Morningstar's Take on the Fourth Quarter

A Fed rate hike, more mergers, and further pressure on oil prices dominated headlines in the final quarter of a volatile year.

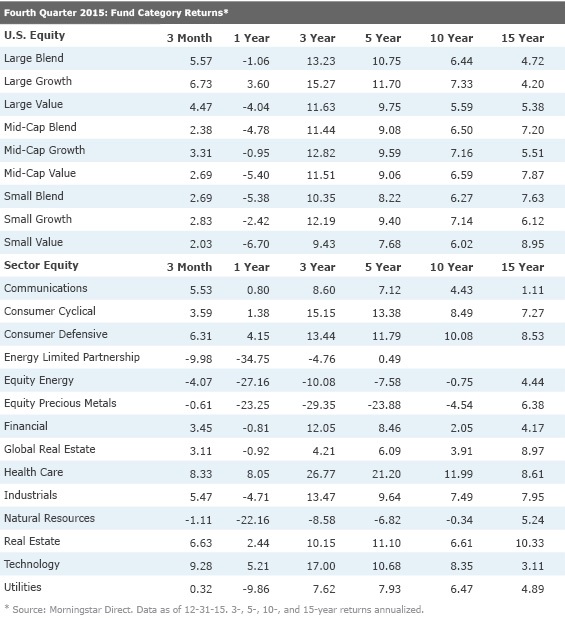

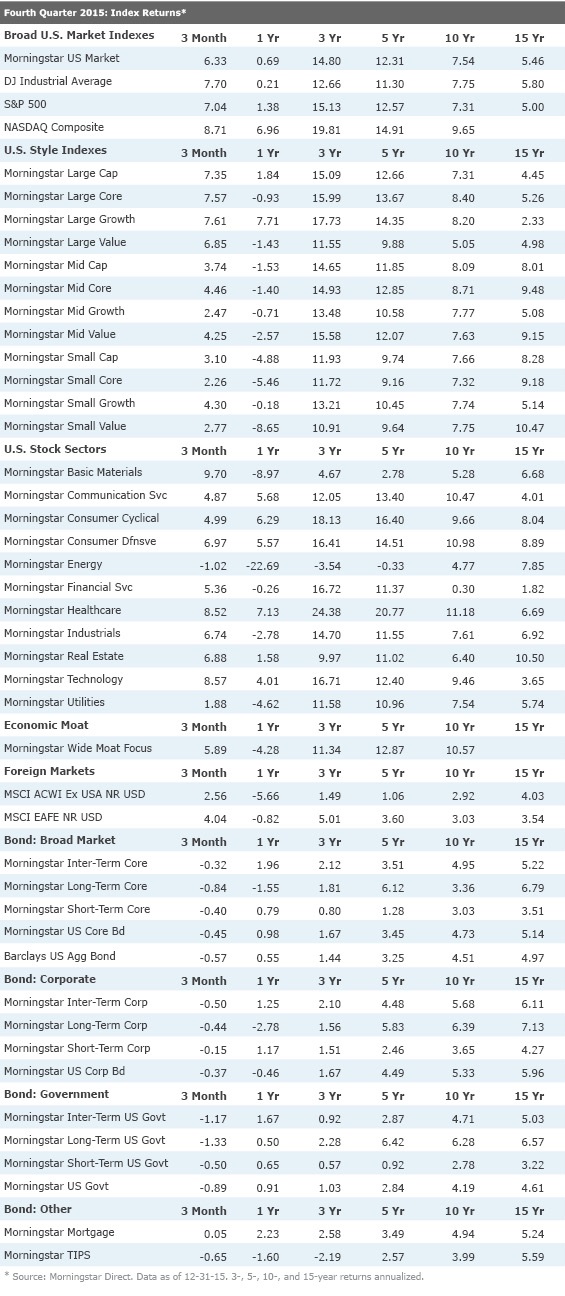

After falling in the third quarter, stocks rebounded at the end the year. In the last 13 weeks, the broad-based Morningstar US Market Index rose more than 6%. The index ended the year up around 0.7% and is now up an annualized 12.3% during the last five years.

But this market-level performance data obscures the big differentials in sector performance. For the full year, the energy and basic-materials sectors were a big drag, with energy underperforming in the quarter, too. The energy fall was obviously connected to the continued decline in oil and other commodity prices. The market is still worried that rising supply from the U.S. and signs that OPEC won't cut production are swamping demand in a slowing global economy. Morningstar's equity analysts think prices could fall even more in the near term but that, over the long term, low prices aren't sustainable and will rebound.

Energy wasn't the only thing driving equities in the quarter. The Federal Reserve's decision to raise interest rates was also in sharp focus. After deferring the first hike due to mixed economic signals and volatility in overseas markets in September, the central bank took a series of strong jobs reports as a sign that it was time to begin normalizing monetary policy. As the Fed begins to tighten, though, other major central banks are keeping their foot on the accelerator. The European Central Bank extended the length of their asset purchase program (though by less than the market had been anticipating), while the Bank of Japan also rolled out new easing programs.

Merger and acquisitions activity continued to dominate corporate headlines. Overall,

, according to data from Dealogic. Major deals announced in the fourth quarter include

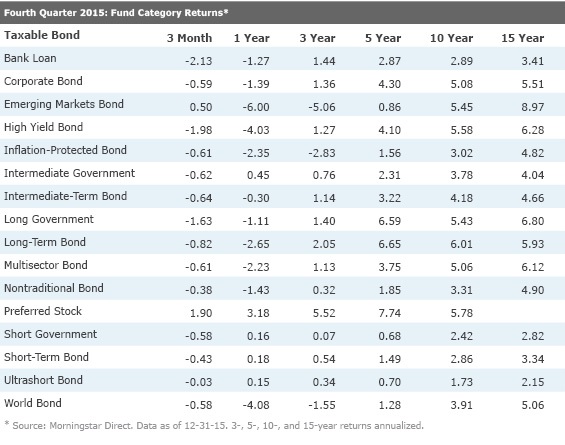

The big story in the fixed-income market in the quarter was in junk bonds. The high-yield bond category was down 2% in the last three months (and more than 4% for the year) as concerns about the energy sector--among other factors--put pressure on the category. Liquidity worries were also highlighted by the abrupt closure of Third Avenue Focused Credit in December. Morningstar analysts don't expect the demise of that fund to be a sign that other funds will soon be in trouble, but it still unsettled the market.

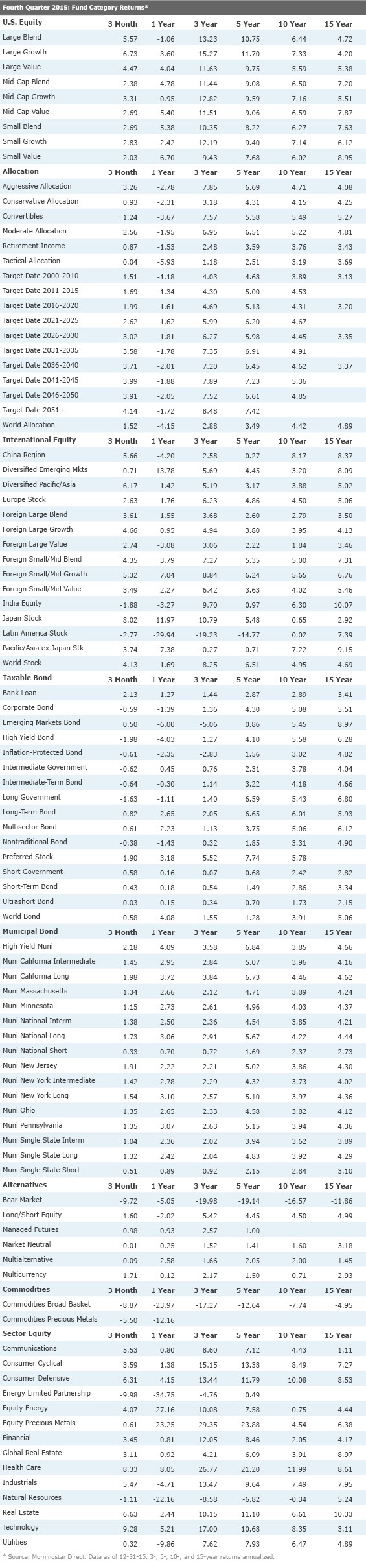

As Morningstar's David Kathman noted in his article earlier this month, domestic-equity mutual funds "have taken investors on another wild ride in 2015." Large-growth funds had the best performance in the quarter, rising nearly 11% in the last three months. That category also was on top of the heap for the full year. Strong returns from

Sector-fund performance was heavily influenced by falling energy prices. Energy limited partnerships were down nearly 10% in the last three months and have shed more than a third of their value during the year. Technology and healthcare funds were the big gainers during the last three months and for 2015.

International-stock fund investors aren't likely to "recall 2015 fondly," Morningstar's Gregg Wolper wrote earlier this month. Most fund categories gained over the last three months (with the exception of India equity and Latin America stock, but the picture is much more mixed for the full year. The Latin America category was down by nearly 30%, and diversified emerging markets dropped over 13%. Japan stock and foreign small/mid growth were the best-performing categories.

Click to see Fourth Quarter 2015 Index Returns and Fund Category Returns.

/s3.amazonaws.com/arc-authors/morningstar/96d7bd4e-92b9-4928-87ef-a13a06b394fa.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/54RIEB5NTVG73FNGCTH6TGQMWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MNPB4CP64NCNLA3MTELE3ISLRY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/96d7bd4e-92b9-4928-87ef-a13a06b394fa.jpg)