November Ratings Activity Includes a Pair of Upgrades

Seven other Morningstar Medalists were downgraded, and three funds were placed under review.

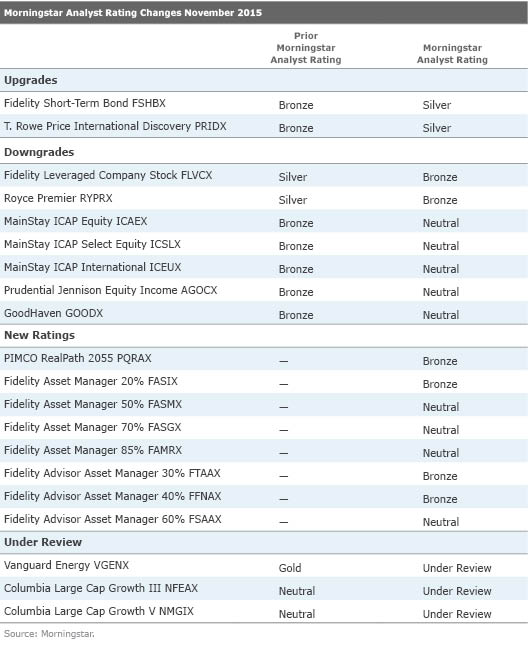

Morningstar Manager Research analysts downgraded seven Morningstar Medalists in November--five of them losing their medalist status with Morningstar Analyst Ratings of Neutral--and upgraded two Analyst Ratings to Silver from Bronze. We also rated eight funds for the first time and placed three funds under review.

In addition, analysts affirmed ratings for 58 funds and four target-date series. In total, Morningstar Analyst Rating activity in November 2015 included 78 U.S. funds and four target-date series. Some of the notable changes are highlighted in this article; a complete list can be found in the table below.

Upgrades

Downgrades

The Analyst Rating for

also has been downgraded to Bronze from Silver to reflect poor performance during the past few years, in part because of poor execution of a time-tested process that has served investors well over the long term. While it has a strong long-term record, the fund has struggled during the past few years. This was partially due to its overweighting of the basic-materials and energy sectors, which a previous comanager, Whitney George, favored. However, lead manager Chuck Royce, who currently has sole discretion over this portfolio, has trimmed those stakes following George's departure. The fund, which tries to capitalize on Royce & Associates' best ideas, is benchmark-agnostic, and its sector weightings and performance can deviate significantly from the Russell 2000 Index's. Royce collaborates with Lauren Romeo and Steven McBoyle to try to identify highly profitable, conservatively capitalized companies in which the firm has the highest conviction.

For a list of the open-end funds we cover, click here. For a list of the closed-end funds we cover, click here. For a list of the exchange-traded funds we cover, click here. For information on the Morningstar Analyst Ratings, click here.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WJS7WXEWB5GVXMAD4CEAM5FE4A.png)