Gibson Smith to Resign From Janus

His departure is a setback for the firm's fundamental fixed-income team, so funds under his management are now Under Review.

We have placed our Morningstar Analyst Ratings for several Janus fixed-income and allocation funds under review following the Dec. 2, 2015, announcement that Gibson Smith, Janus' chief investment officer of fundamental fixed income, plans to resign from the firm effective March 31, 2016. This departure is a significant setback to Janus' fundamental fixed-income platform, which Smith effectively built during his tenure as CIO while generating strong long-term results.

Janus' fundamental fixed-income team will reorganize following Smith's departure early next year. Smith's longtime comanager Darrell Watters will assume the title of head of U.S. domestic fundamental fixed income, while Chris Diaz, who joined Janus in 2011, will become head of global fundamental fixed income. Keeping Watters, who joined Janus in 1993, on board is especially crucial to maintaining continuity to the team's process, as he has comanaged portfolios with Smith since 2007 and is particularly well-versed in bottom-up security selection. Both Watters and Diaz will report to Enrique Chang, who joined Janus in 2013 to head up the firm's equity investing efforts and will take on the newly created title of head of investments.

According to Smith and Janus, Smith is resigning for personal reasons, mainly to spend more time with his family. While Smith wouldn't be the first investment professional to leave the industry well before a traditional retirement age--he turns 47 this year--it is unusual for someone to leave the industry at such a high point in his or her career. Smith joined Janus in 2001 as a credit analyst and was appointed to the CIO role in 2006. Since then, he's overseen significant growth in Janus' fixed-income platform. For example, the firm's flagship bond fund,

Notably, the global macro team headed up by Bill Gross will continue to operate autonomously from the fundamental fixed-income team, and Gross will continue reporting to Janus CEO Dick Weil. Gross surprised the investment world by joining Janus in late September 2014; bringing in such a prominent investment figure created some risk of alienating Smith, as we previously pointed out. Smith and Gross, as Janus promised then, have in fact worked fairly independently of each other; however, the way Janus has built out Gross' operation in Newport Beach, California, including the recent acquisition of Kapstream, an Australia-based fixed-income manager run by former PIMCO employees, stands in contrast to Smith's fundamental fixed-income platform build-out, which Smith grew more organically.

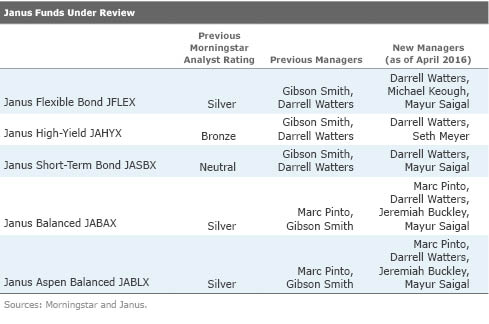

Smith's team was built to provide continuity with a deep bench of capable investors, but his absence will certainly be felt. Following the announcement of Smith's resignation, we placed the Analyst Ratings for the five funds managed by Smith under review as we assess the impact of the upcoming manager changes on the funds' People, Process, and Performance scores. Below is a list of the five funds currently under review:

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)