Morningstar’s 2015 CEO of the Year

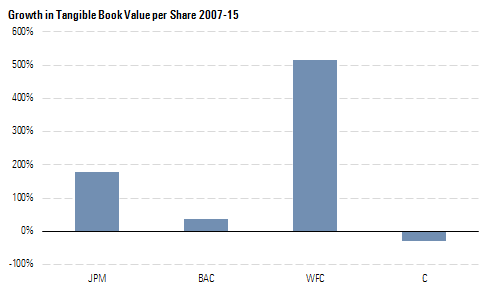

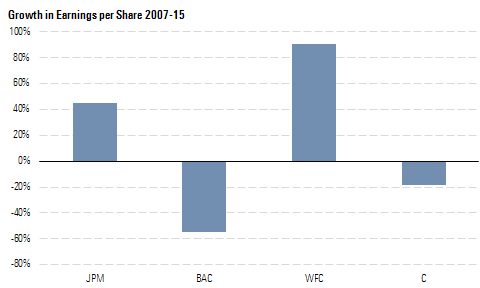

John Stumpf has successfully steered Wells Fargo through a very difficult industry period and built up the bank’s strength while many of its peers languished.

We are pleased to announce that John Stumpf of

The primary job of a CEO is to widen a company's economic moat, and we believe Stumpf has done just that. The bank now has $350 billion in non-interest-bearing deposits, nearly 4 times the $90 billion in low-cost funds it possessed in 2007. Thanks to management's decision to avoid volatile capital markets businesses, Wells Fargo needs to hold less regulatory capital than other banks its size, providing a new source of competitive advantage. Underwriting has remained conservative during Stumpf's time at the top--Wells Fargo's annualized charge-off rate remained well under 3% even at the depths of the recession. We attribute this in part to Stumpf's status as a lifelong banker. After serving with the company for 33 years in capacities including oversight of credit standards, he has a keen eye for risk, in our view.

The combination of cross-selling prowess and management's hold on expenses results in efficient operations. Operating expenses consumed only 58% of revenue in 2015. Few banks combine a low cost of funds, conservative underwriting, and efficient operations, but those that do are able to generate exceptional returns on capital. Wells Fargo is clearly one of these banks, and we recently upgraded its Morningstar Economic Moat Rating to wide as a result. In a difficult environment, the company still generated a 2015 return on total equity of nearly 13%, well above its cost of capital. We like that Wells Fargo bases executive compensation on both absolute and relative performance metrics like these, and we don't think it's surprising that such focus leads to exemplary results.

While the Wachovia acquisition was John Stumpf's tour de force, the company has continued to deploy capital well as it purchases other assets. The bank's low-cost deposit base and good standing with regulators made it a choice bidder for the GE Capital lending businesses that General Electric no longer wished to hold, nor could afford to fund. Wells Fargo added assets and employees in vendor finance, commercial real estate, railcar leasing, and inventory and other asset-based lending. The bank also picked up billions in loans from troubled European banks as those competitors recapitalized in 2012. We think these small, profitable acquisitions are indicative of future mergers and acquisitions as big deals are now out of the question for global systemically important financial institutions.

In today's banking environment, the ability to manage regulatory affairs is growing in importance, and Stumpf has excelled in this arena as well. Wells Fargo is now returning more than half of capital generated to shareholders in the form of dividends and buybacks, with an eye on raising this ratio in the near future. Wells Fargo now boasts a dividend yield over 3%, while other large banks are still attempting to regain the favor of their regulators. Furthermore, the bank repurchased $8.7 billion in shares in 2015 at reasonable prices--an effective use of shareholder capital, in our view.

Finally, we like that Wells Fargo is not blind to the growing role of technology in the financial sector. The West Coast bank has a startup accelerator program, effectively took a large early stake in Lending Club, and was quick to begin experimenting with smaller branches and mobile technology as consumer preferences changed. We think John Stumpf has successfully positioned the bank for many more years of profitable growth--hence his status as 2015 Morningstar CEO of the Year.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RYIQ2SKRKNCENPDOV5MK5TH5NY.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PPB6K765QVEN5C6ZRHVEXM3CIQ.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/4TYZEEXD3RGWNKTVNUJBWDUFAM.jpg)