Nominees for 2015 Fixed-Income Fund Manager of the Year

A tough year for many bond managers, but a couple of winners stand out.

Earlier this week, we announced our nominees for Morningstar's Domestic- and International-Stock Fund Manager of the Year. This article will discuss the nominees for Fixed-Income Fund Manager of the Year. We'll announce the winners on Jan. 26.

To choose funds to nominate, Morningstar's fixed-income manager-research team parses through the coverage universe using a series of quantitative and subjective criteria to determine a list of nominees. As we've written in our nominations for the Domestic- and International-Stock categories, these nominations reflect more than the managers' performance and portfolio decisions in 2015 alone; we're not trying to promote one-year wonders. Rather, we recognize managers whose strong results in 2015 underscore the merits of their approaches and their ability to deliver sound long-term results.

To be nominated, therefore, managers must have demonstrated success over time as well as in 2015 and must run a fund with a Morningstar Analyst Rating of Gold, Silver, or Bronze. In evaluating candidates, we also consider other funds that the managers run (when applicable), as well as their most-prominent funds.

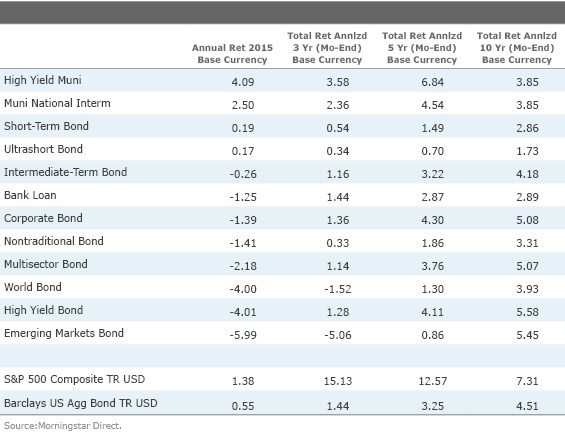

Choosing nominees this year wasn't easy, and many bond managers were probably happy to see 2015 come to an end. The year was defined by volatility in fixed-income markets, driven by the Federal Reserve's first rate hike since 2006, plunging oil prices, and a rising dollar. High-yield and bank-loan funds saw their first annual loss since 2008, while funds in the world and emerging-markets-bond Morningstar Categories suffered as the dollar strengthened against most world currencies.

As seen in the table above, these headwinds caused most taxable-bond categories to post meager returns, and several categories and funds even posted losses for the year. Generally speaking, the fixed-income managers that performed well in 2015 were able to insulate their portfolios from harder-hit segments of the market including high-yield corporates and emerging markets, while also tactically adjusting portfolio duration in response to rate volatility. Below are the two nominees for the Morningstar Fixed-Income Fund Manager of the Year.

Ken Leech, Carl Eichstaedt, Mark Lindbloom, Michael Buchanan and team

Western Asset Core Bond

WATFX

and Western Asset Core Plus Bond

WACPX

No winner's curse here, as our 2014 Fixed-Income Fund Managers of the Year winners were at it again in 2015. The funds' impressive 2015 returns are a continuation of their performance over the past few years. In 2015, the Western Asset Core Bond and Western Asset Core Plus Bond strategies both landed in the top 8% of the intermediate-term bond category after landing in the top 4% in 2014. Over the trailing 10-year period, Western Asset Core Bond lands in the top 15% of its category, while Western Asset Core Plus Bond is again in the top 4%. This record makes sense in light of the team's somewhat bold tendencies. Similar to 2014, the largest positive contributors to this outperformance in 2015 were the funds' duration and yield-curve positioning throughout the year. The team maintained a slightly longer duration than the benchmark in 2015, emphasizing longer-term bonds, positioning that benefited the fund as the yields on short-term bonds increased more than those on long-term bonds. Security and sector selection in investment-grade credit also helped returns, thanks to a tilt towards the financials sector and away from industrials. The team stumbled in some areas during 2015, namely high-yield and emerging markets. In some ways, though, the strong performance of Western Asset Core Bond and Western Asset Core Plus Bond, despite the missteps in certain sectors, is a testament to the strength of Western's overall platform. From a process perspective, these Western Asset funds stand out for their team-based approach, which provides stability and ensures the portfolios can benefit from the depth of Western's analytical resources.

Jerome Schneider

PIMCO Short-Term

PTSHX

It is unusual to see a manager nominated for the performance of a fund in Morningstar's ultrashort-bond category, a relatively conservative group typically run with durations of less than a year. However, in a year when short-term rates rose sharply and many bond funds failed to earn a positive return, Jerome Schneider's performance at PIMCO Short-Term stands out. This fund earned a 1.4% return in 2015, placing it in the top 1% of the ultrashort-term bond category. The fund's returns also compare strongly with the short-term bond category norm, where portfolio durations range between roughly 1.0 and 3.5 years. Schneider actively adjusted the fund's curve positioning and rate sensitivity over the course of the year, which contributed a healthy portion of its returns. Schneider maintained a very short duration for the first half of the year, even briefly taking duration into slightly negative territory in January and February. He then lengthened duration modestly later in the year, generally avoiding issues in the ultrashort reaches of the curve, sensitive to changing expectations surrounding Federal Reserve policy. The stability and success of Schneider's team is important given that it helps in the running of short-term money for funds across the firm, including

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)