Healthcare: Even After Uptick, Some Great Values Remain

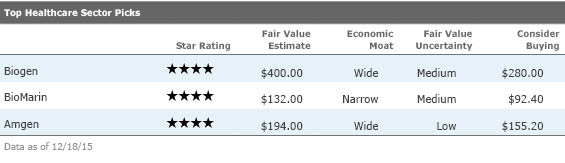

While valuations in healthcare stocks have improved, we still see opportunities in these undervalued companies.

- Despite increasing political rhetoric coming out of Washington, we expect pricing power for drug and biotech companies to remain strong.

- Adding to some healthcare valuations (especially smaller potential healthcare targets), mergers and acquisitions continue at a rapid pace as large conglomerates look for growth avenues and opportunities to cut costs, partly through lowering taxes.

- Strong drug launches and excellent clinical data in specialty-care areas, such as oncology, are increasing the productivity of drug and biotech companies.

As the U.S. presidential campaigns pick up full steam in early January, the political rhetoric on lowering drug prices will probably continue, but we don't see any major shifts in U.S. drug prices over the next several years. Nevertheless, we expect drug pricing concerns to cause increased volatility in pharmaceutical and biotechnology stocks. However, without a major structural reform and a willingness by patients and doctors to limit treatment options, we don't see any major changes in U.S. drug prices.

On the investment banking front, companies continue to acquire and merge to increase their growth potential through creating scale, cutting costs, and focusing on key strategic areas. Further, the persistent low interest rates are also fueling merger and acquisition trends, because cheap capital is available to fund acquisitions. Beyond the heavy prevalence of M&A in the drug space, with large drug firms acquiring Allergan and Pharmacyclics, we are seeing further consolidation in healthcare services.

Turning to a core element of moats with innovation in healthcare, drug companies continue to shift their focus toward specialty-care areas such as oncology and immunology. We expect the shift to increase drug-development productivity and strengthen the moats for drug companies, since these areas of development carry strong drug pricing, a more accommodating stance from regulatory agencies, and steep launch trajectories. Although some of these specialty indications have smaller patient populations than primary care areas, the strong pricing power can easily turn the drugs into blockbusters. In oncology, recent approvals carry price tags over $100,000 per year, opening the door to major market opportunities even in the less prevalent cancers.

Biogen

BIIB

Biogen is the leader in the multiple sclerosis market, with a range of options for patients seeking injectables (Avonex and Plegridy), orals (Tecfidera), or high-efficacy treatments (Tysabri). Competition in MS is heating up, but we still think Biogen has a dominant portfolio that can withstand this pressure, and we assign the firm a stable wide moat rating. We remain optimistic on upcoming clinical data over a longer time horizon (2016-18) and think the firm has a promising collection of neurology-focused pipeline candidates. Recent prices appear to be giving the firm little credit for two key pipeline programs, Alzheimer's drug aducanumab and a novel MS therapy targeting Lingo. Also, the spinal muscular atrophy program (partnered with Isis) should generate phase 3 data in late 2016 or early 2017, and we're bullish on its potential in this rare pediatric indication.

BioMarin

BMRN

BioMarin focuses on the ultra-rare-disease space, and its products have strong global pricing power because of the severe and rare nature of the genetic diseases they target. While Kuvan, Naglazyme, and Aldurazyme are more mature, the ongoing Vimizim launch is poised to make it BioMarin's biggest product. A very productive pipeline has kept research and development expenses high and prevented profitability, but we think the firm should be able to leap from four key marketed products to eight by the end of 2017, securing sustainable profitability at that time. While there is risk around the timing of drisapersen's approval in Duchenne muscular dystrophy, BioMarin's shares trade at enough of a discount to our fair value estimate to make the stock look undervalued regardless of our view on this regulatory outcome. Three other pipeline programs in PKU, Batten disease, and achondroplasia could reach the market by the end of 2017, and outside of DMD, BioMarin lacks competition.

Amgen

AMGN

Amgen has several innovative biologic therapies that have turned into blockbuster products and generated consistently high returns on invested capital, and we think Amgen's pipeline turnaround will continue to support the firm's wide moat. Although Amgen has heavy exposure to biosimilars--close to 40% of total sales are at risk to biosimilars over the next five years--we think the firm is well-positioned to grow throughout upcoming U.S. biosimilar launches. In the near term, fast-growing approved drugs like Prolia/Xgeva and Kyprolis, as well as Amgen's emerging cardiovascular drug Repatha, will counter biosimilar pressure. In the long term, we expect better pipeline productivity (via the deCode human genetics database) and an internal biosimilar pipeline will drive stronger growth. We expect the firm's reputation for quality biologics manufacturing and large biosimilar pipeline will allow it to gain a more than 10% share of the global biosimilar market.

More Quarter-End Insights

Market Outlook: Late-Cycle Behavior?

Economic Outlook: Escape Velocity Not in the Cards for U.S. Growth

Credit Markets: Volatility and Spreads to Remain Elevated

Basic Materials: Fates Tied to Faltering China

Consumer Cyclical: Consumer Volatility Creates Investment Opportunities

Consumer Defensive: Bargains Harder to Come By

Energy: Pain Persists as OPEC Refuses to Play White Knight

Financial Services and Real Estate: Fiduciary Standard Rule Could Have Drastic Impact

Industrials: Unsettled Global Economy Serves Up Individual Stock Bargains

Tech & Telecom: Cord-Cutting and Programmatic Advertising Trends Continue

Utilities: Don't Fear the Fed--Yield and Growth Still Look Good After 2015 Slump

MORN DODFX VINIX VWILX TSVA EGO WU Brightstart429plan MRO VZ MOAT T NKE CMCSA GOOG

/s3.amazonaws.com/arc-authors/morningstar/a90c659a-a3c5-4ebe-9278-1eabaddc376f.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BC7NL2STP5HBHOC7VRD3P64GTU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90c659a-a3c5-4ebe-9278-1eabaddc376f.jpg)