Winter Has Come for Alternative Funds

January's stock market swoon puts a spotlight on liquid alternatives.

Early January 2016 has called to mind the ominous refrain from Game of Thrones that "winter is coming." Uncertainty over economic growth in China, oil-driven deflation, and the end of quantitative easing in the United States have driven a stark sell-off in equities that has understandably sent a chill through investors and their portfolios. The S&P 500 has shed 8% through the first 15 days of the year. It's the worst start to a calendar year ever for the index.

After the financial crisis, liquid alternative funds, including non-traditional-bond funds, quickly grew in popularity, from less than $70 billion in assets in 2009 to $134 billion at the end of 2015, in part because of the anticipation that they would offer downside protection in markets like this. Only about half of the more than 450 liquid alternatives mutual funds have track records of at least three years, and only a fourth have track records of at least five years. So, for a lot of these funds, this downturn, along with the volatility in the third quarter of 2015, has provided the first real test of their down-market capabilities.

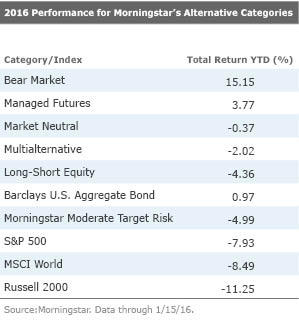

On average, the funds in the largest alternative Morningstar Categories (long-short equity, managed futures, market neutral, and multialternative) have had similar performance as in the third quarter of 2015. For example, on average, long-short equity funds tend to capture about half the downside of equity markets and multialternative funds tend to capture about half the downside of a balanced stock and bond index, such as the Morningstar Moderate Target Risk Index. It's a useful reminder that these strategies do take on market risk. That means most will capture some of the downside in markets and not provide the same kind of ballast as boring high-quality bonds when the world seems to be falling apart. Exhibit 1 shows the average 2016 performance of each category through Jan. 15 compared with select major market indexes.

Bears Get to Roar Not surprisingly, the bear-market category, which only includes funds that are by design net short equity markets, has done very well this year. The average fund in the category is up 15.15%. Given the poor long-term prospects of being net short the market, we don't recommend any bear-market funds to investors, though some tactical allocators may find them useful for short-term maneuvers.

Some managers outside of the bear-market category are starting to see their bearish bets pay off, too. Funds like market-neutral

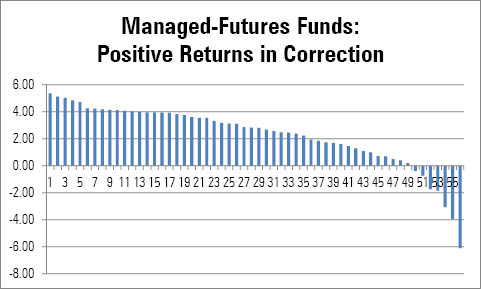

Managed Futures Sit on the Alternatives Throne Again Outside of bear-market funds and bearish managers, the clear standouts have been managed-futures funds. These strategies follow trends across global equity, bond, currency, and commodity markets whether the trend is going up or down. That means in sustained sell-offs they are likely to be short, such as in energy-related commodities this year or equity markets in 2008, which can lead to strong positive gains as long as the trend is intact. Through the first 15 days of 2016, the managed-futures category has posted a 3.77% average return. Managed-futures funds also stood out in the tumultuous third quarter of 2015, when they were up almost 1.00% as the S&P 500 fell 6.44%. This was better even than any non-government-bond or municipal-bond category. It's also notable how widespread the positive performance has been, demonstrating that it's not a single fund or style of managed-futures fund that is doing well. Only seven of the 56 funds in the category have lost money so far this year. Exhibit 2 shows the dispersion of returns across the managed-futures category.

Source: Morningstar. Data through 1/15/16.

Three managed-futures funds are Morningstar Medalists, which indicates that we expect these funds to outperform peers over a full market cycle, and each has provided a good counterbalance during the stock market drop. Silver-rated

As long as trends are intact, these funds should continue to do well. However, if trends like the falling price of oil were to sharply reverse, it's likely that managed-futures funds would suffer losses.

Two of the worst-performing managed-futures funds are

A Dream of Spring This recent bout of market volatility has provided a good stress-test for liquid alternative funds, but it's still important to focus on the long-term role that these funds can play in a portfolio. A good alternative fund isn't necessarily one that's going to make money all the time, but one that can provide returns that don't rely on stocks or bonds going up and offer some downside protection over a full market cycle. Having said that, alternative funds that are falling considerably more than the stock market during this downturn should receive a hard second, or even third, look. For investors seeking an alternative fund, our Morningstar Medalists list shows the funds that we are confident will deliver the desired characteristics of alternative investments.

/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)