Where's the Payoff for Active Investing?

Active U.S. stock funds haven't dodged the downturn.

The Insurance Premium Active U.S. stock funds can't be expected to keep up with fully invested indexes during rallies, and they can't be expected to beat them in choppy markets, when there is no discernible trend to exploit. But active funds certainly can--and will--outperform through prolonged downturns, thanks in part to the cash that they typically carry and in part to defenses that they erect as the decline extends.

So runs the typical defense of active management. It was the most common argument supporting active management even before the 2000-02 tech-stock crash. Afterward, it became omnipresent, as many actively run funds did trounce the indexes during that stretch. Active stock funds were marketed as insurance; they charged a premium that would be wasted during ordinary times but that would pay off when the storm arrived.

Unfortunately for the active managers, that did not happen in 2008. Everything went down together: large companies, small companies, U.S. stocks, foreign stocks, growth, and value. There was no escape route save for raising cash, and few active U.S. stock funds did that in any measure. The captains went with the ship--and investors noticed. Ever since, active U.S. stock funds have suffered outflows. They have been waiting for another chance to demonstrate the power of their insurance.

An Opportunity Squandered Another chance came recently, with blue-chip stocks dropping something over 10% since May and smaller companies faring significantly worse. It's been an eight-month period marked by worries about the Chinese economy and sliding commodity prices. While investment results always look much clearer when viewed through the rearview mirror, one would think/hope that active stock-fund managers might have anticipated the slump.

It appears that they didn't.

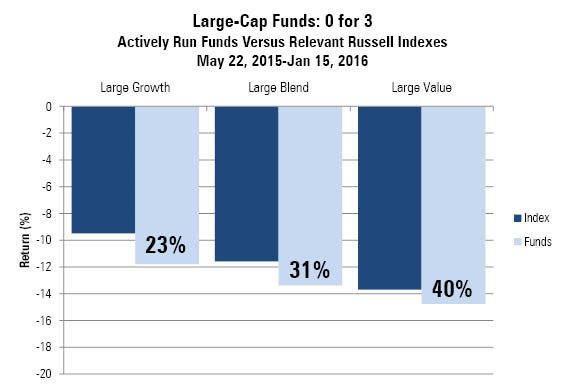

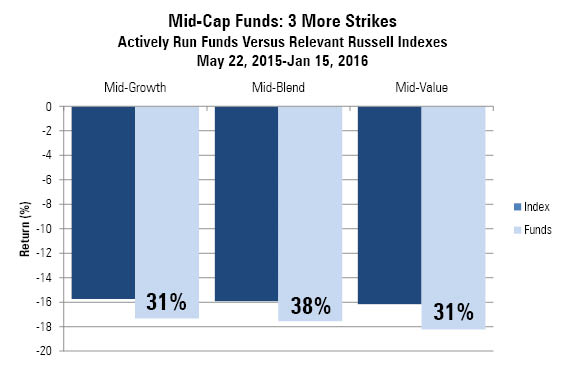

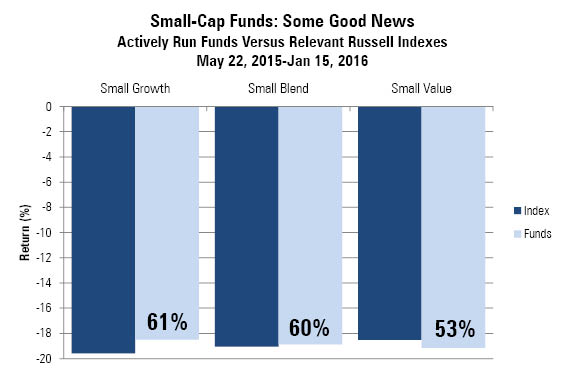

Morningstar's ever-helpful Jeff Ptak examined how active U.S. stock-fund managers have fared from May 22, 2015, through Jan. 15, 2016. The results are shown below. In each of the three charts (large-, mid-, and small-company stock funds, respectively), the average return for a category's actively managed funds, in light blue, is compared with that of the relevant Russell Index, in dark blue (for example, the Russell 1000 Value Index is used for large-value funds).

In addition to measuring the average funds' performance, each light blue bar shows the percentage of active funds that beat the index. A light blue bar that extends well below the dark blue bar indicates that the active-fund average sharply lagged return of the index, and thus the active managers' winning percentage will be small. Conversely, if the light blue bar is shorter than the dark blue bar, the active-fund average for that category beat the comparison index, and the winning percentage will be higher.

(As with most Morningstar studies, this exercise uses the oldest share class for each fund, includes the effect of ongoing fund expenses, and excludes sales loads.)

By the Numbers Actively run large-cap U.S. stock funds lagged the indexes in all three categories.

- Source: Morningstar

Active large-value funds performed relatively best (although the worst in absolute terms), with 40% of actively funds beating the benchmark. Of course, a 60% failure rate isn't the insurance payoff that active-fund investors hoped to see, nor is the 1.18-percentage-point gap the Russell 1000 Value Index scored over the large-value average.

But both figures are better than those recorded by large-growth and large-blend funds. Large-growth funds in particular struggled, with only 23% of actively run funds besting the Russell 1000 Growth Index, and an 11.79% aggregate loss, as opposed to 9.50% for the index.

The tale was similar for mid-cap funds.

- Source: Morningstar

Whereas value managers fared slightly better against the indexes with large-company funds than did growth managers, there was no discernible style effect among mid-cap funds. Overall, however, the relative performance of the actively run mid-cap funds was very like that of the large-cap funds. Once again, the active-fund averages trailed the indexes by about 1.5 percentage points. Their winning percentages ranged from 31% to 38%.

The only hope came from small-company funds.

- Source: Morningstar

Active funds from all three categories had winning percentages over 50% (albeit not much over), and their averages were better in two of the three categories. It wasn't a resounding success by any means, but unlike with funds that invest in large- and mid-cap stocks, small-company funds offered at least a hint of an umbrella.

The Unseized Moment This hasn't been a full test of active funds' downside protection. Even the worst of the nine categories, small-growth stocks, haven't quite fallen the 20% that is required to make an official bear market. If Friday's market close ends up being the low-water mark (wouldn't that be nice?), the past few months will barely be remembered, even by those who watch the markets closely. They will be a mere blip in the longer-term data.

Nevertheless, actively managed U.S. stock funds have had precious few chances to change their relative fortunes since the 2008 crash. Given their tattered reputations, and their ongoing asset redemptions, active U.S. stock funds sorely needed to grab whatever opportunity presented itself. This downturn gave them at least a hope of such a moment, but active funds did not seize it. Their case has now become even harder to make.

John Rekenthaler has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)