company for its growth potential, commitment to corporate responsibility and excellent management team. We finally got a chance to buy the stock in December, after a disappointing earnings announcement caused a 14% drop in the shares from the pre-report price of $73 to our average cost of $63. We hope to own VF Corp. for many years, as we expect its brands to continue to gain market share domestically and abroad.

VF Corp. was the fifth new stock added to the Fund in 2015, joining Danaher, Deere, Intel and PayPal. We chose to divest six stocks: Accenture, Energen, Expeditors International, Teleflex, Spectra Energy and Qualcomm. We also trimmed (but didn’t exit) a number of positions, most notably our drug-related stocks, and added to certain long-term holdings due to improved valuations.

Morningstar analyst Bridget Weishaar believes that VF Corp. has established a broad and growing array of leading lifestyle brands, carefully selected to enhance its presence in high-growth categories and for synergies within existing operating units. She thinks that management will continue to make acquisitions with an eye toward strengthening its brand leadership and will continue to invest heavily in existing brands through branding campaigns, marketing, product development, and in-store experiences--the basis for her wide moat and positive trend ratings. With the shares trading at 76% of her fair value estimate right now, they continue to offer a compelling long-term investment opportunity for investors.

In closing, we should note that the managers at Jensen Quality Growth not only initiated a position in MasterCard during the most recent period, but also made a new-money purchase of Stryker, having liquidated positions in

Stryker (SYK) sells a broad range of orthopedic implants, neurological devices, and surgical tools. The company’s competitive advantages include: leading global market positions, longstanding research collaborations with healthcare organizations, and intellectual property protection. We expect increasing global healthcare demand, new product advances in robotic surgery, and continued acquisition activity should result in steady growth in revenue and earnings.

Morningstar analyst Debbie Wang views the shares as being slightly undervalued, trading at 88% of her $110 per share fair value estimate. She notes that Stryker remains a top-tier competitor in several attractive medical markets, including orthopedic implants, surgical equipment, and neurovascular products, and that, even more importantly, the company enjoys a long record of innovation in its key markets, which she expects to continue longer term. That said, she sees little opportunity for cross-application of technologies and expertise from the orthopedic segment to the neurovascular segment or endoscopy business, for example. This is in contrast with wide-moat Medtronic's history of applying established technology from one market to a different disease or therapeutic area, including adapting the use of electrical manipulation from pacemakers to stimulate nerves that address incontinence. Stryker's more disparate collection of businesses makes it harder to realize this additional return on research and development investment.

One high-conviction purchase that did not make the list of fourth-quarter purchases, but which is interesting nonetheless, was wide-moat

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PLMEDIM3Z5AF7FI5MVLOQXYPMM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/I53I52PGOBAHLOFRMZXFRK5HDA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CEWZOFDBCVCIPJZDCUJLTQLFXA.jpg)