Dividend Investing: Man vs. Machine

Comparing active and passive approaches to dividend investing.

A version of this article appeared in the October issue of Morningstar ETFInvestor. Download a complimentary copy of ETFInvestor here.

At our sixth annual Morningstar ETF Conference, I moderated a panel on dividend investing. We had a diverse group, featuring Fidelity’s Ramona Persaud (the active manager), WisdomTree’s Jeremy Schwartz (the indexer), and CLS Investments’ Scott Kubie (the ETF strategist). Our conversation centered on whether active managers’ (“man”) can add value relative to a strictly passive (“machine”) dividend-oriented investment strategy. While there is no clear-cut answer, it is evident that successful approaches of both kinds share some commonalities, such as low costs and a disciplined process. While the machines might win on average, it is too simplistic to suggest that there is no hope for man.

Meet Our Panelists

Persaud is the manager of actively managed

Schwartz is the director of research for WisdomTree. His firm is a leader in dividend-oriented exchange-traded funds. WisdomTree burst onto the scene in 2006, launching 20 ETFs, each with a dividend focus. WisdomTree Total Dividend ETF DTD weights stocks by their proportionate share of the aggregate dividends paid by U.S. stocks. This is an elegant approach that does not rely on arbitrary screens. Instead, it emphasizes the value of dividends rather than market prices. An added benefit of this approach is its natural, contrarian rebalancing feature that puts more weight in stocks that have seen their dividends rise faster than their stock prices.

Kubie manages funds of funds that use ETFs. His firm scans for opportunities across asset classes. The firm sees it as a better use of time to research asset classes and implement allocations with ETFs rather than to spend that time selecting individual securities or researching actively managed mutual funds. Kubie makes a distinction between dividend-oriented strategies that reach for yield and those that offer the potential for dividend growth. Several of his portfolios include holdings in dividend-oriented ETFs that look to single out firms that will grow their dividends, such as

Rise of the Machines?

Index advocates argue that a rules-based approach succeeds in building dividend stock portfolios because it is disciplined, repeatable, and low-cost. Active managers argue that a strict rules-based approach does not allow for any management discretion. Furthermore, rules-based approaches are less likely to avoid companies at risk of cutting their dividends because the financial statement data that their indexes rely on is inherently backward-looking. Also, a mechanical rebalancing discipline may force indexes to rebalance or reconstitute at inopportune times. For example,

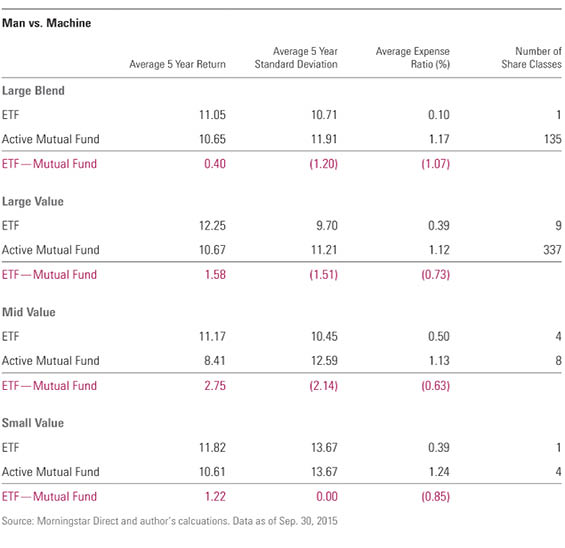

Who Is Winning the War? To examine the historical record, I searched the Morningstar database for ETFs and actively managed mutual funds with a focus on dividends. I looked for U.S. equity funds with the words "dividend," "income," or "yield" in the name, which returned 41 ETFs, though just 15 had at least a five-year track record. A similar search netted 504 share classes of 123 unique funds with at least a five-year track record. I dropped 20 funds from the mid-blend and small-blend Morningstar Categories because there were no dividend-oriented ETFs in those categories.

The table shows that, on average, dividend-oriented ETFs beat their actively managed mutual fund counterparts in each of the four categories studied. Most of the funds in the sample were in the large-value category, where the average ETF returned 12.25% during the five years ended Sept. 30, 2015, compared with 10.67% for the average actively managed, dividend-oriented mutual fund.

The performance gap of 1.58 percentage points between large-value, dividend-oriented ETFs and mutual funds cannot entirely be explained by differences in fees alone. The average large-value ETF in the sample charged 0.39% compared with 1.12% for the average mutual fund. This 0.73-percentage-point expense ratio gap explains roughly half of the difference in these cohorts’ performance. The performance difference also does not appear to be driven by risk. The large-value ETFs in the sample actually had a lower standard deviation of return and a lower beta relative to the Russell 1000 Value Index.

Of the nine large-value ETFs in the sample, eight beat the 10.67% return of the average mutual fund. The best-performing ETF in the group was

Out of 337 active mutual fund share classes in the large-value category, only 52 beat the 12.25% average return of the large-value ETFs in the sample. Fourteen of these included share classes of three Silver-rated funds. These “John Connors” leading the fight against the “Terminators” have common traits: a well-honed, disciplined investment process and low costs.

The John Connors of the Equity-Income Space

About two thirds of Silver-rated

The managers of Silver-rated

There was only one ETF in the large-blend category that passed the screen:

Bronze-rated

Gold-rated

Silver-rated

Ramona Persaud’s Fidelity Dividend Growth hasn’t earned a Morningstar Medalist rating, in part because of her short tenure on the fund. Persaud became the portfolio manager at the start of 2014, but in that time, the fund has returned 2.52% compared with 0.98% for VIG.

They'll Be Back Each of these seven dividend-oriented mutual funds has bested the average dividend-oriented ETF in its category. What these mutual funds have in common is that they have a Positive Process Pillar rating (aside from Persaud's). While this is just one brief period of time, the results seem to suggest that having a disciplined process grounded in fundamental research is more important than the broad flexibility afforded by active management. Also, the seven mutual funds are low-cost, with an average expense ratio of just 0.60%. Indexlike discipline mixed with an element of human intuition/discretion and a competitive fee appears to be a winning strategy for outwitting the growing field of "machines" in the dividend space.

Attribution: Laura Lallos HLIEX, Alec Lucas VEIPX VDIGX, Jeff Holt LCEAX, Katie Rushkewicz Reichart PRDGX, and Greg Carlson FDGFX.

Disclosure: Morningstar, Inc.'s Investment Management division licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)