For World-Bond Funds, Currencies Are No Sideshow

Three approaches to currency management drive different risk/reward profiles.

Solid long-term performance and diversification from U.S. bond and equity markets have made the world-bond fund category one of the fastest-growing categories that Morningstar tracks. Because of the wide variety of approaches (unhedged versus U.S.-dollar-hedged, global versus non-U.S., broad-based versus single-sector), funds within the Morningstar Category have a large range of risk exposures.

It makes most sense to divvy up the category by various approaches to currency management rather than by credit, regional, or sector focus, as currency movements have the most significant impact on risk/return profiles. World-bond funds tend to follow one of three currency-management approaches: unhedged, tactically hedged, and U.S.-dollar-hedged. (In this article, tactically hedged funds will be referred to as "tactical" and U.S.-dollar-hedged funds as "hedged.")

World-Bond Fund Currency Approaches: A Primer Tactical: Nearly 60% of world-bond funds employ a tactical approach to currency hedging as of November 2015. The managers of these funds actively manage exposure to non-U.S.-dollar currencies through currency forwards or futures. Some of these funds' managers will make modest adjustments to these exposures relative to an index, while others rely more heavily on currency to add returns. In the latter case, managers will often hold net short positions to individual currencies or will have a positive view on a currency but not own any underlying bonds.

Nearly all the funds in this subgroup are focused on a combination of government and corporate debt, with the Barclays Global Aggregate Index appearing as the most common benchmark. The government-only Citi World Government Bond Index is also prevalent. More than two thirds of these funds have a global purview; the remaining funds exclude the United States.

Unhedged: Around one fourth of active and passive world-bond funds leave their overseas currency exposures completely unhedged and, as a result, carry the most currency risk among the three subgroups examined here. From a regional standpoint, half the group focuses on non-U.S. debt while the rest have a global purview. More than half of these offerings focus mostly, if not solely, on government debt. A smaller subset focuses on global or non-U.S. corporates, and just a few are dedicated to global inflation-linked bonds. Therefore, funds in this cohort sport varying levels of interest-rate and credit risk. Given the variety of approaches used in this group, many different benchmarks are employed beyond the broad-based Barclays Global Aggregate and the Barclays Global Aggregate ex-U.S. indexes.

Hedged: The smallest subset (17% of world-bond offerings) comprises funds that fully hedge currency exposures back to the U.S. dollar. These funds, which are mostly global, focus on Treasuries or a mix of Treasuries and corporates, and there are no dedicated high-yield or inflation-protection strategies in the group. Here, investors forgo currency risk, with hedged versions of the Barclays Global Aggregate and the Barclays Global Aggregate ex-U.S. serving as common benchmarks.

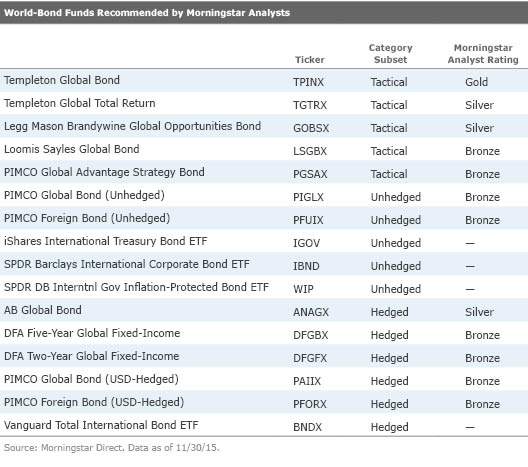

Our Top Picks In the U.S., Morningstar covers 14 actively managed world-bond funds that use tactical, unhedged, and hedged approaches, as well as five passive funds that track the Barclays Global Aggregate, Barclays Global Aggregate ex-U.S., S&P/Citigroup International Treasury Bond Ex-U.S., and DB Global Government ex-US Inflation-Linked Bond indexes. These funds account for roughly two thirds of assets in the U.S. world-bond category. Of these, Morningstar recommends 12 active and four passive funds, as shown in the following table. (Morningstar does not issue Analyst Ratings for exchange-traded funds.)

Unhedged world-bond funds are the most volatile of the three category subgroups, largely because of currency movements, so investors need a higher risk tolerance. To illustrate,

Given that tactical funds court at least some currency risk and many, including most Morningstar Medalists, have large helpings of emerging-markets debt, it follows that the tactical group has been closer to the unhedged cohort in experiencing higher levels of standard deviation and steeper sell-offs in downdrafts.

By contrast, hedged world-bond funds have been far less volatile than unhedged or tactical funds, with standard deviations more akin to those of the Barclays U.S. Aggregate and other U.S. government debt indexes. Investors looking to diversify equity risk should consider this subgroup as it has displayed lower correlations to the S&P 500 over time.

/s3.amazonaws.com/arc-authors/morningstar/9117d33d-7edf-4c01-b517-49ddd5f2b25c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/9117d33d-7edf-4c01-b517-49ddd5f2b25c.jpg)