Currency-Hedged ETFs Can Serve as Core Holdings

But like all allocation decisions, it's best to stick to your plan.

Currency-hedged exchange-traded funds continue to enjoy strong inflows in 2015. Through the first 11 months of the year, a net $45 billion flowed into these products, accounting for a significant slice of the net $209 billion of flows into international-equity funds and ETFs. Much of this flow can be attributed to those looking for a short-term trade as the U.S. dollar continues to strengthen. However, there are also investors who are starting to use these products as a long-term, strategic allocation. Most investors have unhedged currency exposure in their international-equity allocation, as most international-equity funds are not hedged. To temper this foreign-currency exposure (that is, the volatility from moving currencies), investors can replace unhedged international-equity funds with currency-hedged ETFs.

If you plan to use currency-hedged ETFs as part of your strategic allocation, determine how much of your international-equity allocation you want to hedge, and stick with it. It may be tempting to try to trade in and out of currency-hedged ETFs depending on which way the U.S. dollar is moving, but generally speaking, market-timing is not a sensible strategy for long-term investors.

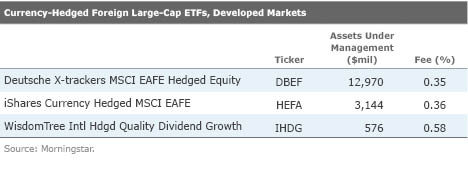

There are three ETF providers that provide a large suite of currency-hedged ETFs--iShares, Deutsche Bank, and WisdomTree. These providers, in total, offer about 60 different ETFs covering many segments of the international-equity markets--large cap, small cap, regional, and single country. Most of the iShares and Deutsche ETFs track market-cap-weighted MSCI indexes. The WisdomTree ETFs track fundamentally weighted indexes, and that can result in style tilts and larger (or smaller) weightings in certain countries.

Foreign Large Cap

The most common benchmark for the international-equity category is the MSCI EAFE Index, which is composed of developed-markets equities from Europe and Asia-Pacific (and therefore does not include Canada).

Before investing in a foreign-equity fund, investors should check to see if they are comfortable with the fund's country weightings--a large concentration in one country can be a source of risk, as that country's market performance can dominate the performance of the fund. This Deutsche and iShares funds track a market-cap-weighted index, so as a result, the countries with the largest equity markets have the largest weightings, and this may not necessarily correspond to the relative size of a country's economy. The largest countries in the MSCI EAFE Index are Japan at 23% and the United Kingdom at 20%. Germany actually has a larger economy than the U.K., but because of its relatively small equity market, it has a 10% weighting in the MSCI EAFE Index.

WisdomTree International Hedged Quality Dividend Growth IHDG launched in 2014 and tracks an index that only has two years of live history. This fund has a growth tilt and has outperformed the MSCI EAFE Index as growth has significantly outperformed during the last two years. Investors may want to wait for a longer track record before jumping in. ETF companies tend to launch products that track indexes with strong recent performance, which may not persist in the long term. This fund tracks a fundamental index that screens for companies in developed Europe and Asia-Pacific that have better long-term earnings-growth expectations and higher returns on equity and assets. Currently, the fund does not have any large allocations in a single country. However, over time, fundamentally weighted funds can see large shifts in country allocations, more so than a market-cap-weighted fund. Investors interested in this fund should be comfortable with its growth tilt and the fact that country allocations can shift somewhat unpredictably.

The iShares and Deutsche funds appear to be the same, as they both track the MSCI EAFE 100% Hedged to USD Index and hedge their currency exposure with forward contracts. However, the iShares fund employs a fund-of-funds structure as it holds shares of unhedged

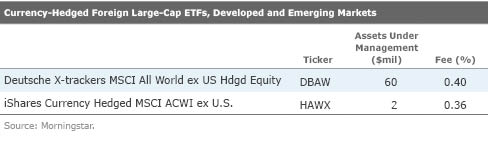

Funds that invest in both developed and emerging markets also fall in the foreign large-cap category. Deutsche X-trackers MSCI All World ex US Hedged Equity DBAW and iShares Currency Hedged MSCI ACWI ex U.S. HAWX both track the currency-hedged version of the MSCI All Country World Index ex USA (MSCI ACWI ex USA Index). This index currently has about a 20% weighting in emerging-markets countries. The cost to hedge certain emerging-markets currencies can be very high, and these include countries that typically have high short-term rates, such as Brazil, Russia, India, South Africa, Russia, Indonesia, and Turkey. These countries account for less than 10% of the MSCI ACWI ex USA Index, but hedging these currencies does drag on the performance of the index. During the last five years, the cost to hedge the entire index has been between 40 to 90 basis points a year (which is higher than the 10 basis points it costs to hedge the MSCI EAFE Index).

Europe

The currency-hedged Europe ETFs highlight the importance of checking the portfolio before you invest, as the name of the ETF can be confusing. The Deutsche X-trackers MSCI Eurozone Hedged Equity DBEZ and

The three eurozone-focused funds are quite concentrated, with France and Germany each comprising about 25% and Spain and the Netherlands each comprising 10% to 15%. The WisdomTree fund can have somewhat different country weightings from the Deutsche and iShares funds. This WisdomTree ETF seeks to be more of a short-term play on the falling euro as it tilts toward exporters, or companies more likely to benefit from a falling euro. It first screens out firms that do not derive the bulk of their revenue from exports out of the eurozone. The firms that qualify for inclusion are then weighted by annual cash dividends paid. With this type of specialized focus, this fund is probably better suited for tactical investors looking to capitalize on the falling euro, and less suited for long-term investors. That said, during the last two years, as the euro has fallen against the U.S. dollar, this fund's performance has been fairly similar to that of the MSCI EMU 100% Hedged to USD Index. This WisdomTree fund used to be a broader international-equity fund, and in 2012 changed its index to focus on exporters domiciled in the eurozone, so historical data prior to 2012 is not applicable to this fund.

Deutsche X-trackers MSCI Europe Hedged Equity invests in all 15 of the developed countries in Europe, including the U.K. (which accounts for about 30%) and Switzerland (13%), which are not part of the European Monetary Union. With somewhat different country allocations, this fund's performance can be fairly different from the other three, which only invest in the EMU.

Capital Gains Currency-hedged ETFs use currency forwards to hedge their foreign-currency exposures, and there are tax issues related to these derivatives contracts. Currency-hedged funds must distribute to fundholders the gains on currency forwards, which are taxed at a combination of long-term and short-term capital gains rates (60% long-term and 40% short-term). During periods when the U.S. dollar is rising against hedged currencies, the monthly roll of these currency contracts can result in capital gains. In addition, the use of these derivatives does introduce counterparty risk. However, this risk is limited, as the contracts cover only the movement of the foreign currency and not the entire value of the fund.

It is tempting to jump into currency-hedged ETFs when the U.S. dollar is rising against other currencies. Investors should first consider the tax consequences of any change and ensure that the resulting portfolio is still consistent with long-term investment goals.

Disclosure: Morningstar, Inc.'s Investment Management division licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/de44b91c-c918-4e53-81c3-ce84542f3d36.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/de44b91c-c918-4e53-81c3-ce84542f3d36.jpg)