Utilities: Don't Fear the Fed--Yield and Growth Still Look Good After 2015 Slump

It's time for investors to focus on utilities' fundamental earnings-growth prospects and dividend yields to attain the consistent shareholder returns they expect from the sector.

- The global utilities sector is trading at a 0.97 market-cap-weighted price/fair value ratio at the end of November. We think the most value is among regulated utilities with dividend yields above 4% and power producers that can benefit from a rebound in historically low power and natural gas prices.

- U.S. utilities' 3.7% median dividend yield represents a historically attractive 140-basis-point premium to the 10-year U.S. Treasury yield. Some high-quality utilities are trading with dividend yields that are double those of 10-year U.S. Treasury yields.

- Merger and acquisition activity picked up in the second half of 2015, featuring some eye-watering valuations. Electric utilities have shown a willingness to pay top dollar for faster-growing natural gas utilities.

- Global energy markets are convulsing as renewable energy, weak electricity demand, and low worldwide commodity prices bring down margins for fossil-fuel power generators worldwide. Although we think we've reached a bottom, it could be several years before a rebound.

After a glorious 2014 and a dreadful 2015, utilities are back where they started two years ago--fairly valued. The market's myopic focus on interest rates during the past two years has finally subsided as the U.S. Federal Reserve raised its target rate in December for the first time in nearly a decade. Now we think it is time for investors to focus on utilities' fundamental earnings-growth prospects and dividend yields, with the aim of attaining the consistent shareholder returns that they expect from the sector.

U.S. utilities are on their way to finishing 2015 down nearly 10%, the first time since 2008 that utilities have posted a negative return in a calendar year. Most of that downdraft came during the first half of the year, when rising interest-rate expectations and overheated valuations contributed to a 14% drop in the Morningstar Utilities Sector Index between late January and mid-summer.

But with higher interest rates mostly priced into utilities' valuations, some pockets of value have developed during the second half of 2015. Most utilities' dividends, balance sheets, and growth outlooks are as strong as they have been through this cycle. Utilities continue to enjoy low-cost financing that is turbocharging earnings growth and shows no sign of abating. Spreads between regulatory allowed returns, which drive revenue, and financing costs are as wide as they have been in at least three decades.

This attractive financing dynamic has led to a half-dozen substantial acquisition bids during the last year, all at eyewatering valuations. Deals such as

Offsetting these tailwinds, we expect weak electricity demand and regulatory risk to remain a concern for some utilities in the U.S. and globally. Diversified utilities and independent power producers with coal and nuclear generation around the globe are struggling as natural gas becomes a cheaper, more environmentally friendly fuel source for power generation.

Given these concerns, we encourage investors to seek utilities with premium dividend yields, consistent and transparent long-term growth opportunities, and stable regulatory frameworks. We think these utilities will produce solid long-term shareholder returns regardless of interest-rate movements.

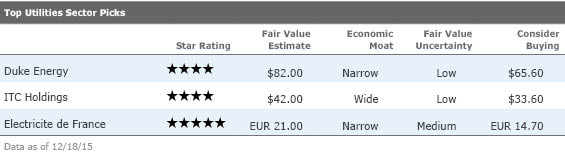

Duke Energy

DUK

Duke Energy became the largest U.S. utility after it merged with Progress Energy in 2013. Duke's regulated utilities in the Carolinas, Indiana, Florida, Ohio, and Kentucky contribute about 90% of earnings. Duke also owns and operates renewable wind and solar assets and Latin American hydroelectric generation assets. In 2015-19, we expect Duke to invest $41.8 billion, of which nearly $30 billion is growth capital. That growth investment and management's ability to achieve cost savings support our 6% earnings growth estimate. Investors' worries about the international segment are far out of line, resulting in a dividend yield and valuation multiples that haven't been this attractive since the financial crisis.

ITC Holdings

ITC

ITC Holdings is the only publicly traded pure-play independent electric transmission company in the United States. ITC has been one of the fastest-growing utilities during the past decade and now has more than 15,600 miles of high-voltage transmission lines and supporting facilities in seven U.S. states. ITC's wide moat and the financial incentives federal regulators offer to enhance transmission grid reliability, renewable energy interconnection, and low-cost natural gas power generation should continue to support industry-leading returns on capital and earnings growth. We expect ITC's capital investments to support close to 8% average annual earnings growth and 13% annual dividend growth during the next five years, even as regulated rates of return come down. We think any downside from lower allowed revenues is more than priced into the stock.

Electricite de France

(

)

EDF is one of the world's largest energy companies, controlling the French power grid along with a massive global generation fleet. Its French nuclear fleet comprises 58 plants, and it operates the largest power supply business in France. Investments in France's regulated electricity grid and renewable energy, along with new capacity-market revenue, should drive 2% annual EBITDA growth through 2019. This, in turn, should support a healthy dividend, most of which goes to the French state, owner of nearly 85% of shares. EDF's performance is heavily influenced by French regulation and structural reforms to European power markets, both of which are subject to political meddling. Even with our expectations for a modest rise in French tariffs and substantial lost customers as France moves toward a different pricing scheme, we still think the market is overly pessimistic. EDF also has upside from newbuild nuclear in the United Kingdom and possibly China.

More Quarter-End Insights

Market Outlook: Late-Cycle Behavior?

Economic Outlook: Escape Velocity Not in the Cards for U.S. Growth

Credit Markets: Volatility and Spreads to Remain Elevated

Basic Materials: Fates Tied to Faltering China

Consumer Cyclical: Consumer Volatility Creates Investment Opportunities

Consumer Defensive: Bargains Harder to Come By

Energy: Pain Persists as OPEC Refuses to Play White Knight

Financial Services and Real Estate: Fiduciary Standard Rule Could Have Drastic Impact

Healthcare: Even After Uptick, Some Great Values Remain

Industrials: Unsettled Global Economy Serves Up Individual Stock Bargains

Tech & Telecom: Cord-Cutting and Programmatic Advertising Trends Continue

/s3.amazonaws.com/arc-authors/morningstar/ea0fcfae-4dcd-4aff-b606-7b0799c93519.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PLMEDIM3Z5AF7FI5MVLOQXYPMM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/I53I52PGOBAHLOFRMZXFRK5HDA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CEWZOFDBCVCIPJZDCUJLTQLFXA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ea0fcfae-4dcd-4aff-b606-7b0799c93519.jpg)