Getting a Portfolio De-Cluttered and Retirement-Ready

We help a couple position their portfolio for staggered retirement dates.

"I would really like to simplify this mess."

So closed Grant's email requesting a portfolio makeover. A 64-year-old government transportation worker, he's looking forward to retirement in about three years. His wife Lori, a 53-year-old school principal, plans to stay on the job for at least 10 more years.

While the two maintain separate portfolios, Grant manages both--and he wishes his could look more like Lori's. While not exactly svelte, her portfolio includes index funds that provide broad market exposure. Grant's portfolio, meanwhile, slices the market a bit more finely. While it, too, is anchored in index funds, it includes many small positions in funds focused on individual sectors, such as energy and REITs, as well as investments targeting specific style-box squares, such as mid-growth and mid-value.

Grant says he would like help streamlining their total portfolio mix, as well as assistance in teeing up his portfolio to supply in-retirement income. Grant likes the bucket approach to retirement portfolio planning and would be interested in adopting it for his in-retirement strategy. Additionally, he's keen to get a second set of eyes on the viability of his total retirement plan. While he has a small pension and will receive decent benefits from Social Security, he'll need to rely on his portfolio for a portion of their living expenses.

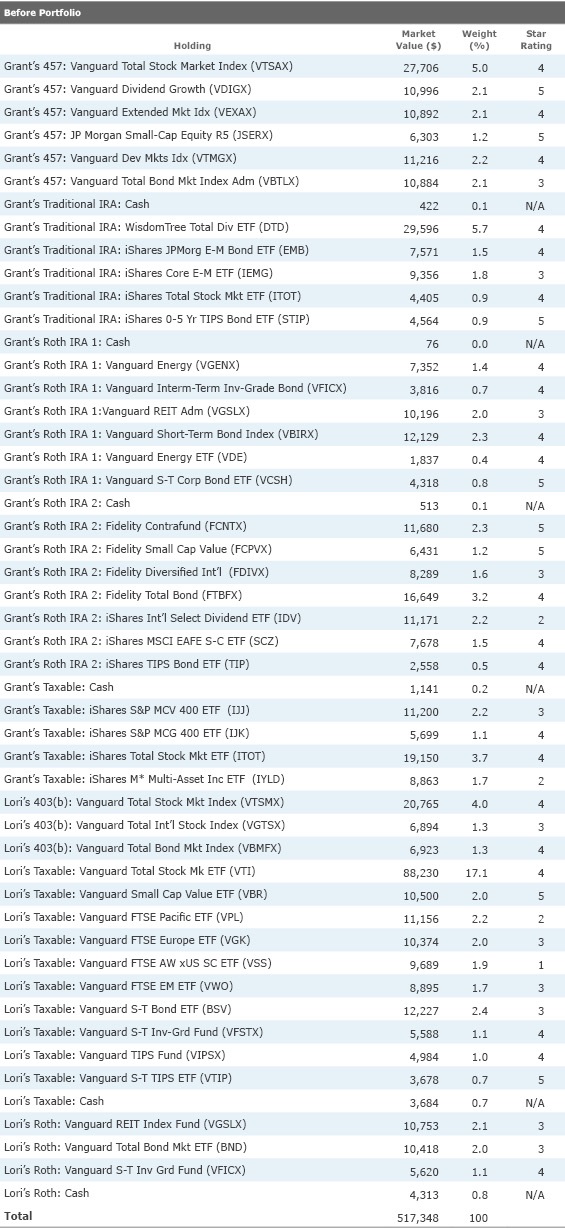

The Before Portfolio

Grant and Lori's combined portfolio of about $500,000 looks fairly conventional on the surface, as depicted by Morningstar.com's

. Although their asset allocation is aggressive for their life stage, with roughly three fourths of their holdings in stocks, their portfolio is nicely diversified across the Morningstar Style Box and roughly mirrors the market-cap and style allocations of a total market index fund. Owing to a heavy emphasis on index funds and exchange-traded funds, the portfolio's total costs are low--its asset-weighted expense ratio is 0.21% versus 0.68% for a similarly weighted portfolio of average funds.

Multiple accounts are a given for most late-career individuals and couples, and Grant and Lori have eight in total. But there are some redundancies: Grant has Roth IRAs with two separate mutual fund companies, for example. Moreover, each of the subportfolios has a lot going on. While Lori's 403(b) is a model of minimalism, featuring a total bond, U.S. stock, and international stock index fund, it's the exception; the rest of the accounts are much busier and include some overlap. For example, Grant's taxable account features a total stock market index ETF as well as ETFs focused on the mid-cap value and mid-cap growth areas of the U.S. market. Tilting toward mid-cap stocks isn't unreasonable, but that tilt isn't coming through, as the aggregate portfolio looks quite indexlike. One of Grant's Roth IRAs, meanwhile, includes both

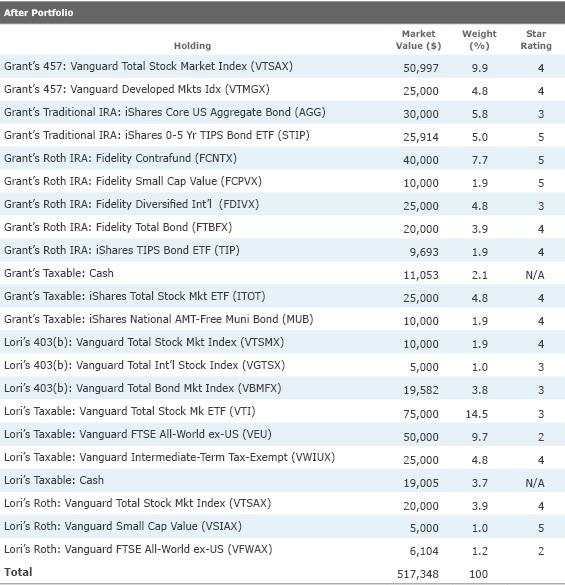

The After Portfolio I always like to tackle the most important issues first when conducting these portfolio makeovers: In this case, it's Grant's impending retirement. Will his portfolio be able to supply him with enough living expenses to augment his Social Security and pension payments? And can it be better positioned to deliver a stable cash flow in retirement?

On the first question, it's going to be tight but doable. Grant earns $90,000 a year and is currently steering about $22,000 a year combined to his 403(b) and his Roth IRA. Grant expects that the combination of his pension and Social Security will replace about two thirds of his current spendable income. That means his portfolio will need to replace the remaining third--about $20,000 per year--in income to maintain their current standard of living prior to Lori's retirement. Given the couple's $520,000 portfolio and the fact that Lori's pension is a good one, covering 100% of her final year's salary upon retirement, that's a reasonable initial withdrawal rate. It will go lower when Lori retires.

Grant intends to file for Social Security benefits at his full retirement age, 66, and that seems like a reasonable strategy, too. While delaying up until age 70 can help boost payouts over a couple's lifetimes, especially when there's a younger spouse in the mix, Lori won't receive Social Security spousal benefits because she has her own teacher's pension. Thus, the virtue of delaying Social Security is much less clear-cut in this couple's case. Despite having a longer life expectancy than Grant, Lori won't benefit if he delays by being able to take advantage of a higher spousal benefit for the rest of her life.

In terms of portfolio positioning, it's not too soon for Grant to start thinking about "bucketing" his retirement portfolios so that they'll be in position to meet in-retirement withdrawals. Because he and Lori may well be in a lower tax bracket once he retires, it will probably make sense for him to draw from his tax-deferred account in his first years of retirement, while leaning on his taxable and Roth accounts later on. Doing so means he will reduce the amount of his portfolio that will eventually be subject to RMDs. (Checking in with a tax advisor to map out withdrawal sequencing would also be money well spent.)

Grant's portion of the portfolio, with a tiny cash stake and roughly 25% in bonds, is arguably too aggressive given impending withdrawals. I targeted a 60% equity weighting for Grant's assets. To that end, I boosted the bond and cash stakes within his tax-deferred accounts (his 457 and Traditional IRA), assuming they will be first in the queue for withdrawals. I enlarged his position in Treasury Inflation-Protected Securities, to help preserve purchasing power in this portion of the portfolio. I'm assuming Grant will roll over his 457 assets into an IRA when he retires, so there's no need to treat his IRA and 457 as two separate kitties; they'll eventually be one.

My "after" portfolio also allocates a greater share of Grant's taxable account to bonds, to help facilitate withdrawals from that account when it's advantageous from a tax standpoint. Because Grant's Roth will probably be last in line for withdrawals, that account is more stock-heavy in my "after" portfolio. In the interest of simplification, my "after" portfolio consolidates his two Roth IRAs into a single Roth account. I also slashed the noncore investments, in the interest of simplifying and lowering the total portfolio's cost load.

Lori's accounts, meanwhile, can stay more aggressive for a few reasons. First, she's lucky enough to have a pension that will fully replace her ending salary. Because she won't be drawing heavily on her assets during retirement, safety and liquidity are much lower priorities for her. Plus, her time horizon is longer than Grant's.

I reduced the number of holdings in her taxable account and also concentrated on "asset location"--making sure that her taxable account houses tax-efficient investments like broad-market index funds while her tax-advantaged accounts hold less tax-efficient assets like bonds.

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/O26WRUD25T72CBHU6ONJ676P24.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WDFTRL6URNGHXPS3HJKPTTEHHU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EC7LK4HAG4BRKAYRRDWZ2NF3TY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)