The January Sell-Off and Your Mutual Funds

A look at which funds took it on the chin and which remained unscathed.

It's been a rough start to the year for the markets. Even after Thursday's rebound, we are seeing a lot of red ink. Through Jan. 14, 2016, the S&P 500 was down 5.9%, the Russell 2000 was down 9.6%, and the MSCI EAFE was down 6%. Outside of high-yield bonds, and those issued by energy companies in particular, bonds have done pretty much what you would have expected them to do in a volatile market: provide some diversification.

The Barclays U.S. Aggregate Bond Index was up 0.93% through Thursday. The Barclays Municipal Index also was positive, and most high-quality taxable-bond funds and indexes were up as well;

For stocks, it's a steep sell-off in a short period of time, but it's really just a pinprick given how well stocks have done in the past several years. Crashing oil prices, slowing Chinese growth, and tightening U.S. monetary policy have taken their toll in the past year, leaving major indexes down for the trailing year. But since the March 9, 2009, bottom of the financial crisis through Jan. 14, the S&P 500 has gained 18.5% annualized. If you had the foresight and fortitude to plunk down $10,000 in an S&P 500 index fund or ETF back then, you'd have nearly $32,000 as of Thursday.

So, you do not want to overreact and upend your portfolio because markets have gotten volatile. Yet there are pockets of severe damage, and it is worth paying attention to them to gain perspective, help set expectations, and perhaps glean rebalancing ideas.

Chinese stocks and oil prices have gone off a cliff this year. (Interestingly, though, the bad news on China came out last year--so far this year the indicators have been fairly positive.) Oil prices have plunged to $31 a barrel, and the Shanghai Composite is down about 15% for the year. The longer-term returns of both the China-region Morningstar Category and oil also are much worse than the broad markets.

You can also see the pain on the company level as coal and oil company bankruptcies are soaring.

Many mutual funds have felt the pain, but those that favor small-cap stocks, energy, natural resources or emerging markets have taken a much harder hit. You can see the breakdown of category returns on the Fund Category Performance page of Morningstar.com.

For the year to date through Jan. 14, 361 open-end funds have double-digit losses. In addition, 1,078 funds are in the red even going out three years. Growth funds in general have felt more pain than value in January, but there have been big drops among all groups of funds, including value, high yield, and emerging markets.

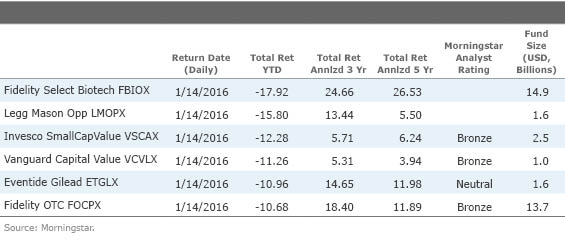

As you can see in the table, some prominent funds have taken double-digit losses. Among the prominent funds that have been hard-hit are:

We'll be watching these funds closely in light of their losses, but so far we are sticking with our Morningstar Analyst Ratings, which means our long-term outlook hasn't changed. Short-term performance rarely helps you find long-term winners, and it's often the case that good funds that are hit the hardest also rebound the most in the ensuing rally.

New Wrinkle While slowing growth in China and falling oil prices were the biggest news in 2015, we're seeing some recently surging sectors take it on the chin. For example, biotech has been hit hard, too, and healthcare funds have the biggest losses after the natural-resources and energy categories. Healthcare funds are down 10% for year to date, and tech funds, the stars of 2015, are off 8%.

Meanwhile, more defensive stocks and blue chips have lost a little less than small caps and more-cyclical names. Large-blend funds are down 6%, while small-growth funds are down 10%.

High Quality Holds Up Well High-quality longer-duration bond funds held up quite nicely. It's not a big surprise as falling commodity prices signal both lower inflation and slower global economic growth. Long government funds are up 2.1%, intermediate-government funds gained 0.7%, and intermediate bonds gained 0.4%. On the muni side, most intermediate and long-term funds gained around 0.6% or 0.7% for the year to date.

Lower-quality funds were hurt by the energy decline, however. High-yield bond funds lost 1.5%, and emerging-markets bond funds lost 1.8%, but bank-loan funds only lost 0.3% as they tend to be of higher quality than high yield. In high yield, the worst damage remained in funds with large energy positions, as the spread between energy bonds and the rest of the high-yield market continues to widen. Northeast Investors Trust NTHEX is off 3.7% for the year to date, and

The Real Danger While a decline in oil prices is a boon for some industries, investors worry that it could ripple across the economy. Stocks look relatively cheap if the economy continues to grow, but it is another matter completely if we are falling into a recession. Our stock analysts' fair value estimates show that all industries are trading at a discount and many at a substantial discount. Most are in the high 80% to low 90% range, which is better than most of the past three years but not nearly the bargain we saw in 2009, when many sectors hit the 50%-60% price-to-fair-value range. The only exceptions are the consumer defensive and utilities sectors, which are only a hair below their fair value estimates.

The Possible Opportunity If this is a blip for the economy and the bottom for oil, then bargains likely abound. There are plenty of signs of capitulation for the natural-resources realm. Hedge funds that focus on commodities are shutting down, companies are going bankrupt, and those that aren't are still curtailing their production plans.

Precious-metals funds have an average loss of 23% annualized for the past five years, while equity energy funds are down 10% and natural-resources funds are down 8%. Generally, you want to buy such investments after a severe sell-off like this one, but that doesn't mean they won't lose more from here.

My Own Portfolio As usual, I'm doing close to nothing in my portfolio. My 401(k) is set to rebalance every January, so that means I recently added a bit of commodities, value, and high yield while selling a bit of growth. If the sell-off in commodities and high yield gains steam, I'll probably buy more but not so much that it would alter my plan.

Back to the Long-Term We're writing about short-term markets here to help you understand what's going on--not to suggest you sell what's been hit hardest and buy what's done best. Our Morningstar Medalists list shows you what we think are the best bets for superior risk-adjusted long-term performance.

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)