Financial Services: Fiduciary Standard Rule Could Have Drastic Impact

The Department of Labor's proposed rule could affect around $3 trillion of client assets and $19 billion of revenue at full-service wealth management firms.

- Our overall financial services sector valuation remains attractive at a price/fair value ratio of 0.90. Similarly, the real estate sector remains undervalued at a price/fair value ratio of 0.97.

- In Australia, against the backdrop of a slowing economy, we have been surprised by recent strength in specialty retail sales performance.

- We expect REIT prices generally to move inversely with changes in long-term government bond yields. Higher interest rates would take some time to show up in REIT financial metrics, but eventually higher rates could cause higher debt financing costs, put pressure on traditional after-interest expense measures of REIT cash flow (such as funds from operations, adjusted funds from operations, and funds available for distribution), and lead to higher cap rates, which could pressure investment spreads.

We assess that the U.S. Department of Labor's proposed conflict-of-interest, or fiduciary standard, rule could drastically alter the profits and business models of investment product manufacturers like BlackRock and wealth management firms like Morgan Stanley that serve retirement accounts. Based on our proprietary estimates, we believe that the rule will affect around $3 trillion of client assets and $19 billion of revenue at full-service wealth management firms.

Additionally, we think that investors and business analysts looking only at the more studied implementation costs of the rule are vastly underestimating the rule's potential impact on the financial sector. Current government and financial industry reports have a high-end annual cost estimate of $1.1 billion, but even our low-end prohibited transaction revenue estimate, arrived at using Morningstar Direct data, is more than double that at $2.4 billion. The rule's financial repercussions also extend far beyond wealth management firms.

Full-service wealth managers may convert commission-based IRAs to fee-based IRAs to avoid the additional compliance costs of the Department of Labor rule. As fee-based accounts can have a revenue yield upwards of 60% higher than commission-based, this could translate to as much as an additional $13 billion of revenue for the industry.

Robo-advisors stand to benefit from the Department of Labor rule, as they pick up a portion of our estimated $250 billion to $600 billion of low-account-balance IRA assets from clients let go by the full-service wealth management firms. Capturing a fraction of these loose assets will bring stand-alone robo-advisors much closer to the $16 billion to $40 billion of client assets that we believe they need to become profitable.

We believe that over $1 trillion of assets could flow into passive investment products from the Department of Labor rule. The increase would be from higher adoption of robo-advisors, increased usage of passive investment products from financial advisors that formerly may have been swayed by distribution payments, the proposed "high-quality, low-cost" exemption, and the effect of advisors trying to balance out higher explicit financial planning charges.

We believe beneficiaries will be discount brokerages, like

Real Estate In Australia, against a backdrop of a slowing Australian economy, we have been surprised by recent strength in specialty retail sales performance. We don't think domestic economic fundamentals support a continuation of this trend as household income has been buoyed by one-offs of lower borrowing costs and falling fuel prices. We forecast a moderating rate of rent growth, but growth nonetheless. Our outlook for tepid long-term growth reflects a rising proportion of sales occurring online and rising Federal government budget deficits, which increase the likelihood of further rationing of handouts.

We expect REIT prices generally to move inversely with changes in long-term government bond yields. Higher interest rates would take some time to show up in REIT financial metrics, but eventually, higher rates could cause higher debt financing costs, put pressure on traditional after-interest expense measures of REIT cash flow (such as funds from operations, adjusted funds from operations, and funds available for distribution), and lead to higher cap rates, which could pressure investment spreads.

Also, to the extent that low interest rates have diverted investor funds to REITs searching for higher yield, funds could flow out of REITs if interest rates rise, pressuring commercial real estate and REIT valuations. Although rising interest rates might signal a strengthening economy, which could benefit real estate fundamentals, we do not expect the macro environment to improve enough to offset what could be another 200-basis-point rise in U.S. government bond yields to levels nearer historical norms.

Although the potential negative impact of rising interest rates remains a key concern for REIT investors, U.S. REIT management teams seem less concerned. The majority of U.S. REITs have improved their balance sheets since the last downturn and appear as a group to remain more conservatively leveraged than the last boom in the mid-2000s. Moreover, upcoming maturities for many U.S. REITs over the next few years still carry interest rates that far exceed current borrowing costs, so even a 100-basis-point rise in rates from here would have a negligible impact on cash flow, at least over the medium term.

Nonetheless, recent trading activity suggests that investor expectations about actual or expected future interest rates can have an immediate impact on U.S. REIT stock prices. Although we still view the potential for higher interest rates as a valuation risk for U.S. REITs, we would expect higher interest rates to have a negligible impact on our estimates of value. We already embed a mid-4s yield on the 10-year Treasury into our weighted average costs of capital, relative to the low-2s level recently observed in the Treasury market.

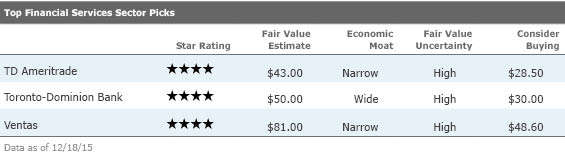

TD Ameritrade

AMTD

Over the next five years, we're projecting pretax operating income at TD Ameritrade to more than double, due to both revenue growth and operating margin expansion. Interest rate-related revenue remains the key driver of medium-term earnings. Some 40% to 50% of the company's interest-rate-sensitive balances are more leveraged to short-term rates than long-term rates, so there will be an almost immediate benefit once the Fed Funds Rate increases. Due to TD Ameritrade's unique relationship with Toronto-Dominion, it won't have to retain capital to grow its interest rate-related income, so it can increase its dividend or share repurchase activity along with earnings.

We believe that there are three concerns on investors' minds that are overblown. The first is a market correction. While this will have a direct impact on the company's assets under management revenue streams, stock market volatility will increase trading volumes, and the benefit from rising interest rates is more important.

The second is that an increase in interest rates will lead to a trading commission pricing war. Commission pricing wars are a negative-sum game, so we don't think any rational player will start one. While historically there may be some correlation between rising interest rates and lower commission pricing, the last 15 years can be characterized as having more players and room for material differences in trade pricing. Now, client assets are concentrated in the hands of fewer, larger players, and commission pricing is low in absolute terms with changes in pricing less likely to cause client switching.

The last major concern is over how much TD Ameritrade may share the benefit of rising interest rates with clients. It's important to note that the "trading cash" awaiting investment by TD Ameritrade's customers is largely rate insensitive. They are traders hoping to put the cash to use, instead of people shopping around for the highest certificate of deposit rate. While the company may have to slightly revise its guidance for how much it will benefit from rising rates, the market has more than already priced this in.

Toronto-Dominion Bank

TD

With its strong retail network in both Canada and the U.S., Toronto-Dominion Bank continues to deliver excess returns during this low rate environment. We take comfort in TD Bank's relatively low exposure to the oil patch, which, compared with other Canadian peers, will not have a significant impact upon those returns should energy pricing remain subdued. Also with a high percentage of residential loans either government insured or currently at low loan/value ratios, we take comfort that any impact upon the bank due to a housing bubble burst will not erode TD Bank's capital base. With the expectation that mortgage rates will rise very slowly in the medium term, we think any impact upon the bank due to delinquencies caused by higher rates will be stretched out over several years, also minimizing the impact to TD Bank's capital. Trading at a significant discount to our fair value estimate and 10.8 times 2016 estimated earnings, along with healthy 3.9% dividend yield, we think this is an attractive opportunity for investors.

VTR

Healthcare REITs in general are one of the most attractive property sectors in our U.S. real estate coverage on a relative valuation basis, and Ventas--with its narrow moat and exemplary stewardship--is currently our favorite among the bunch. In general, U.S.-based healthcare REITs should benefit from some favorable tailwinds, including an expanding and aging population and potentially tens of millions of people added to the ranks of the insured because of the Affordable Care Act--all of which should drive incremental demand for healthcare real estate relative to historic levels. Plus, healthcare is a property sector in which the vast majority of assets remain in private hands, so Ventas should have opportunities to further consolidate ownership. We think the combination of Ventas' 7%-plus cash flow yield (using our 2016 normalized AFFO estimate) with growth prospects in the low- to mid-single-digit range (if not higher, depending on external growth opportunities) provides investors with a compelling total-return prospect in the current environment.

More Quarter-End Insights

Market Outlook: Late-Cycle Behavior?

Economic Outlook: Escape Velocity Not in the Cards for U.S. Growth

Credit Markets: Volatility and Spreads to Remain Elevated

Basic Materials: Fates Tied to Faltering China

Consumer Cyclical: Consumer Volatility Creates Investment Opportunities

Consumer Defensive: Bargains Harder to Come By

Energy: Pain Persists as OPEC Refuses to Play White Knight

Healthcare: Even After Uptick, Some Great Values Remain

Industrials: Unsettled Global Economy Serves Up Individual Stock Bargains

Tech & Telecom: Cord-Cutting and Programmatic Advertising Trends Continue

Utilities: Don't Fear the Fed--Yield and Growth Still Look Good After 2015 Slump

/s3.amazonaws.com/arc-authors/morningstar/efa3b691-314a-4c23-8933-a09951d6793b.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YQGRDUDPP5HGHPGKP7VCZ7EQ4E.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/efa3b691-314a-4c23-8933-a09951d6793b.jpg)