December Ratings Activity in U.S. Driven by High-Yield Concerns and Manager Departures

Downgrades abound.

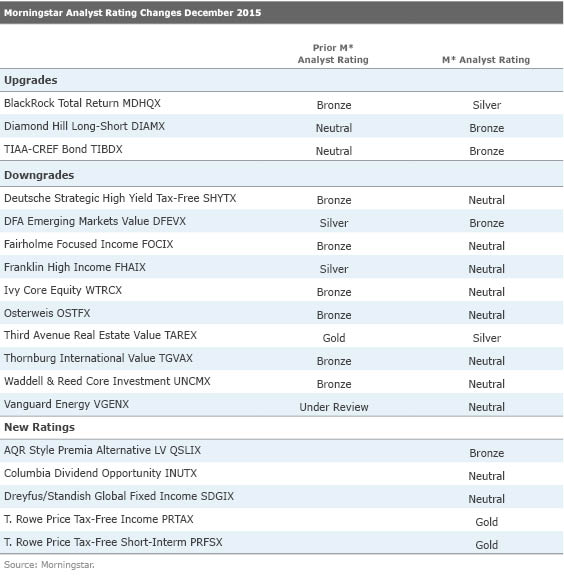

December was a busy month, as Morningstar manager research analysts in the United States downgraded the Morningstar Analyst Ratings of 10 funds, upgraded the ratings of three others, rated two funds for the first time, and re-initiated coverage of three funds.

Some notable changes are highlighted here; a complete list can be found in the table below.

Upgrades

The rating of

The Analyst Rating for

Downgrades

The meltdown and abrupt closure of Third Avenue Focused Credit (which Morningstar last rated in early 2013, giving it a Neutral) due to tanking distressed-debt positions in the energy sector prompted a reevaluation of several other funds because of related concerns.

The rating of

The Analyst Ratings of

New Ratings

We re-initiated coverage of

For a list of the open-end funds we cover, click here. For a list of the closed-end funds we cover, click here. For a list of the exchange-traded funds we cover, click here. For information on the Morningstar Analyst Ratings, click here.

/s3.amazonaws.com/arc-authors/morningstar/e9419b77-5e99-4d39-8b08-8c553bef37bd.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e9419b77-5e99-4d39-8b08-8c553bef37bd.jpg)