Energy: Pain Persists as OPEC Refuses to Play White Knight

The current glut in crude supply continues to weigh on prices and will take several quarters more to work through.

- We continue to believe that crude oil prices are well below the levels required to encourage sufficient investment to meet demand beyond 2017, and our long-term per-barrel price outlook remains at $70 Brent and $64 West Texas Intermediate.

- Near-term prices could be ugly, though. OPEC spooked markets yet again in December by failing to signal any willingness to cut production and defend prices, even though weaker member states (like Venezuela) are hurting because of lower oil revenue.

- Upstream capital spending in the United States will fall sharply in 2016 for the second consecutive year as producers struggle to align budgets with cash flows. Reduced investment will translate to stronger output declines, and while it won't happen overnight, this will eventually help markets rebalance.

- Sharp curtailments in oil-directed drilling activity could also reduce U.S. natural gas production growth in the near term. But the wealth of low-cost inventory in areas like the Marcellus and Utica ultimately points to continued growth through the end of this decade and beyond.

- Abundant supply is holding current natural gas prices low, but in the long run we still anticipate relief from incremental demand from liquefied natural gas exports as well as industry. Our midcycle U.S. natural gas price estimate is unchanged at $4 per thousand cubic feet.

The most pressing question on the minds of energy investors: How long will it take for the industry to work through the current period of oversupply and rebalance itself? The answer: Not anytime soon.

Current supply imbalances are such that oil production as of today is effectively running two years ahead of demand. Declining U.S. oil production over the next several quarters will help reduce global oversupply, but in our opinion, that alone cannot quickly fix the current global imbalances.

For the market to approach any semblance of normalcy before 2017--and likely for prices to respond accordingly--requires one or more of the following: Saudi Arabia reverses course from its "maintain market share at all costs" approach and cuts production; global demand surprises to the upside from current expectations of 95 million barrels a day in 2016 and 96 mmb/d in 2017; or a geopolitical event occurs (for example, political upheaval in Venezuela or another oil-exporting nation). Without one or more of these occurring, "lower for longer" looks to be the unavoidable near-term course for the industry.

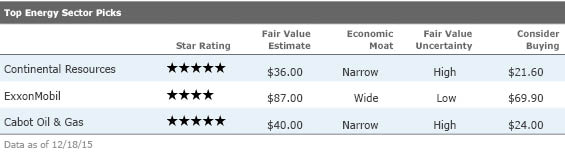

Continental Resources

CLR

Continental is our top pick in the U.S. oil-focused exploration and production group. Continental played a key role in the early development of the Bakken Shale and now holds 1.2 million net acres prospective in this prolific oil play. The company has added a second string to its bow with the ongoing delineation of the South Central Oklahoma Oil Play. Even at today's prices, wells drilled in these areas offer attractive returns, and Continental's positions will take at least 20 years to work through. The firm has a strong liquidity reserve and will be free cash flow neutral in 2016.

ExxonMobil

XOM

We view ExxonMobil as offering the best combination of value, quality, and defensiveness. Exxon will see its portfolio mix shift to liquids pricing as gas volumes decline and as new oil and liquefied natural gas projects start production. The company historically set itself apart from the other majors as a superior capital allocator and operator, delivering higher returns on capital than its peers as a result.

Cabot Oil & Gas

COG

On the gas side, Cabot controls more than a decade of highly productive, low-cost drilling inventory targeting the dry gas Marcellus Shale in Pennsylvania. Fully loaded cash break-even costs are less than $2.50 per mcf, based on 2015 cost structure and current, historically low oil prices.

More Quarter-End Insights

Market Outlook: Late-Cycle Behavior?

Economic Outlook: Escape Velocity Not in the Cards for U.S. Growth

Credit Markets: Volatility and Spreads to Remain Elevated

Basic Materials: Fates Tied to Faltering China

Consumer Cyclical: Consumer Volatility Creates Investment Opportunities

Consumer Defensive: Bargains Harder to Come By

Financial Services and Real Estate: Fiduciary Standard Rule Could Have Drastic Impact

Healthcare: Even After Uptick, Some Great Values Remain

Industrials: Unsettled Global Economy Serves Up Individual Stock Bargains

Tech & Telecom: Cord-Cutting and Programmatic Advertising Trends Continue

Utilities: Don’t Fear the Fed--Yield and Growth Still Look Good After 2015 Slump

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/17f48ad3-acb4-4abc-982b-fb3b14ceda2f.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/737HCNGRFLOAN3I7RKGB7VPEKQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/17f48ad3-acb4-4abc-982b-fb3b14ceda2f.jpg)